Many high-net-worth and ultra-high-net-worth investors often neglect tax implications when determining asset allocation within their portfolios. They tend to prioritize achieving the highest pre-tax returns, overlooking the importance of incorporating tax efficient investing into their decision-making process. Do you know which asset classes are the most tax efficient and how to evaluate them based on their projected returns, volatility, and correlations with other asset classes? This guide will provide valuable insights into tax efficient investing, spotlight the most tax efficient asset classes, and present a framework along with strategies to enhance after-tax returns in your investment portfolio. In this article, I will focus solely on portfolio optimization and will not explore advanced tax strategies involving trusts, entities, family offices, or other complex tax optimization strategies.

Understanding After-Tax Investment Returns

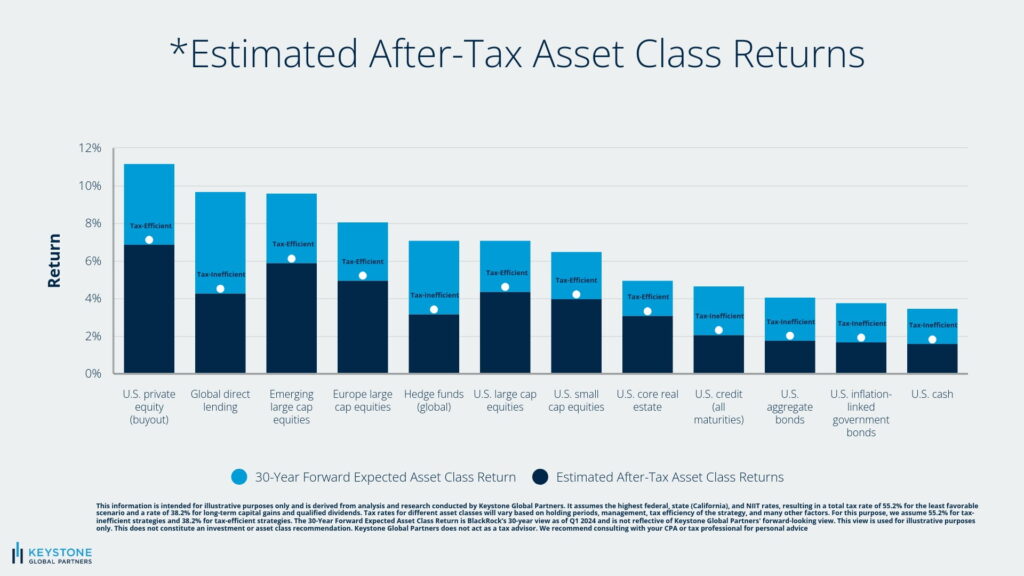

Let’s start by defining after-tax returns. In simple terms, it refers to the profit you earn from an investment after accounting for taxes. This concept is crucial for tax efficient investing across all investment types and should never be overlooked when evaluating performance. Tax rates on various asset classes can differ significantly, influenced by factors like whether returns come from non-qualified dividends or short-term capital gains. For instance, in California, these could be taxed at a maximum rate of 55.2%, and in New York City, the rate reaches 55.6%. In contrast, long-term capital gains and qualified dividends are taxed at a much lower rate of 38.2% in California and 38.6% in NYC, creating a 17% gap between the most and least efficient tax rates.

After-Tax Portfolio Optimization Techniques

A tax efficient portfolio should be constructed based on after-tax projected investment returns, asset class correlations, and volatility. Many investors tend to concentrate exclusively on pre-tax returns when assessing their investments, selecting assets, and optimizing portfolio techniques. However, this approach can result in misleading conclusions regarding overall performance and risk. We base our asset allocation, manager selection, and investment decisions on an after-tax perspective.

Least Efficient Asset Classes

Which asset classes are the least tax efficient for investing purposes? Generally, yield-based asset classes (excluding municipal bonds) such as traditional fixed income, inflation-linked bonds, liquid credit, private debt, and cash are among the least efficient. These classes are also subject to the highest ordinary income tax rates. Additionally, certain hedge funds and non-correlated investment strategies that produce a significant amount of short-term capital gains, like absolute return funds, fall into this category.

However, it’s important to note that not every manager within these asset classes is entirely inefficient. Analyzing the historical performance of each investment is critical. For example, when evaluating a hedge fund’s tax efficient investing strategies, reviewing the K-1 forms from previous years is essential. Understanding tax efficiency is crucial when allocating to a particular asset class or manager.

Most Efficient Asset Classes

Typically, the most tax efficient investing asset classes are private equity, public equities, direct property, and private equity real estate. This is due to the more tax-advantaged rates of long-term capital gains, and the fact that there is typically a longer hold period for the tax efficient investment, which allows the value of these unrealized capital gains to compound over time without being taxed during this compounding period.

As for owning and investing in real estate directly, it tends to be the best tax efficient investing asset class due to depreciation and expenses that can offset income being paid by tenants. When there is a sale, a 1031 exchange could also be used to reinvest the proceeds into another property tax-free and defer the tax, allowing for more value to compound over time.

Increase Illiquidity Budget to Benefit from Tax Deferral

Tax deferral reduces the effective tax rates on asset classes. An important point to highlight is that a longer holding period will lower the effective tax rate of an asset class. What does this mean? By holding onto an unrealized capital gain for an extended period, you allow those pre-tax dollars to compound. It’s as if the IRS is giving you a loan for free. This contrasts with selling at the end of each year and paying taxes, or even worse, selling in under a year and facing the least favorable short term capital gains (STCG) tax rates. For this reason, privately held, long-term illiquid investments such as private equity and directly held real estate are advantageous in tax-efficient investing because they are typically held for a long period before being sold. Of course, these decisions need to align with the portfolio and the investor’s liquidity and risk profile.

Enhancing Tax Efficiency through Increased Equity and Equity-like Risk

Investors can enhance the effectiveness of their tax efficient investment portfolio by increasing exposure to equity and investments with equity-like risk, provided that such volatility remains within their risk tolerance. This can be achieved by prioritizing private equity, real estate, and public equities with longer holding periods. Such portfolio optimization techniques can lead to improved tax efficiency and tax deferral. It is equally important to steer clear of tax-inefficient asset classes like TIPS and to only use private debt and absolute return hedge fund managers when the after-tax alpha warrants the investment.

Tax-Inefficient Managers Should Only Be Chosen if the Potential Tax Inefficiency Can Be Offset by Significant Alpha Generation

Understand the typical mix of long-term capital gains (LTCG), short-term capital gains (STCG), qualified dividends, ordinary income, and, if applicable, futures. Consider how often gains are realized or deferred for a manager. For a manager who is not tax efficient in their investing strategies, it is crucial to have a high level of conviction that their alpha generation (excess performance) will continue. There is a strong correlation between tax inefficiency and uncorrelated returns. Most managers who generate high alpha tend to exhibit low tax efficiency. Some multi-strategy hedge funds, for example, fit this description.

Public Equity is a Highly Tax Efficient Investment

Compared to other asset classes, public equity is highly tax efficient. This is due to a combination of long-term capital gains and qualified dividends being taxed at lower rates than ordinary income, along with the ability to hold these securities for the long term. We believe that public equities should not be the primary focus for alpha generation; rather, attention should be given to asset allocation within the equity market. Additionally, investors can tax-loss harvest public equities during down years, allowing them to offset and defer taxes in the current and future years since any unused losses can be rolled forward indefinitely. However, over time, as a tax managed portfolio strategy grows, the ability to tax-loss harvest diminishes.

Municipal Bonds

For individuals in the top tax brackets, municipal bonds can be a smart, tax efficient investment choice due to their exemption from federal taxes—and often state and local taxes as well. We generally prefer municipal bonds over treasuries and high-yield municipal bonds over high-yield corporates. While there are exceptions, this serves as a general guideline for being tax efficient while investing.

Strategies to Enhance the Tax Efficiency of Your Investment Portfolio

- Make Portfolio Decisions on an After-Tax Basis – Whether you are evaluating managers, allocating assets, or reporting on performance, always consider these factors on an after-tax basis.

- Favor Equity-Like Risk Over Yield-Based Strategies – Prioritize private equity, public equities, direct real estate, and private equity real estate over yield-based strategies, such as traditional fixed income, inflation-linked bonds, liquid credit, private debt, and cash.

- Increase Your Illiquidity Budget – For those who can tolerate increased illiquidity, consider increasing the allocation of private investments in your portfolio. A longer holding period can effectively reduce the tax rate on an asset class.

- Municipal Bonds Offer Tax Advantages – Municipal bonds are a particularly tax efficient investment for high-income earners, as they are exempt from federal taxes and often from state and local taxes as well. They represent a solid option for individuals in the highest tax brackets who want to prioritize tax efficient investing strategies.

- Consider Tax-Inefficient Managers Only with Strong Conviction – If you choose to engage with a manager known for low tax efficiency, ensure that there is a strong conviction in their ability to generate alpha and deliver future performance.

- Tax-Loss Harvesting – Offsetting gains with losses in other investments can defer and reduce overall tax liabilities.

- Tax-Efficient Structures – Consider trust planning in state tax-free jurisdictions. Utilize CRUTs for tax deferral and charitable opportunities. Some families may also explore PPLI or similar for tax efficient investing strategies.

- QSBS – When investing directly in venture capital, private equity, or through a PE or VC fund, you may come across QSBS-eligible companies. For those that qualify, there can be significant tax exemptions, potentially up to $10 million or 10 times the basis. Be sure to pay attention to this to ensure that no tax savings are left on the table.

- Charitable Strategies – Consider family foundations, Donor Advised Funds (DAFs), Charitable Lead Trusts (CLTs), Charitable Remainder Trusts (CRTs), and donating highly appreciated long-term securities.

- Direct indexing is a tax managed portfolio strategy that can benefit charitable families that plan to donate highly appreciated securities to charity. However, if this is not the case, or if there are not consistent inflows and potential outflows, the opportunities for tax loss harvesting may diminish, and the associated fees can reduce the overall benefits of the tax efficient investment strategy.

- Asset Location – For families with tax-deferred entities such as retirement plans or IRAs, consider these accounts for holding tax-inefficient asset classes.

- 1031 Exchanges – When you sell your investment property and reinvest the proceeds into a new property, you can defer paying taxes on the gains from the sale, provided you qualify and follow the rules.

- Opportunity Zone Funds – Real estate investments that offer tax benefits for investors, including the deferral of capital gains and the potential for tax-free appreciation on the investment.

- Favor ETFs over Mutual Funds – ETFs are generally more tax efficient investments than mutual funds, as mutual funds may distribute year-end embedded gains.

- Holding Periods – To the extent possible, hold securities for the long term, at least until they qualify for long-term capital gains tax treatment (a minimum of one year). Longer holding periods are more tax efficient for investing. We believe that generating alpha in the public markets is more challenging, which favors longer-term equity holding periods.

- Tax Lot Optimization – When rebalancing or selling, portfolio optimization techniques, such as wisely choosing tax lots to ensure that any partial sales utilize the shares with the lowest tax cost, can help minimize tax liabilities.

- Year-End Mutual Fund Analysis – For those with mutual funds in their portfolio, it’s important to conduct a year-end mutual fund analysis (we do this in October) to determine whether any distributions will be paid out and whether selling the mutual fund before the distribution outweighs the cost of receiving it.

Final Thoughts on Tax Efficient Investing

Tax optimization is crucial; however, the reality is that portfolios are influenced and constrained by various factors, including liquidity preferences, risk tolerances, appetites for complexity, and entity-level portfolio goals. For instance, a family may be unable to increase their illiquidity budget or may not have a long investment horizon. This article serves as a guide to help you explore areas where you can enhance your portfolio’s tax efficiency. It’s essential to remember that every family is unique, with distinct needs and goals. Therefore, it is always advisable to consult a financial advisor or tax professional before making significant changes to your portfolio or investment strategy.

FAQs

Which investment is the best for tax?

There is no single investment that can be deemed the best for tax purposes, as it ultimately depends on an individual’s financial situation and goals. However, some investments may offer more favorable tax benefits, such as municipal bonds for high-income earners or Qualified Small Business Stock (QSBS) for potential exemptions of up to $10 million. Additionally, long-term equity may be a more tax efficient investment compared to fixed income. It is important to consult with a financial advisor or tax professional to determine the best tax efficient investment strategies for your specific needs and circumstances. Therefore, it is always advisable to seek proper guidance before making any investment decisions.

Which is the best investment strategy to reduce taxes?

There is no one-size-fits-all investment strategy to reduce taxes, as it heavily depends on an individual’s unique financial situation and goals. Some strategies that may help reduce taxes include utilizing tax efficient structures like trusts or charitable giving options, considering tax-loss harvesting during down years, and being mindful of the holding periods for investments. Factors such as income level, risk tolerance, and liquidity preferences also play a role in determining the best investment strategy for reducing taxes. It is recommended to consult with a financial advisor or tax professional to create a personalized plan that addresses your specific needs and goals while minimizing tax liability.

What are the most tax efficient investments?

Some of the most tax efficient investments include municipal bonds, qualified small business stock (QSBS), long-term equity holdings, and real estate investment opportunities like 1031 exchanges and opportunity zone funds. Additionally, utilizing strategies such as direct indexing and asset location can also help increase tax efficiency. However, it is essential to note that what may be considered a tax efficient investment for one person may not necessarily be the same for another individual. It is best to consult with a financial advisor or tax professional to determine the most suitable and efficient investments for your specific circumstances. Overall, being mindful of taxes when making investment decisions can significantly impact your portfolio’s overall performance and should always be taken into consideration.

Are there tax-free investments?

Some investment options that may offer tax advantages include municipal bonds, investing in Roth IRAs, and Health Savings Accounts (HSAs), among other strategies such as QSBS and opportunity zones where investment returns are tax-free. However, these investments have specific eligibility requirements and contribution limits that individuals must meet to reap the full benefits. It is vital to consult with a financial advisor or tax professional to determine the best combination of investments for your unique situation in order to maximize potential tax savings while still meeting your financial goals. Being strategic and informed can help minimize taxes on investment earnings. Overall, it’s essential to always consider taxes when making any investment decisions and seek proper guidance.