We’re navigating unprecedented times right now around the world. Between COVID-19 sweeping through all countries, record market volatility, and most companies being forced to go virtual, – there’s a lot to process. At Keystone, we’re seeing our clients move through a range of psychological emotions. In this post I discuss some tips on mindset and opportunities to take advantage of amidst the market declines.

Our team focuses on helping founders and entrepreneurs maximize their wealth by creating long-term financial plans that support their goals. The unfortunate truth is that a market downturn often hits startup founders and business owners the hardest. These individuals work hard to grow their companies, provide jobs, and capture market opportunities, hoping to someday realize value from their efforts. Having that work jeopardized by a market downturn can be incredibly stress-inducing. Making decisions under such stress can jeopardize the quality of those decisions.

However, there are a few things to keep in mind for your personal finances during these times. Let’s look at a few points that we’ve brought up with our clients in recent weeks.

Behavioral Finance

It’s not a secret that humans aren’t always rational. Just looking at the American public’s overwhelming need to stockpile toilet paper during the coronavirus pandemic. Of all the things to stockpile in the event of long-term shelter-in-place measures, toilet paper isn’t at the top of “necessary” items. Food, water – these things make sense. But toilet paper? Shouldn’t that fall somewhere further down the list of what’s required to survive?

The truth is that we, as people, often experience unprecedented events (like the coronavirus, or record market volatility) as something outside of our control – and we panic. We want to take action and regain control, but may not know what to do. When we are at a loss of what to do, we look to others. However, it seems toilet paper is the most visible purchase and it looks as if there is a mad rush by everyone else to buy toilet paper. Hence, some people stockpile toilet paper.

The same types of concepts can be applied to investing and finance. We see behavioral biases playing a significant role in how some people are reacting in the current market environment. Being aware of your own behavioral biases is a good step towards helping you make the best possible financial decisions.

Let’s look at three strong biases we see pop up again and again

Herd Mentality

This shows up when investors behave like the larger group with whom they are associated. Individually they may not have made these same choices. This belief is based on the assumption that the larger group cannot be wrong, and it often feels better to be in agreement with and included with a group.

During market volatility, people often fall into this herd mentality. If the media and friends are talking about unknown market bottoms, and conversations with others all lead to discussions of sales, it carries an influence on one’s mind. However, not everyone is on the same plan or has the same risk tolerance. The right thing for one person can be the total opposite of the right decision for someone else. If everyone sells in a panic when the market is down, it can temporarily drive prices away from their fundamental value and be an opportunity to buy at a discounted price.

Loss Aversion

Most investors have a natural aversion to losing money, and studies have shown that people care a lot more about losing a dollar than they do about gaining a dollar. Investors subject to this bias could panic sell during sharp market declines in an attempt to avoid the possibility of further losses, then miss out on the opportunity to participate in the recovery.

Recency Bias

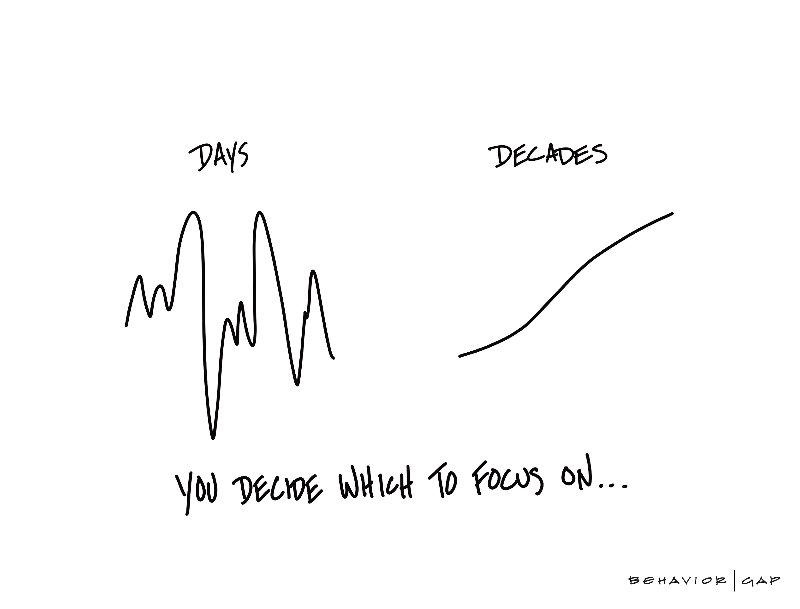

We are more likely to remember something that has happened recently, especially if it makes us uncomfortable. The sprained ankle from yesterday feels more painful than the fractured wrist from ten years ago. If the declines of the last few weeks are on our minds front and center, we will tend to forget the longer-term returns of markets – even if we just experienced a decade-long bull market. During volatile periods, investors are vulnerable to short-term decision making that could undermine their long-term success. We like to highlight this graphic when it seems like the day-to-day market volatility is taking precedence over the long view:

During market volatility, it can be hard to pull ourselves out of these different biases and focus on our long-term goals. We all have a strong inclination to rationalize our own thoughts, sometimes it is hard to see our own biases. If you find yourself falling into some of these behavioral biases, reach out to a financial planner who can help. This can be critical at crisis periods and under stressful conditions to ensure you are making the best decision for your long-term financial objectives.

Opportunities during COVID-19

You might ask, what opportunities does a decline in the market afford? Challenging times can provide opportunities, we outline a few below

View The Markets As Having Gone “On Sale” – When the markets decline, equities are “on-sale.” It’s a good time to be buying if you have extra cash available and are planning to invest for the long-term.

Refinance Your Mortgage – Rates are near historic lows right now, which may mean it’s a good time to refinance your current mortgage. If you have a plan to stay in your home for a few years or more, taking time to refinance and lock in a lower interest rate can result in material cash flow savings.

Harvest Losses – When it makes sense, harvesting losses during a bear market can offset tax on future gains. The conditions for this are nuanced but make sure to avoid the wash sale rule and we suggest speaking with an advisor first.

Adjust Your Portfolio Contribution/Withdrawal Strategy – Depending on your situation, it could be an excellent time to increase contributions or temporarily lower withdrawals. If you must source cash from your portfolio, selling fixed income rather than equities is a better choice.

Convert Your IRAs to Roth IRAs – You will save on taxes by converting while IRA account values are temporarily depressed. Converting an IRA to a Roth IRA allows you to continue tax-free growth, enjoy tax-free withdrawals at retirement, and have the ability to leave a tax-free inheritance to your heirs. Keep an eye on your tax brackets and identify whether a full Roth conversion vs. a partial conversation strategy makes sense.

These are just a handful of ways you can maximize your financial plan during a bear market.

Need Help?

Navigating these times is challenging, and talking to a financial planner can help. Our team focuses on serving startup founders and entrepreneurs, and our unique experience may be an excellent fit for your needs during the current environment. We are available for anyone who wants to chat during these stressful weeks or needs financial guidance. Click here to schedule now.