Trusts & Estate Planning

Trust and estate planning is an essential process that ensures your wealth is transferred efficiently while protecting your family’s future. Our comprehensive approach to trust and estate planning includes wealth transfer, asset protection, family dynamics, and business succession planning.

- Protecting assets and facilitating efficient transfer to the next generation while supporting your values and interests.

- Develop strategies to pass down not just assets but also values. This may include charitable trust strategies.

- Establishing family missions, governance structures, and educational initiatives.

- Providing administrative support to streamline the process.

- Prioritizing family values in all decisions.

By focusing on these critical areas in trusts and estates, we help you create a lasting legacy for generations to come.

The Importance of Trusts and Estates

As your wealth increases, so does the complexity of your estate plan. Without a carefully crafted trust and estate plan, there is no assurance that your wealth will be distributed according to your wishes. Trust and estate planning provides several essential benefits.

Protecting Your Loved Ones

Trust and estate planning ensures that your assets are distributed as you intend. You are providing financial security for your heirs and safeguarding their future.

Minimizing Taxes

Effective trust and estate planning can include tax optimization strategies which can significantly reduce estate and gift taxes. This ensures that more of your wealth is passed on to your beneficiaries.

Avoiding Probate

A comprehensive estate plan can help bypass the often lengthy and costly probate process. Trust and estate planning allows for a smoother transition of your assets.

Our Role and Expertise in Trust and Estate Planning

At Keystone, we partner with a network of legal experts to ensure your approach to trusts and estates is comprehensive and tailored to your unique needs. We offer modeling, advice, and education on various trust and estate planning strategies before you engage with a legal team to help you save both time and money. Whether you prefer to work with our specialized team of vetted partners or have us collaborate with your current trust and estate attorney, we are happy to accommodate your preferences for trust and estate planning.

Strategic Trust and Estate Planning Advice and Collaboration

We offer strategic guidance on trust and estate planning and work closely with your legal advisors to develop a plan that aligns with your goals and values. Our dedicated team ensures that every element of your estate plan is carefully crafted, executed, and integrated with your overall financial planning and investment strategies.

Managing Complex Assets

Whether dealing with real estate, family businesses, or unique investments, we can provide specialized support and strategic advice. By working with us on trusts and estates, you can manage your complex assets effectively.

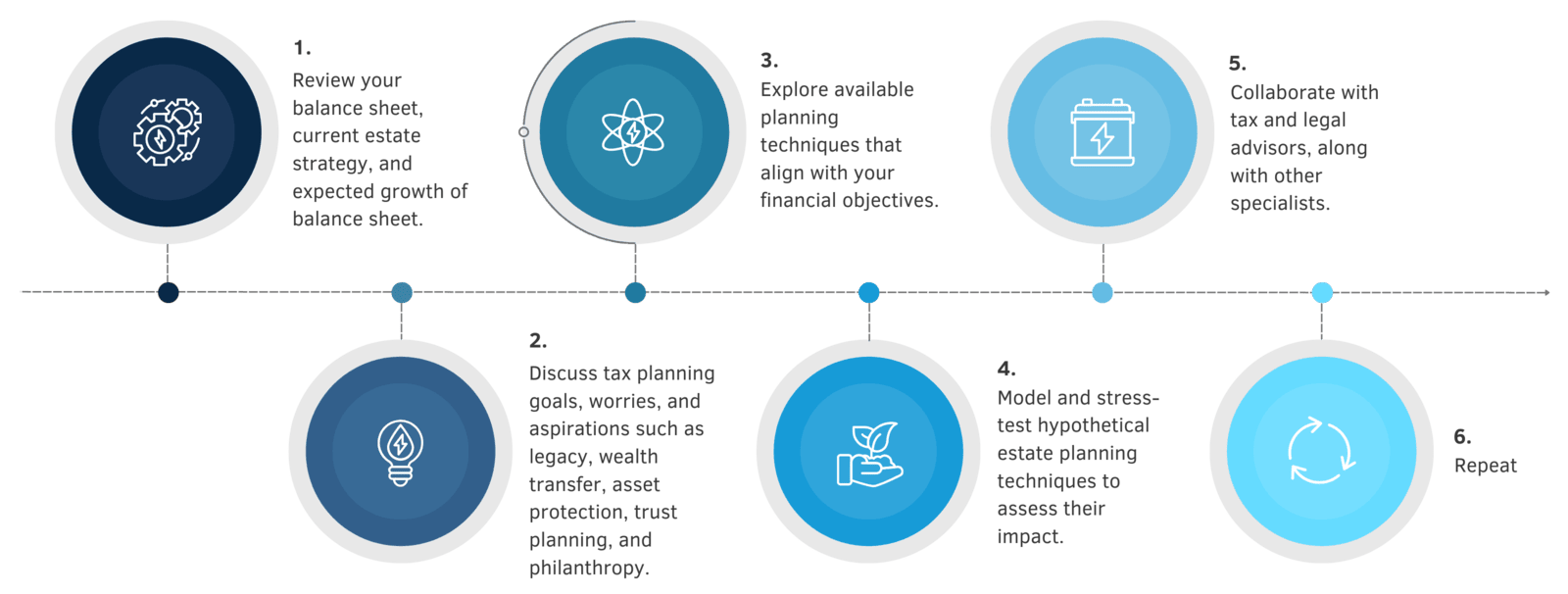

Our Trust and Estate Planning Process

Benefits of Trust and Estate Planning

Tax Efficiency

Trusts like Grantor Retained Annuity Trusts (GRATs) and Intentionally Defective Grantor Trusts (IDGTs), along with other strategies, allow you to effectively minimize tax liabilities. This ensures that your beneficiaries receive the greatest possible benefit.

Managing Complex Family Dynamics

Trusts provide a structured approach to asset distribution. This can be helpful in managing blended families, special needs dependents, or ensuring responsible inheritance management.

Asset Protection

Trusts can offer an added layer of protection against creditors and legal challenges. The right trust and estate planning preserves your family’s financial legacy.

Keystone, Your Trust and Estate Planning Quarterback

Choosing the right partner for your trusts and estates needs can be confusing if you don’t know where to look. At Keystone, we bring a deep understanding of the intricate details involved in trust and estate planning to help you quarterback the entire process.

Our commitment to excellence ensures that your estate plan is not only effective but also reflective of your personal wishes and goals. For more information on trust and estate planning you can read our fundamental guide.

Ongoing Support

Trust and estate planning is not a one-time task – it’s an ongoing process that demands regular reviews and adjustments.

We recommend revisiting your plan every three to five years or following significant life events and material changes in your net worth. This ensures it aligns with your goals and complies with current laws.

Frequently Asked Questions

We recommend reviewing your estate plan every three to five years or after significant life events such as marriage, divorce, births, deaths, and material changes in your net worth.

While both documents play important roles in estate planning, trusts offer more flexibility and control over the distribution of assets and can help minimize taxes and avoid probate. We recommend consulting with a trust and estate planning expert to determine if a trust is necessary for your specific situation.

If you pass away without an estate plan in place, your assets will be distributed according to state laws, which may not align with your wishes. This can lead to family disputes, delays in asset distribution, and potentially higher taxes and legal fees. Comprehensive trust and estate planning ensures that your final wishes are carried out.

Trusts are not always necessary for estate planning, but they can offer numerous benefits such as tax efficiency, managing complex family dynamics, and asset protection. We recommend consulting with a trusts and estates expert to determine if they align with your financial goals and needs.

Certain trusts, such as GRATs and IDGTs, can help minimize estate taxes by removing assets from your taxable estate. Other trusts, like Charitable Remainder Trusts (CRTs), can also provide tax benefits by allowing you to donate assets while still receiving income from them during your lifetime. We recommend consulting with a trust and estate planning expert to determine the most effective tax planning strategies for your specific situation.

Trust services is a broad term and can refer to the management and administration of trusts. This can include investment management, trustee services, tax planning, distribution of assets, and more.

Trust accounts are available at most financial institutions, including banks, brokerage firms, and trust companies. Before opening one yourself, research and compare various options to identify the best fit for your needs and goals. When it comes to drafting and establishing a trust, this process is typically best handled by an attorney.