This article provides a more comprehensive and enriched perspective, expanding upon the original piece authored by our co-founder, Peyton Carr. Initially published in Barron’s on December 11, 2023.

The notion of having an exit for a startup founder or business owner, after years of business exit planning, is often romanticized and hailed as the pinnacle of entrepreneurial success. However, this summit merely serves as a new viewpoint, revealing new financial and emotional landscapes. This article aims to offer a comprehensive overview of the post-deal experiences shared by many of our founder clients after the ink has dried and the champagne corks have landed.

The Emotional Aftermath

Contrary to popular belief, the years immediately following an startup exit plan are not solely a euphoric voyage toward newfound riches. They encompass a mixture of excitement, relief, and, paradoxically, at times, a tinge of regret. Founders of a privately owned business often grapple with an existential crisis and a feeling of detachment from their community. Who are they without their startup? Let’s unpack this.

Identity Reconfiguration

First and foremost, it is crucial to acknowledge the profound emotional impact associated with the business exit planning process and the exit itself. A business exit is not merely a financial occurrence; it represents a significant milestone in one’s life.

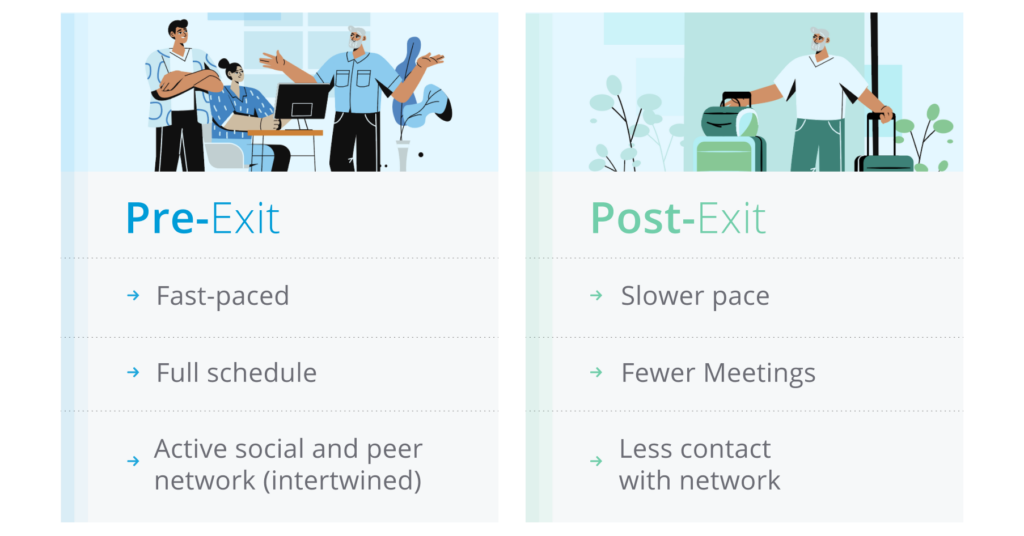

Similar to someone entering retirement, transitioning from an intense entrepreneurial lifestyle to a less structured day-to-day can be unsettling. Taking proactive measures to manage your emotional well-being is just as important as any financial decision you will make after your startup exit strategy. It is natural to experience restlessness and to question the choices you have made.

Founders’ identities are often intertwined with their companies, especially when they’ve been deeply engaged for years. The title of “CEO/Founder of XYZ company” goes beyond being a mere role; it becomes an integral aspect of their social identity, providing them with acknowledgment that they have built business value, and validation within their professional circle. Moving away from the fast-paced, all-consuming position that seems to be moving at breakneck speed to the deafening sound of “crickets”, post-startup exit, can be an extreme shift for many founders.

Insight: It is not uncommon for founders to experience a loss of identity and a sense of disconnection, especially if they find themselves without a clear purpose after a sale. Remember that you are not alone in feeling this way; it is a common phase that many founders and business owners go through after their startup exits. Allow yourself the necessary time to rest and contemplate what you truly desire for your future. What are your passions? How do you envision your daily life unfolding? Strive to gain clarity on your life’s purpose, understanding that this process may take a couple of years. Additionally, focus on rebuilding your social network. Be cautious about making significant financial commitments or overcommitting yourself with your time. When considering investments, such as supporting a friend’s startup, assess whether the decision is based on the investment’s merit or for other reasons. In our planning, we often account for our founder clients to take a couple year sabbatical after startup exits to explore what comes next.

The Financial Horizon for a Founder or Business Owner

Let’s pivot to the financial intricacies that come along with a company sale. Just as you meticulously planned for your company’s lifecycle, a detailed personal financial plan and life plan are just as important.

Now that a founder’s bank account balances have a few extra zeros in them (perhaps following a private sale or a successful IPO), the temptation for extravagant spending is real. However, remember that you have not just sold your company—you’ve also purchased your financial future.

Insight: After exiting their companies, many founders quickly move into angel or startup investing, assuming their entrepreneurial achievement will effortlessly translate into investment wins. This assumption often tends to be untrue. Additionally, some founders think that startup investing/advising will fill the void of what they truly miss but may not realize yet, which is building and creating. If you have a passion for venturing into the world of venture capital or angel investing, establish a deliberate target exposure for your total venture or angel investment exposure and back out what that translates into per year, and for each investment. Make certain that your investments are diversified, utilize your existing network, and make smaller commitments at first for educational purposes and if you prefer a more passive approach rather than actively assisting the startups you invest in. After a year or two, evaluate whether this is a long-term interest for you. Incorporating these decisions into your overall financial plan is vital, and this part of your portfolio should align with your broader investment and financial planning strategy.

Advanced Financial Planning and Decision Modeling

Post-exit startup, your financial trajectory changes considerably. Whether through secondary sales or startup exits, knowing your options for liquidity becomes an essential part of strategic planning. You’ll have options to diversify, invest in the markets, and diversify into alternative assets such as private equity, real estate venture, hedge funds, and other asset classes and opportunities. And perhaps even create a family office. These decisions should align with a financial plan that factors in your life goals, risk tolerance, time horizon, and your passions. Designing an intentional plan rather than shooting from the hip is a good opportunity.

Insight: After the exit startup phase, many founders find themselves intrigued by the idea of investing in rental properties within the real estate market. However, some founders realize they’re not keen on the landlord responsibilities, and often end up hiring a property management company. Founders sometimes make hurried decisions in the post-startup exit phase. I advise thoroughly modeling each decision before taking the plunge and dedicating sufficient time for thoughtful consideration. Would an established real estate private equity fund offer a similar or superior return profile while also freeing up your time? Or is direct property ownership something you’re genuinely enthusiastic about? Each choice should not only be evaluated quantitatively but should also be scrutinized from a qualitative lens.

Tax Minimization Strategies and Post-Startup Exit Strategy

Business exit planning for your venture involves considering complex tax consequences. However, a proactive and multi-dimensional long-term tax planning strategy can be as impactful as a favorable startup exit valuation and the business exit planning you did before the company sale. Hopefully, you’ve done some business exit planning and leveraged some of the various startup exit strategies in your tax planning related to selling company stock, and are familiar with the QSBS rules, which you can read more about in my Advanced Tax Strategies for Company Founders article here. Even if not, there are still things you can do.

Insight: Tax optimization is an ongoing process that requires continuous iterations. It is not just a “one-and-done” project. Primarily because your net worth, family, tax laws, health philanthropic pursuits, hobbies, succession planning options, and opportunities are constantly changing. It starts when your business valuation and enterprise value are low, and continues through a startup exit and throughout your next chapter. The way we describe it to our founders is that similar to having a product roadmap, a tax and personal planning roadmap also needs perpetual maintenance with changing landscapes and conditions.

Risk Mitigation

Having substantial wealth increases your exposure to market risks and potential creditors. Implementing asset protection strategies, including the use of trusts (such as trust and estate) and other entities, can effectively safeguard your wealth while also providing valuable tax advantages.

Having the appropriate level of property and casualty insurance is helpful, and opting for umbrella insurance provides a substantial increase in liability coverage.

Insight: It is a reality that anyone can file a lawsuit against another person, regardless of the merit of the claim. When you achieve financial success, it can unfortunately attract potential lawsuits, as your newfound wealth becomes public knowledge. These legal risks can range from a guest getting injured during a gathering at your home to your child being involved in a car accident. Numerous cases with multi-million-dollar judgments have been documented for incidents like these.

Continuous Monitoring and Adjustment

Your post startup exit investment strategy should be fluid and coordinated with your financial plan. Many founders tend to neglect their own wealth management and financial planning and don’t have a comprehensive strategy. The primary driver that will dictate your lifestyle standards is the wealth you’ve built. Regular meetings with your advisors can help in optimizing your portfolio based on market conditions, the opportunity set that presents itself, your personal circumstances, your financial goals, and your passions.

For many founders, their approach to financial risk undergoes a transformation post startup exit. The level of risk and approach often becomes more conservative post company sale. The portfolio risk exposure can influence their future opportunities. Excessive risk can restrict options in bad market environments. Most of the entrepreneurs we work with highly appreciate the freedom, flexibility, and opportunities to pursue their own unique paths.. This is written into almost every one of our post-exit startup founder’s Statements of Financial Purpose.

Insight: Each investment choice should be carefully evaluated in terms of its alignment with a founder’s overall financial plan and goals. Some founders eventually realize that they no longer need to assume excessive risk and are comfortable sacrificing potential gains for the sake of perpetual freedom to pursue their passions. For those founders who still possess an appetite for high-risk ventures, we recommend setting aside a specific amount for particularly aggressive investments. Even if this allocated capital were to diminish completely, it would not jeopardize the overarching financial objectives.

Repeat Founders

For exited founders who continue to have the startup itch, we’ve found they can sometimes grow restless post-company sale. Various motivations drive founders to embark on new ventures. From our observations, some are enthusiastic to leverage their past experiences and networks to develop a superior and more polished version of their former company. On the other hand, some crave the process of building and creating, constantly in search of fresh ideas. For some founders, whether or not they start a new company after their startup exits depends on factors such as the quality of the idea, their cofounder(s), and timing. Irrespective of the specific reasons, the fulfillment that repeat founders derive from business ownership, and initiating and managing a new venture significantly enhances their overall quality of life.

Insight: Numerous entrepreneurs contemplate whether they should inject personal funds into their latest startup venture. Navigating this issue can be tricky, and the approach may vary. Engaging with a venture capitalist in the early stages, when your idea is still taking shape, can prove to be beneficial. But, it can show confidence to your team and look good optically to have skins in the game if you participate at some level. However, it is a delicate balance, as you must discover the perfect equilibrium that aligns with your unique financial circumstances. It is crucial to avoid investing an amount that generates any form of anxiety regarding your personal financial situation. This is a conversation you can have with your financial planner.

The Bottom Line

Life after exiting is a multi-dimensional journey that goes beyond financial aspects. It entails adjusting not only your investment portfolio and financial strategy but also your emotional and psychological well-being. It’s a profound and enlightening phase, a second act that requires strategic planning, self-reflection, and wisdom, just as the first did.

Whatever path you take, startup exits are not the end of your entrepreneurial journey; they’re rather a significant milestone that brings new challenges and opportunities. I recommend tapping your network, and connecting with experts who understand both the emotional and financial intricacies and who can guide you in piloting this new terrain effectively.