For ultra-high-net-worth individuals and many of our family office clients looking to maximize charitable impact while navigating tax efficiency and maintaining control, donor-advised funds (DAFs) and private foundations offer two distinct approaches.

Each vehicle has unique advantages and trade-offs, making it essential to carefully evaluate the donor-advised fund vs private foundation options. Below, we compare these two vehicles across eight critical dimensions to guide informed decision-making.

Structural Overview

Donor-Advised Funds (DAFs)

A donor-advised fund (vs private foundation) functions as a charitable investment account managed by third-party sponsoring organizations such as Schwab Charitable (now Dafgiving360) or Fidelity Charitable, for example. Donors contribute assets (cash, securities, private stock, crypto, real estate), receive an immediate tax deduction, and recommend grants to IRS-qualified charities over time. Key characteristics of DAFs include:

- Immediate Tax Benefits: Contributions are eligible for deductions up to 60% of adjusted gross income (AGI) for cash donations and up to 30% for appreciated assets.

- Flexibility on Distributions: Unlike private foundations, DAFs are not subject to annual payout requirements, allowing funds to grow tax-free indefinitely.

- Low Overhead: Sponsoring organizations handle administrative tasks such as compliance, record-keeping, and grant disbursement.

Private Foundations

A private foundation (vs donor-advised fund) is a standalone 501(c)(3) entity funded by individuals or families. It provides philanthropists with greater control but comes with higher administrative responsibilities. Key features include:

- Full Control: Donors oversee investments, grant-making strategies, and operational decision-making.

- Legacy Building: Foundations often perpetuate multi-generational family philanthropic involvement.

- Higher Administrative Costs: Annual operating expenses typically range from 2.5% to 4%, compared to approximately .05% to 0.6% for DAFs, given the more complex governance requirements.

All of the above characteristics make understanding the difference between a donor advised fund vs private foundation crucial for informed planning.

Tax Deduction Limits

Both vehicles offer significant tax advantages, albeit with different thresholds between a private foundation vs donor-advised fund (and vice versa).

- DAFs: Donors can deduct up to 60% of AGI for cash contributions and 30% for appreciated assets such as stocks, private stock, or real estate.

- Private Foundations: Lower deduction limits apply—30% of AGI for cash and 20% for assets like securities. Despite these lower limits, private foundation tax benefits can still be significant depending on your goals and structure.

Payout Requirements

One of the stark differences between a donor-advised fund vs private foundation is its payout obligations.

- DAFs: No minimum payout requirements. This provides flexibility, as funds can grow tax-free over time while donors distribute grants when it aligns with their charitable objectives.

- Private Foundations: Must distribute at least 5% of net assets annually, a regulation designed to ensure ongoing charitable donations. While this promotes consistent giving, it reduces flexibility.

Control

Philanthropists with specific objectives or a hands-on approach may value the distinct levels of control between private foundation vs donor-advised fund.

- DAFs: Donors hold advisory privileges, recommending charities to receive grants. However, the sponsoring organization retains ultimate control over the fund’s administration and final grant approvals.

- Private Foundations: Full operational control allows donors to directly oversee organizational strategies, manage investments, and establish tailored grant programs. This independence can be key for philanthropists pursuing highly specific initiatives.

Anonymity

For donors who prioritize privacy, visibility varies significantly between a donor-advised fund vs private foundation.

- DAFs: Offer the option to remain anonymous when making grants, appealing to those who prefer discretion.

- Private Foundations: Required to publicly disclose grants, financial information, and donor details through annual filings (Form 990), limiting anonymity.

Startup Time

The time and complexity involved in setting up a private foundation vs donor-advised fund (and vice versa) can influence a donor’s choice, especially for those with time-sensitive tax planning needs.

- DAFs: Establishment is usually quick, often taking just days. Sponsoring organizations handle most of the administrative work.

- Private Foundations: Setting up a private foundation involves more complexity, generally requiring several weeks to months, as well as legal and tax formalities, including establishing governance structures.

Excise Tax

Tax efficiency between a private foundation vs donor-advised fund (and the opposite) extends beyond contributions, encompassing operating structures as well.

- DAFs: Are not subject to excise taxes, allowing funds to grow without the burden of additional taxes on net investment income.

- Private Foundations: Pay an excise tax of 1.39% on net investment income, creating an additional financial consideration for donors.

Asset Optimization Strategies

DAFs

A donor-advised fund (vs private foundation) excels in handling complex, illiquid assets, offering streamlined processes for maximizing tax advantages. Examples include:

- Appreciated Securities: Avoid capital gains taxes and receive deductions for fair market value. For example, donating $1 million in stock with a $200,000 cost basis generates a $1 million deduction while sidestepping $800,000 in capital gains.

- Private Company Stock: Contributions of pre-IPO shares or privately held company stock qualify for immediate deductions, eliminating pressures to liquidate.

- Cryptocurrency/Real Estate: Assets such as cryptocurrency or real estate can also be donated at fair market value, bypassing capital gains taxes.

- Restricted Stock: Locked-up shares can be converted into charitable contributions, providing additional liquidity options.

Private Foundations

While a private foundation (vs a donor-advised fund) is less tax-efficient in certain scenarios, it allows for unique opportunities unattainable with DAFs, including:

- Direct Program Operations: Foundations can operate their own charitable activities, such as running a museum, scholarship fund, or international aid program.

- Family Employment: Donors may employ family members for foundation management and administration, offering opportunities to engage the next generation.

- Non-501(c)(3) Grants: Private foundations can support individuals, political advocacy, or other non-traditional charitable causes, provided legal guidelines are met.

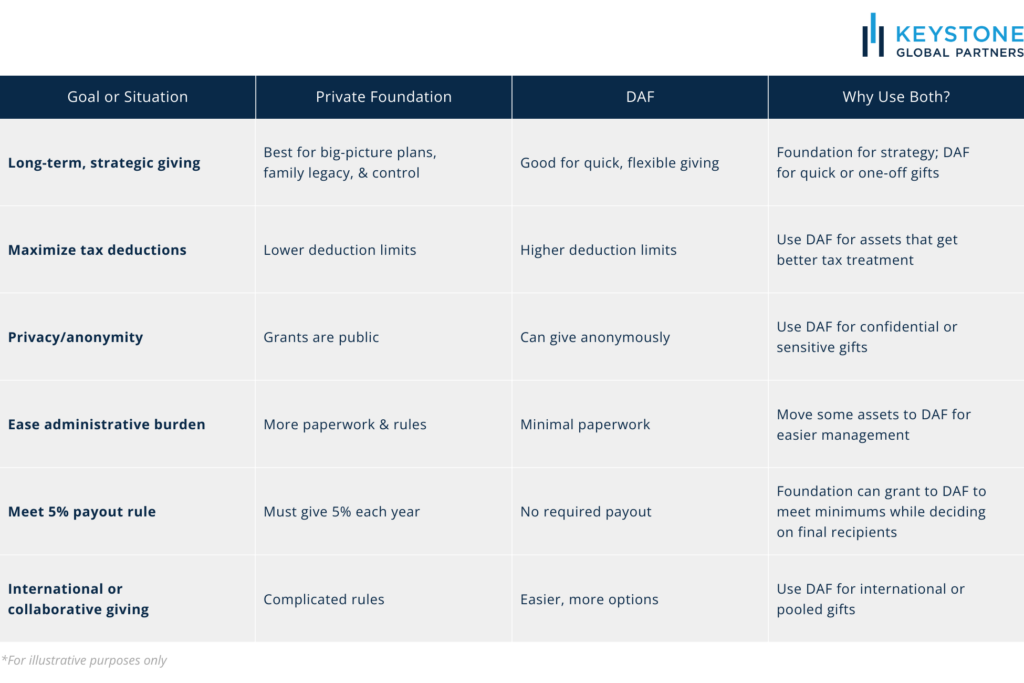

Decision Framework

When to Choose a Donor-Advised Fund vs Private Foundation:

- You prioritize tax efficiency with higher deduction limits (60% AGI for cash) (30% for long term capital gains stock) and the ability to donate complex assets effectively.

- Anonymity is essential for your philanthropic activities.

- You seek simplicity and low administrative costs for contributions exceeding $1 million.

When to Choose a Private Foundation vs Donor-Advised Fund:

- You need direct control over operational and strategic decisions.

- Family involvement and legacy establishment are crucial to your philanthropic goals.

- You intend to fund initiatives like scholarships, direct aid, or grants to non-charitable entities, where greater flexibility is required.

Hybrid Approaches

For sophisticated donors looking to maximize their giving strategy, a combined DAF and foundation strategy can maximize both impact and efficiency.

- DAF-First Approach: Fund a DAF with complex or illiquid assets to maximize immediate tax deductions.

- Foundation-to-DAF Conversion: Over time, mature private foundations may transfer assets to DAFs, reducing administrative burdens while ensuring continued grant-making activity.

Real-World Scenarios

When deciding between setting up a private foundation vs donor-advised fund, consider modeling different approaches based on specific asset contributions and goals. For instance:

- A $10 million donation of private company stock may fare better in a DAF due to the DAFs ability to deduct the fair market value of the private stock and the 30% AGI deduction limit for assets. The foundation will be limited to the basis, with less (20% of AGI) deduction for stock.

- A $50 million art collection could be better suited to a foundation, allowing donors to showcase the collection in exhibitions as part of direct program operations.

Final Thoughts

Donor-advised funds and private foundations each offer powerful tools for achieving philanthropic ambitions, but the right choice depends on an individual’s unique priorities. High-net-worth donors should evaluate their goals for tax efficiency, control, and legacy creation while consulting tax and legal advisors.

For many, integrating both vehicles into a hybrid strategy may deliver the optimal balance of flexibility and long-term impact. Lastly, this article only covers the difference between a donor-advised fund vs. private foundation. There are numerous other charitable strategies worth exploring beyond those discussed in this article, including Charitable Remainder Trusts.

FAQs

What is the difference between a DAF and a private foundation?

A donor-advised fund (DAF) is a charitable giving account established through a public charity, allowing donors to make irrevocable contributions while benefiting from immediate tax deductions, up to 60% of adjusted gross income (AGI) for cash donations and 30% for certain assets. DAFs offer flexibility, anonymity, low startup costs, and minimal administrative responsibilities.

In contrast, a private foundation is an independent legal entity created and controlled by the donor, typically through a board of directors or trustees. Private foundations provide maximum control over investments and grantmaking, including the ability to fund individuals and organizations outside of public charities. However, they require significant setup costs, ongoing administrative work, annual tax filings with public disclosure, and must meet a 5% annual payout requirement. Tax deduction limits for private foundations are lower, generally 30% of AGI for cash and 20% for assets.

In summary, DAFs are ideal for donors seeking simplicity, privacy, and cost-efficiency, and maximum tax deductibility, while private foundations are better suited for those who prioritize control, visibility, and creating a long-term philanthropic legacy.

Can you convert a DAF to a private foundation?

No. Once assets are contributed to a donor-advised fund (DAF), they become the irrevocable property of the sponsoring public charity. These assets cannot be “converted” or rolled back into a private foundation controlled by the donor. While some DAF sponsors may permit grants to unrelated private operating foundations (such as museums or research institutes), such grants are often subject to strict oversight and compliance requirements. Transfers to a donor-controlled, non-operating private foundation are generally disallowed under IRS rules and prohibited by most DAF sponsors’ policies.

What are the pros and cons of a private foundation?

Pros

Maximum Control and Flexibility: Private foundations provide donors with complete autonomy over investment strategy, grant timing, and mission direction, allowing them to fund unconventional projects, make program-related investments, provide scholarships directly to individuals, and support international organizations through expenditure responsibility procedures that donor-advised funds cannot accommodate.

Perpetual Legacy Building: Unlike other giving vehicles, foundations can exist indefinitely and engage multiple generations in governance, creating lasting family philanthropic traditions while building public recognition through transparent operations and the ability to establish signature programs like research institutes or named endowments.

Tax Benefits for Large Gifts: Contributions remove assets permanently from the donor’s taxable estate while providing immediate charitable deductions up to 30% of AGI for cash and 20% for appreciated property, plus donors avoid capital gains taxes on contributed assets that continue growing tax-free except for the modest 1.39% excise tax on investment income.

Professional Family Engagement: Foundations can pay reasonable salaries and reimburse expenses for family members who provide legitimate services, creating opportunities to professionalize philanthropy while mentoring heirs in fiduciary responsibility and civic leadership. Operational Independence: Beyond making grants, foundations can run direct charitable programs, conduct research, publish findings, own real property for charitable purposes, and implement sophisticated impact investing strategies—operational capabilities that other charitable vehicles cannot match.

Cons

High Setup and Administrative Costs: Legal formation typically costs $7,500-$25,000 upfront, while ongoing administration routinely absorbs 0.5%-3.0% of assets annually for audit fees, tax preparation, compliance monitoring, and investment oversight—making foundations economically inefficient for balances under $2-5 million.

Complex Regulatory Compliance: Foundations face strict liability for self-dealing violations (10%-200% penalties), mandatory 5% annual payouts with 30% penalties for shortfalls, excise taxes on investment income, and extensive recordkeeping requirements including public Form 990-PF filings that eliminate donor anonymity.

Lower Charitable Deduction Limits: Tax benefits are capped at 30% of AGI for cash gifts and 20% for appreciated property (versus 60% and 30% respectively for Donor Advised Funds / public charities), and privately held stock contributions are limited to cost basis rather than fair market value.

Inflexible Payout Requirements: The mandatory 5% distribution requirement continues regardless of market conditions

Public Scrutiny and Family Risk: All grants, trustee names, compensation, and investments become public record through Form 990-PF filings, exposing families to media criticism, controversial investments, or political grants.