Last updated: October 2025 | Source: Tax Foundation 2025 State Tax Competitiveness Index

Executive Summary

For founders planning business exits in 2025, state capital gains tax policy represents one of the most significant and controllable variables in post-exit wealth preservation.

While federal capital gains rates remain relatively stable, state-level treatment varies dramatically, creating tax savings opportunities that can approach or even exceed $7 million on a $50 million exit between the highest- and lowest-tax jurisdictions, especially in high-tax city + state combinations versus zero-tax states.

This analysis examines the capital gains tax structures of all 50 states, QSBS conformity status, and the strategic planning implications for venture-backed founders.

Key Findings: The State Capital Gains Landscape

At a high level, states fall into a handful of clear categories based on how they treat capital gains and QSBS, with dramatically different implications for founders’ after-tax proceeds.

Zero-Tax States: The Ultimate Advantage

Eight states impose no capital gains tax whatsoever:

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Wyoming, and New Hampshire

Among these, Texas and Florida stand out as major founder ecosystems with complete capital gains tax elimination. A founder selling a $40 million company in Texas faces zero state capital gains tax versus $5.32 million in California, a difference that could fully fund another startup.

We treat Washington separately because, despite having no wage income tax, it now imposes a long-term capital gains excise tax of 7%–9.9% on certain high-income taxpayers.

The QSBS Conformity Crisis

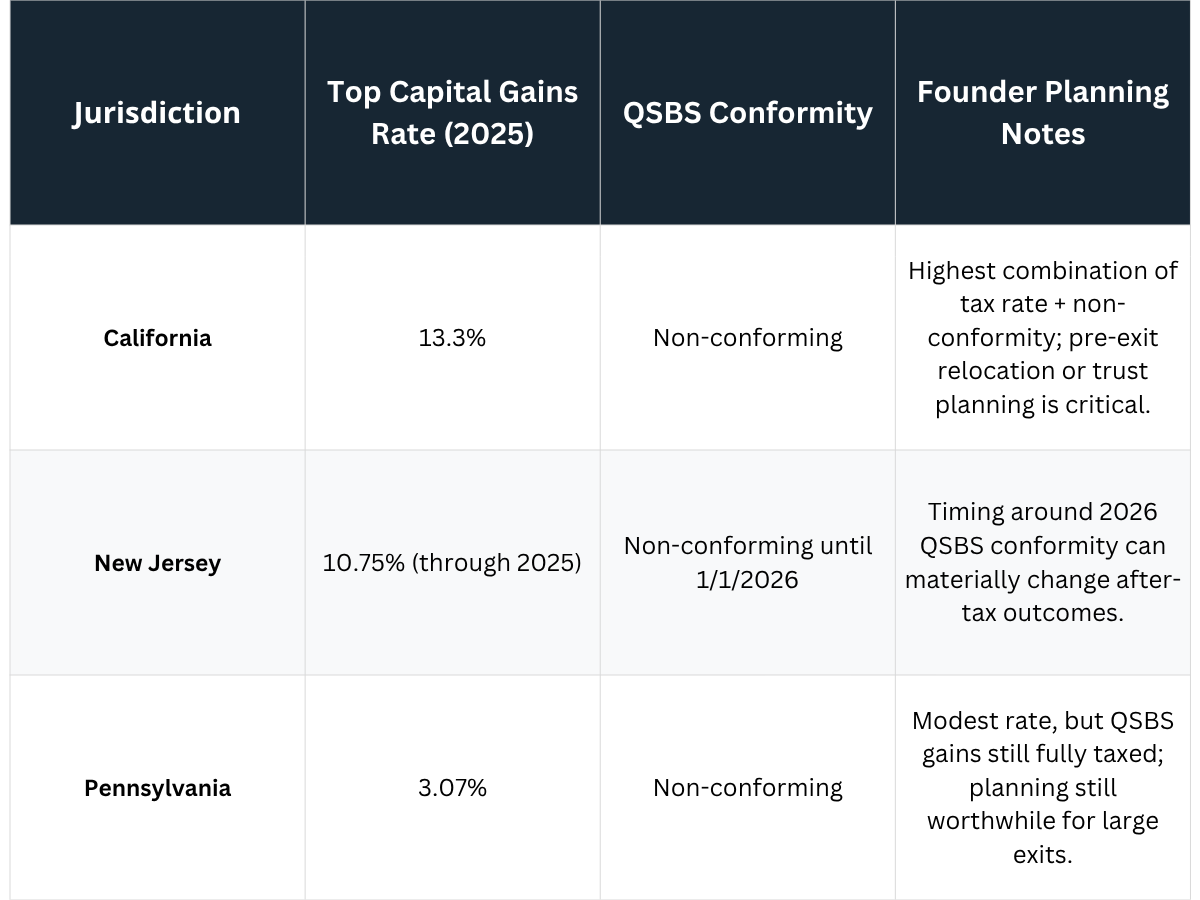

The most critical finding for venture-backed founders: five states, plus the District of Columbia, do not conform to federal QSBS exclusions, meaning qualifying small business stock gains face full state or local taxation regardless of federal treatment:

Non-conforming jurisdictions:

- California: 13.3% (includes 1% Mental Health Services Tax)

- New Jersey: 10.75% (but will conform starting January 1, 2026)

- Pennsylvania: 3.07%

- Alabama: 5.0%

- Mississippi: 5.0%

- District of Columbia: up to 10.75% (capital gains taxed at ordinary-income rates; DC recently voted to decouple from federal QSBS, so qualifying QSBS gains remain fully taxable at the District level)

California presents one of the most significant challenges to preserving founder wealth. With the nation’s highest state capital gains rate AND non-conformity to QSBS, a $50 million qualifying exit faces $6.65 million in state taxes versus zero in conforming no-tax states.

State-by-State Analysis: Complete Breakdown

Category 1: No Income Tax States (8 States)

Ultimate founder-friendly jurisdictions

These states eliminate capital gains taxation by forgoing income taxes:

Alaska – 0%

- QSBS: Conforms (automatic)

- Founder ecosystem: Limited

- Trust advantages: Dynasty and Non-grantor trust favorable

Florida – 0%

- QSBS: Conforms (automatic)

- Founder ecosystem: Major hub (Miami, Tampa)

- Population: 22.6M (largest zero-tax state)

Nevada – 0%

- QSBS: Conforms (automatic)

- Trust advantages: No state income tax, privacy protections

- Founder ecosystem: Growing (Las Vegas tech)

South Dakota – 0%

- QSBS: Conforms (automatic)

- Trust advantages: Privacy, no rule against perpetuities

- Business climate: Top-ranked tax competitiveness

Tennessee – 0%

- QSBS: Conforms (automatic)

- Founder ecosystem: Nashville emerging

- Recent change: Eliminated Hall Tax effective 2021

Texas – 0%

- QSBS: Conforms (automatic)

- Founder ecosystem: Major hub (Austin, Dallas, Houston)

- Population: 30M (largest state by founder activity in zero-tax category)

Wyoming – 0%

- QSBS: Conforms (automatic)

- Trust advantages: Non-Grantor Trusts, Dynasty trusts, privacy

- Business formation: Most favorable LLC/corporation laws

New Hampshire – 0% on wages and capital gains

- QSBS: Conforms (automatic)

- Note: Interest & Dividends Tax repealed effective Jan 1, 2025

- Proximity: Boston ecosystem spillover

Near Zero-Tax: Missouri – 0% state tax on capital gains (effective 2025)

While Missouri taxes wages and ordinary income, recent legislation allows a 100% deduction for individual capital gains beginning in 2025. In practice, that means founders can owe zero state tax on qualifying capital gains while still being subject to regular state income tax on salary and other ordinary income.

Category 2: Lower Capital Gains Rates (8 States)

Preferential treatment versus ordinary income

These states recognize the inflation-adjustment problem and tax capital gains at reduced rates:

Arizona – Effective ~1.875% on eligible long-term gains (25% subtraction from the 2.5% flat rate for long-term capital gains on assets acquired after 12/31/2011)

- QSBS: Conforms

- Founder ecosystem: Phoenix growing

- Recent trend: Continued rate reductions

Arkansas – 1.95% (50% exclusion from 3.9% rate)

- QSBS: Conforms

- Exclusion limit: 50% exclusion generally, and gains exceeding $10M fully excluded

- Planning note: Incredibly generous for large exits

Hawaii – 7.25% (special rate vs. 11% ordinary income rate)

- QSBS: Partial conformity (50% exclusion of QSBS gains from state tax)

- Geographic isolation limits relocatability

Montana – 4.1% (versus 5.9% on ordinary income)

- QSBS: Conforms

- Tax Foundation ranking: Middle tier

New Mexico – Effective top rate around 3.5% on eligible gains (40% exclusion, enhanced in 2025)

- QSBS: Conforms

- Allows the greater of $2,500 or 40% of up to $1,000,000 of capital gain from the sale of a New Mexico business (effective 1/1/2025), which can reduce the effective rate on qualifying gains to roughly 3.5%.

North Dakota – 1.5% (40% exclusion from 2.5% rate)

- QSBS: Conforms

- Lowest effective rate among taxing states

South Carolina – Approximately 3.4% to 3.6% (44% deduction from a top ordinary rate currently around 6.2%, yielding an effective long-term capital gains rate near 3.5%)

- QSBS: Conforms

- Founder ecosystem: Charleston emerging

Wisconsin – 5.355% (30% deduction from 7.65% rate)

- QSBS: Conforms

- Additional: 60% deduction for farm assets

Category 3: States with Higher Capital Gains Rates

Minnesota – 10.85% (includes 1% surcharge on investment income over $1M)

- QSBS: Conforms

- Unique: One of two states taxing capital gains higher than ordinary income

- Minnesota imposes an additional 1% NIIT on net investment income over $1M, hence a top effective rate on gains of 10.85% (9.85% + 1%)

- Minnesota imposes an additional 1% surtax on net investment income (including capital gains) over $1M, bringing the top effective state rate on those gains to 10.85% (9.85% + 1%). It is one of the few states that explicitly layers a separate capital gains/investment income surcharge on top of ordinary income tax rates. Maryland has recently adopted a similar 2% capital gains surtax for high earners.

Washington – 7.0% (Capital gains only, above the standard deduction) and 9.9% applied to the portion of long-term capital gains over $1M

- QSBS: Conforms

- Founder ecosystem: Major (Seattle tech)

- Unique structure: Only taxes capital gains, not W-2 income

- Standard deduction: $278K (2025)

- Washington’s capital gains tax was upheld by the state supreme court, and the U.S. Supreme Court declined to hear further challenges, so while it remains politically controversial, it currently appears durable.

Category 4: Same as Income Tax – High Rate States

Founder-heavy states with significant tax costs

California – 13.3% (Top rate including 1% Mental Health Services Tax)

- QSBS: Non-conforming

- Founder ecosystem: Dominant (SF, Silicon Valley, LA)

- Mental Health Tax: 1% on income over $1M brings total to 13.3%

- Top rate on wages can reach 14.4%; capital gains remain subject to the 13.3% top PIT rate

- Planning imperative: Pre-exit relocation and or trust planning critical

New York – 14.7% (Top State + NYC combined)

- QSBS: Conforms

- Founder ecosystem: Major (NYC fintech, media)

- Planning note: NYC adds 3.876% on top of top 10.9% state rate

New Jersey – 10.75%

- QSBS: Non-conforming through 2025; will conform starting January 1, 2026

- Founder ecosystem: Strong (NYC spillover)

- Legislative update: Passed QSBS conformity law effective 2026

Oregon – 9.9%

- QSBS: Conforms

- Founder ecosystem: Portland tech

- No sales tax offset benefit

Category 5: Same as Income Tax – Moderate Rate States

Balanced approach states

Notable states in this category:

Colorado – 4.4% (Flat rate)

- QSBS: Conforms

- Founder ecosystem: Strong (Denver/Boulder)

- Trend: Continued rate reductions

Delaware – 6.6%

- QSBS: Conforms

- Business advantages: Corporate formation benefits

- Trust planning: Favorable non-grantor and dynasty trust laws

Georgia – 5.19% (Recently flattened from graduated)

- QSBS: Conforms

- Founder ecosystem: Growing (Atlanta fintech)

- 2024 reform: Moved from graduated to flat rate

Massachusetts – 5.0% (9% on the amount above the surtax threshold, which is $1.08M (2025) for LTCG)

- QSBS: Conforms

- Founder ecosystem: Major (Boston biotech, fintech)

- State follows federal QSBS treatment

North Carolina – 4.25% flat in 2025, scheduled to fall to 3.99% from 2026 onward

- QSBS: Conforms

- Founder ecosystem: Emerging (Research Triangle)

- Tax Foundation ranking: 12th nationally

Category 6: Remaining States

Connecticut, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Michigan, Missouri, Nebraska, Ohio, Oklahoma, Rhode Island, Utah, Vermont, Virginia, West Virginia, and Washington, DC

(Separate note: Missouri is an income-tax state that now fully exempts individual capital gains beginning in 2025, making it effectively a 0% capital gains jurisdiction despite taxing wages and other ordinary income.)

District of Columbia (Washington, DC) – Capital gains taxed as ordinary income

DC taxes capital gains at the same graduated rates as ordinary income (top marginal rate currently 10.75%). Historically, DC conformed to federal QSBS treatment, but in 2025, the DC Council voted to decouple from the federal QSBS exclusion. As a result, DC residents can still claim the QSBS exclusion on their federal return, but will owe full DC income tax on otherwise-excludable QSBS gains.

Maryland – Ordinary income plus capital gains surtax for high earners

Maryland taxes capital gains at ordinary income tax rates and, for higher-income taxpayers, layers on an additional 2% surtax on net capital gains once federal adjusted gross income exceeds certain thresholds. For founders in this bracket, the combined state and local burden on capital gains can be meaningfully higher than the headline income tax rate.

These remaining states generally treat capital gains as ordinary income at their standard rates and either fully or substantially conform to federal QSBS treatment (though some have local nuances or special deductions). For founders in these jurisdictions, the primary strategic considerations involve federal QSBS optimization, trust planning, and potential relocation to more tax-advantaged states, except for Washington, DC.

Advanced Tax Planning Strategies

Beyond simple state selection, sophisticated founders can leverage advanced tax planning structures to minimize capital gains exposure while preserving operational flexibility.

These strategies require 12-36 months of planning but can generate tax savings exceeding $10 million on large exits through geographic arbitrage, trust optimization, and strategic entity structuring.

1. Geographic Arbitrage Opportunities

Primary Target States for Founder Relocation:

- Texas: No state taxes + major ecosystem (Austin)

- Florida: No state taxes + growing ecosystem (Miami)

- Nevada: No state taxes + business-friendly environment

Timing Considerations:

- Establish residency for a minimum of 6-12 months before the anticipated exit – Ideally longer.

- Document intent through business operations, home purchase

- Avoid “temporary” appearances that could trigger an audit

2. Trust-Based Tax Minimization

Non-Grantor Trust Structures:

- The state of trust, trustee, and many other factors determine tax jurisdiction and whether the trust is taxed in the grantor’s home state (careful planning required).)

- Can be domiciled in zero-tax states regardless of settlor residence if structured property

- Particularly effective for QSBS in non-conforming states

Dynasty Trust Advantages:

- Perpetual duration in Dynasty Trust states

- Income tax benefits in zero-tax jurisdictions

- Generation-skipping transfer tax planning

3. QSBS Multiplication Strategies

Family Gifting Programs:

- Gift QSBS shares to multiply $10M/$15M exclusions

- Non-grantor trusts to multiply “stack” QSBS

- Particularly valuable in non-conforming states

2025 Legislative Updates and Trends

Legislative momentum in 2025 continues to favor founder-friendly tax policy. Federal enhancements to QSBS now allow up to a $15 million exclusion per issuer per taxpayer, along with shorter holding periods and broader eligibility for qualifying companies. Meanwhile, competitive states are actively reducing capital gains rates, further amplifying planning opportunities. For founders approaching an exit, careful consideration of these evolving rules is critical, as they can significantly influence optimal deal structuring and state residency strategies.

Federal QSBS Enhancement

The “One Big Beautiful Bill Act” QSBS updates (for stock acquired after the law’s enactment):

- Increases QSBS exclusion caps to $15 million, indexed to inflation.

- Create tiered QSBS benefits for shorter holding periods

- Apply to QSBS issued after July 4th, 2025

- Larger Companies Qualify: The act raised the eligibility ceiling for QSBS from $50 million in assets to $75 million, expanding the number of companies that qualify

These new $15 million caps and 3/4/5-year tiered exclusions apply only to QSBS issued after the law’s enactment (July 4, 2025); QSBS acquired before that date remains subject to the legacy 5-year holding period and $10 million (or 10x basis) exclusion rules.

State-Level Developments

Rate reduction trends:

- Iowa: Adopted a 3.8% flat income tax rate, effective January 1, 2025. This replaces the prior multi-bracket system and positions Iowa among the lowest-tax states with an income tax.

- North Carolina: Phasing down its flat personal income tax rate from 4.75% in 2023 to 3.99% by 2027. The rate for 2025 is set at 4.25%. Note:

- Georgia: Transitioned from a graduated income tax to a flat rate. For 2025, the personal income tax rate is set at 5.19%, with scheduled reductions to 4.99% by 2029, subject to revenue triggers.

- Arizona: Reduced its personal income tax to a flat 2.5% as of 2023. AZ has a 2.5% flat income tax; some long-term gains get a 25% subtraction (assets acquired after 12/31/2011 and generally from Arizona sources), yielding an effective 1.875% on those gains. There are currently no scheduled additional rate reductions, but future cuts have been discussed by lawmakers.

New conformity challenges:

- Some states are enhanced conforming to federal QSBS, and some decoupling. New Jersey, for instance, plans to conform as of Jan 1, 2026

- Monitor 2025 legislative sessions in non-conforming states

Washington’s Unique Evolution

Washington’s capital gains tax has already survived major constitutional challenges. The Washington Supreme Court upheld the tax, and the U.S. Supreme Court declined to hear further appeals. While the tax remains politically controversial and is a frequent target for repeal proposals, it currently appears durable—founders should monitor political developments, but should not assume the tax will be struck down.

Practical Implementation Roadmap

Tax optimization strategies remain theoretical without systematic execution; the difference between successful and failed state tax planning often comes down to proper timing and methodical implementation. The following roadmap provides specific action steps tailored to your exit timeline, recognizing that founders with 12-36 months have different options than those facing immediate liquidity events:

For Founders 12–36 Months from Exit

| Phase 1: Analysis

Months 1–3

|

Phase 2: Strategic Planning

Months 4–12

|

Phase 3: Implementation

Months 13–36

|

|---|---|---|

|

|

|

For Founders in Active Exit Process

If you already have an LOI or definitive term sheet on the table, your playbook shifts from long-term optimization to targeted, time-sensitive moves.

| Immediate Actions | Risk Management |

|---|---|

|

|

The Strategic Imperative

State capital gains tax planning represents one of the single highest-ROI tax strategies available to venture-backed founders. The difference between optimal and suboptimal state positioning can exceed $6.65 million on a $50 million exit, more than enough to fund multiple new ventures.

Key strategic priorities:

- California founders: Serious relocation analysis is essential given the dual impact of the highest rates and QSBS non-conformity.

- Residents of all non-conforming states: Should begin trust-based planning or relocation analysis immediately, especially when exits exceed eight figures.

- New Jersey founders: Must consider timing strategies around 2026 QSBS conformity—crossing that date can materially shift after-tax outcomes.

- Founders already in optimal states: Can focus more heavily on federal QSBS optimization, deal timing, and long-term estate planning.

The 2025 landscape offers unprecedented opportunities for founders willing to engage in sophisticated state tax planning. The states that have recognized the mobile nature of capital, particularly Texas and Florida, are positioning themselves as long-term winners in the competition for founder domiciles.

Ready to Turn State Tax Rules Into a Strategic Advantage?

The difference between an optimized exit and a missed opportunity can often be traced to smart, early tax planning, especially when it comes to navigating state capital gains and QSBS conformity. If you’re preparing for a liquidity event or want to understand how the latest state and federal changes impact your exit, now is the time to get expert guidance.

Connect with our founder to walk through your specific scenario and discover how advanced planning can help you capture every available dollar.

Schedule an Exit Strategy Discussion

About Keystone Global Partners: We provide comprehensive exit planning and wealth management for ultra-high-net-worth, venture-backed tech founders. Our founder, Peyton, is nationally recognized for deep expertise in QSBS and advanced tax planning strategies for $20M+ exits.