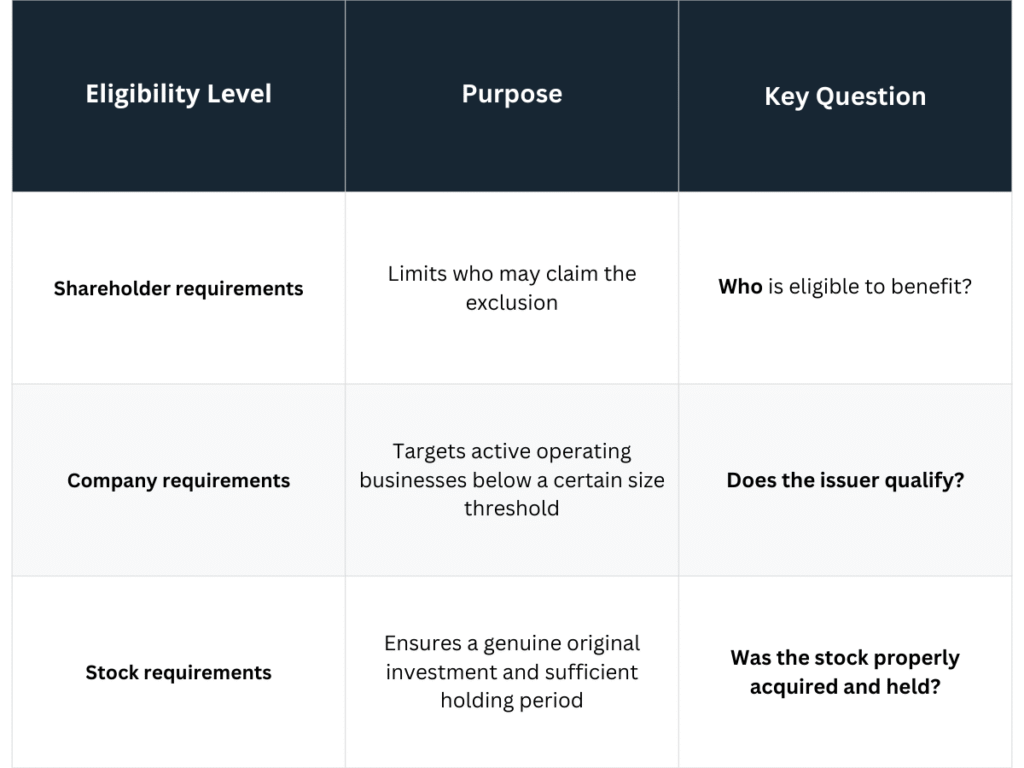

Qualified Small Business Stock (QSBS) Eligibility: Complete Requirements Guide for 2026

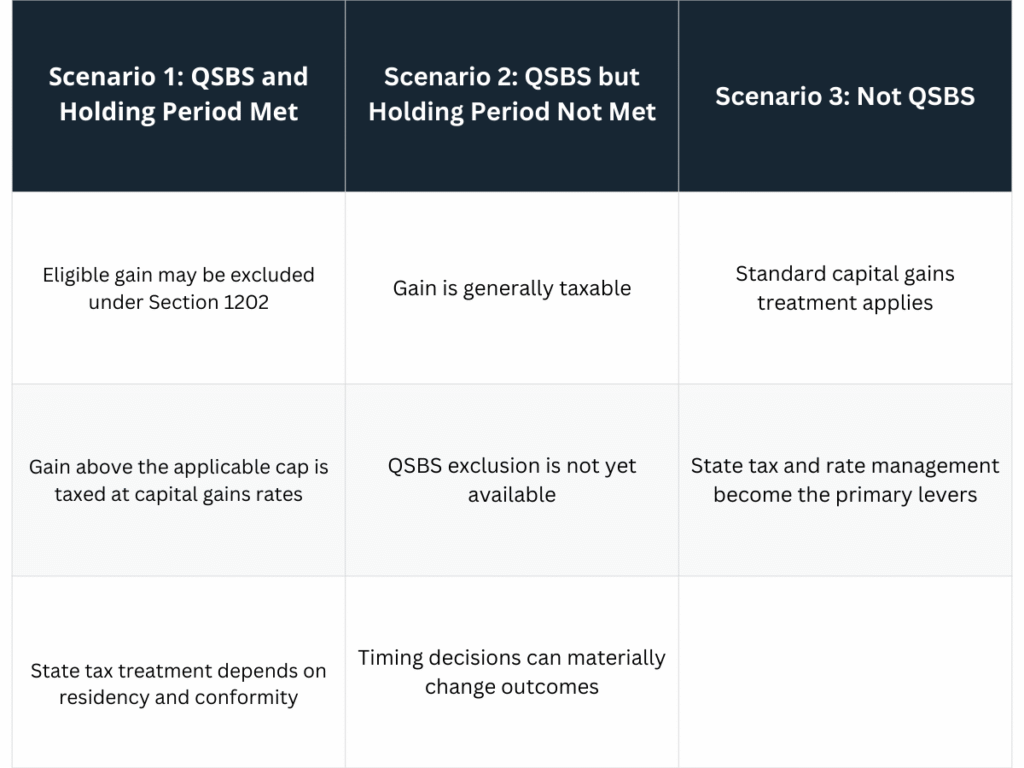

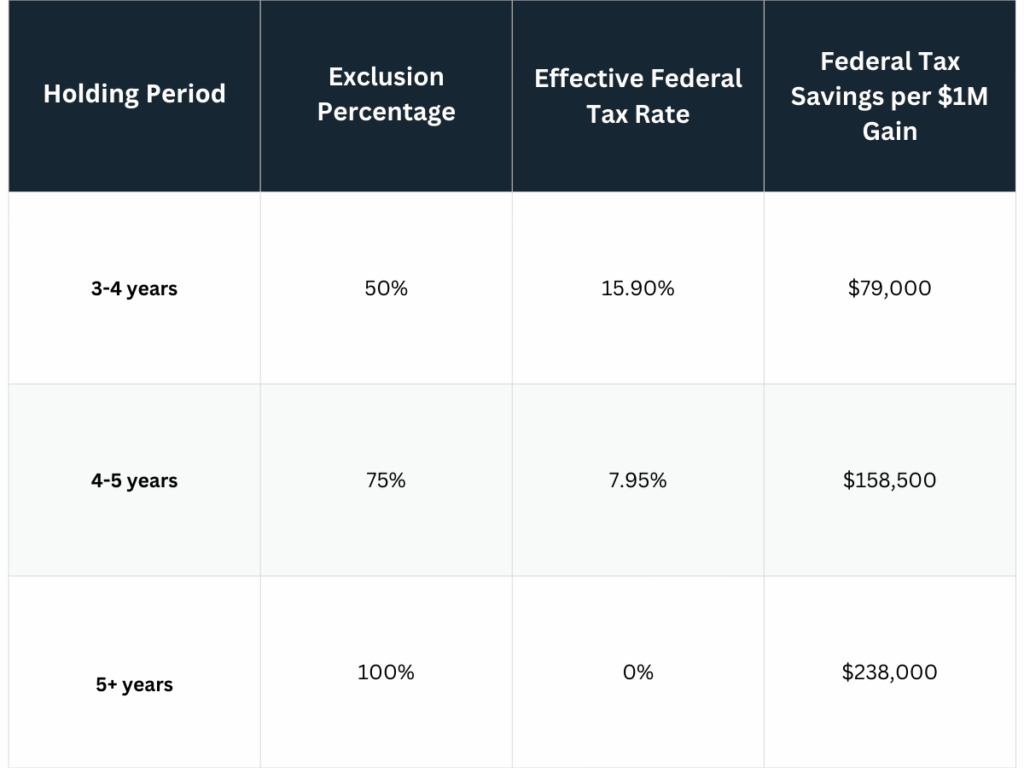

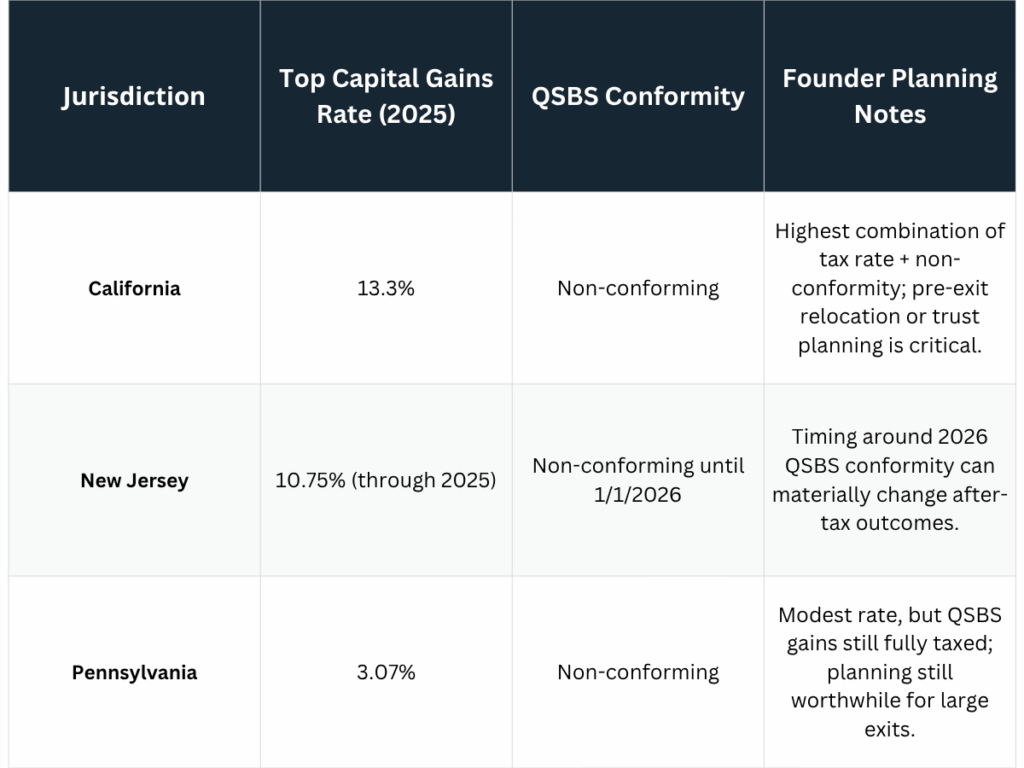

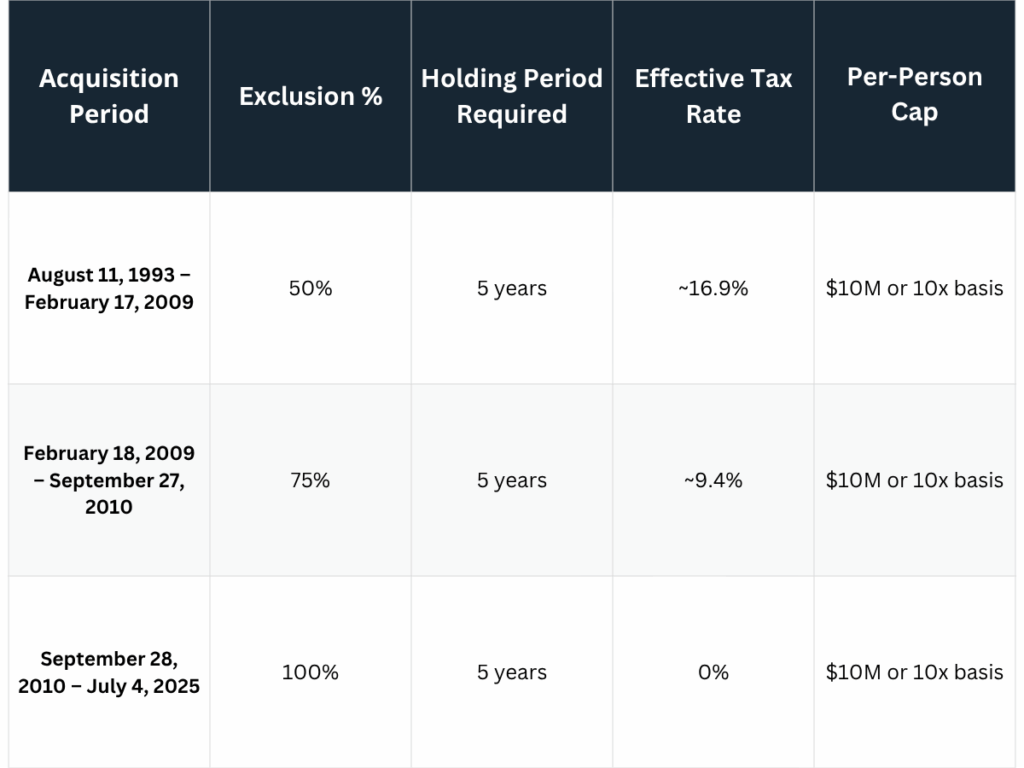

When you are sitting on a potential $40 million personal exit from your tech startup, understanding Qualified Small Business Stock (QSBS) eligibility can mean the difference between excluding a substantial