As we move through the year, it’s important to understand the details of the gift tax and the tax-free gift limit in 2024 for effective wealth sharing with loved ones. The lifetime gift tax exemption is a significant factor that can influence your financial planning. This blog post outlines essential information about the gift tax exemption to aid in informed decision-making.

What is the Gift Tax?

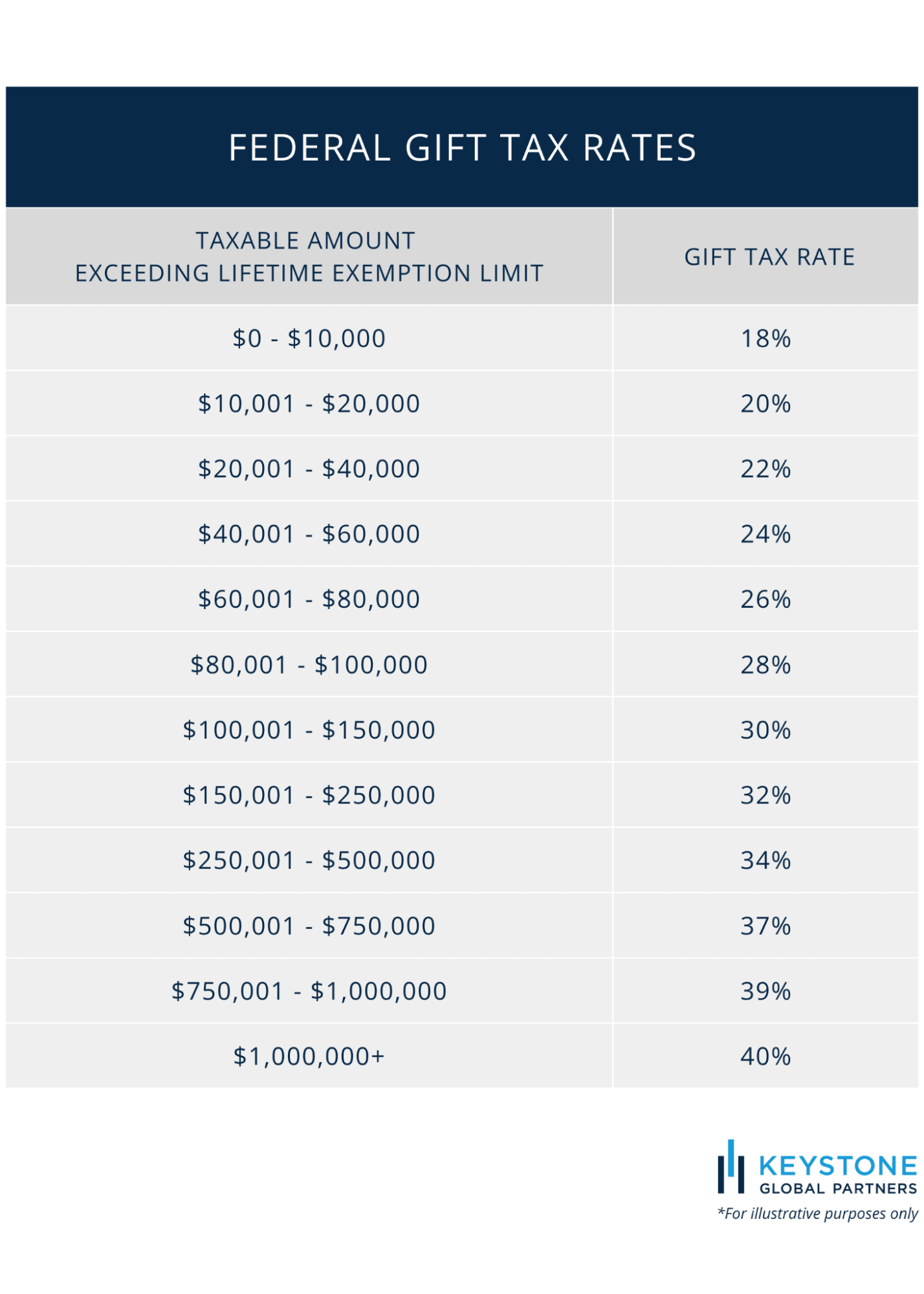

The gift tax is a federal tax levied on the transfer of money or property between individuals when equal value is not received in return. This tax, which ranges from 18% to 40%, is typically the responsibility of the giver rather than the recipient.

Most Americans are unlikely to encounter gift taxes due to specific exemptions set forth by the IRS. However, families and individuals with substantial wealth should familiarize themselves with how this tax works, as it relates to important decisions they may need to make.

The Annual Tax-Free Gift Limit for 2024

A key exemption is the annual gift tax exclusion. The tax-free gift limit in 2024 is set at $18,000 per recipient. This allows individuals to gift up to $18,000 to multiple recipients each year without incurring gift tax. For married couples, the tax-free gift limit in 2024 rises to $36,000 per recipient.

For instance, if you and your spouse have three married children and three grandchildren, you can collectively gift up to $36,000 to each family member, totaling $324,000 in tax-free gifts. Staying within these limits enables you to avoid filing a gift tax return or incurring any tax liability for the year.

Keep in mind that this benefit applies to each calendar year. To maximize your gifting potential, consider making contributions at year-end, such as on December 31, and again at the beginning of the following year, for example, on January 1. Following the scenario above, you can effectively transfer a total of $648,000 in a short period and enjoy the tax-free gift limit in 2024 and 2025.

Lifetime Gift Tax Exemption 2024

In addition to the annual exclusion, a lifetime gift tax exemption exists. The lifetime gift tax exemption in 2024 is set at $13.61 million per individual. This exemption is combined with the estate tax exemption to cover both the total value of gifts during your lifetime and your estate’s value upon death.

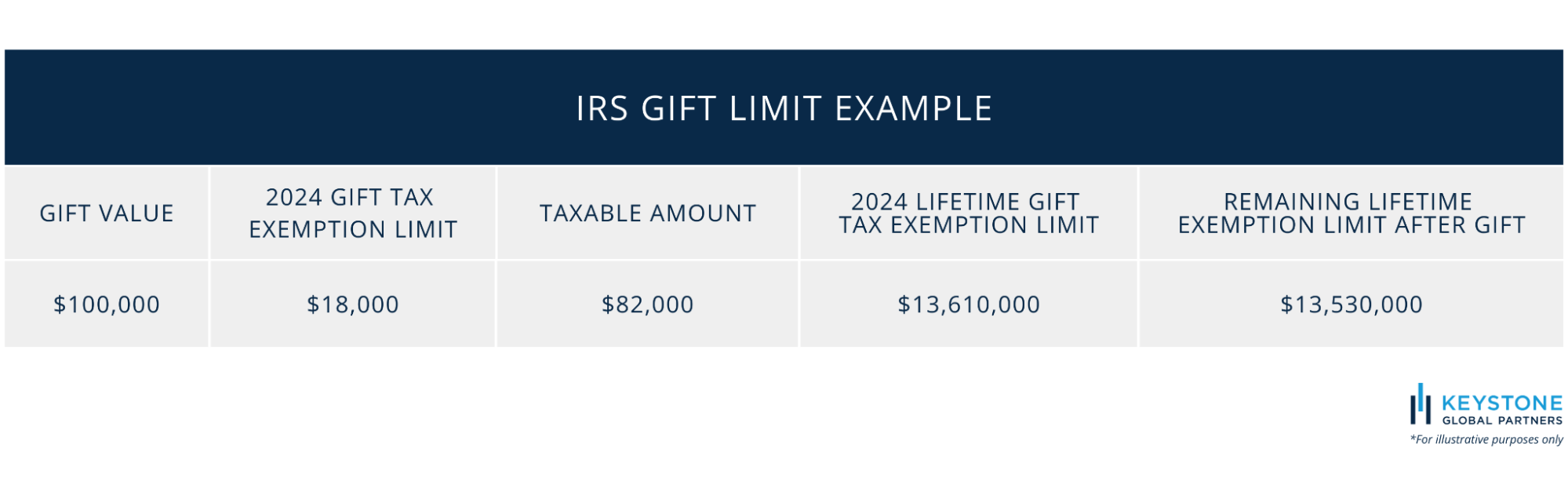

If your gift exceeds the annual gift tax exemption limit, the excess amount is not taxed immediately but is subtracted from your lifetime gift tax exemption for 2024. For example, if you gift $100,000 to your granddaughter, exceeding the annual limit by $82,000, this excess is deducted from your lifetime exemption and leaves you with $13.53 million remaining.

Practical Example of the Lifetime Gift Tax Exemption

Imagine gifting $30,000 to 10 grandchildren within a single year. In doing so, you surpass the $18,000 tax-free gift limit by $12,000, which results in a total excess of $120,000.

10 grandchildren x $12,000 = $120,000

This $120,000 will be deducted from your lifetime gift tax exemption. You’ll still have $13.49 million remaining in your lifetime gift tax exemption bucket. Since you have this amount left in your lifetime gift tax exemption, you won’t owe any taxes on the gifts.

Upcoming Changes to the Lifetime Gift Tax Exemption in 2026

Significant changes are expected for the lifetime gift tax exemption and estate tax exemption. Scheduled for 2026, the historically high gift tax exemption will be reduced by half, adjusted for inflation. Estimates indicate this could lower the lifetime gift-tax exemption to approximately $7 million or less.

These changes have significant implications for individuals and families with substantial wealth. If the tax-free gift limit sunsets as planned, gifts made in 2026 or later may face a gift tax rate of up to 40%. This potential increase highlights the need for strategic financial planning and estate planning.

Gifts made before the 2026 deadline will benefit from the current lifetime gift tax exemption of $13.61 million. By utilizing this exemption, wealthy individuals can make considerable tax-free gifts while also reducing the taxable value of their estates and potentially minimizing future estate tax liabilities.

In light of these forthcoming changes, consulting with a tax professional can offer valuable insights. Working with one can also provide you with advanced tax strategies to maximize your gifting potential under current regulations. This proactive approach ensures effective use of the tax-free gift limit in 2024 and other exemptions while mitigating future tax impact.

FAQs

What is the tax-free gift limit for 2024?

The annual tax-free gift limit for 2024 is $18,000 per recipient. This is the maximum amount you can gift to an individual without filing a gift tax return.

Filing a return does not automatically mean you owe tax. You can actually deduct any excess from your lifetime gift tax exemption, which is $13.61 million per person as of 2024. Taxes on additional gifts apply only after the exemption is exhausted at rates between 18% and 40%.

How much money can you be gifted per year without being taxed?

The recipient is not taxed. The giver is responsible for taxes if the gift exceeds the tax-free gift limit for 2024 and the lifetime gift tax exemption.

What happens if I exceed the annual tax-free gift limit?

Exceeding the tax-free gift tax limit in 2024 does not incur immediate tax. Instead, the excess is deducted from your lifetime gift tax exemption. Taxes are only due after the lifetime gift tax exemption is fully exhausted, at rates ranging from 18% to 40%.

How do I avoid gift tax?

To avoid gift tax, stay within the tax-free gift limit for 2024 and utilize the lifetime gift tax exemption. Strategies such as trusts can also help mitigate potential gift taxes. Consult a tax professional for tailored guidance on minimizing your gift tax liabilities.

Can I deduct gifts on my taxes?

Gifts to individuals are not tax-deductible. Only donations to qualified organizations may be eligible for deductions on your federal income taxes.

Does the 2024 gift tax exemption have anything to do with 2024 tax brackets?

No, the gift tax exemption is separate from federal income 2024 tax brackets. The gift tax rates range from 18% to 40%, depending on the value of gifts made during your lifetime and at death. Consult a tax professional for advice on minimizing potential gift and estate taxes based on your unique financial situation.