Tax Strategy and Optimization are integral to maximizing your wealth

Our goal is to enhance your wealth through tax strategy and tax optimization. We offer proactive oversight of your tax obligations to minimize tax burden – both in current and future years. Our continuous and iterative approach aims to maximize “tax alpha” by considering tax saving strategies in every financial decision.

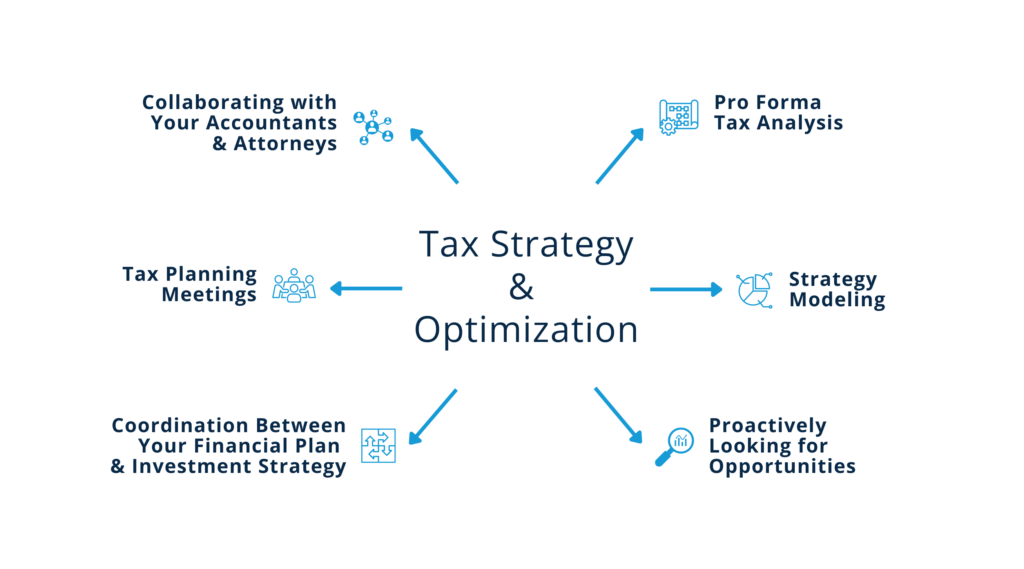

Our Areas of Focus on Tax Strategy and Optimization

Our Approach to Tax Strategy for our Clients

Navigating the ever-changing landscape of tax, which often represents your largest expense, requires a strategic approach. Developing tax saving strategies that leverage every opportunity to minimize taxes poses a significant challenge. This is particularly the case for individuals with substantial wealth and intricate financial situations.

At Keystone, tax strategy is an integral part of our wealth management approach for every client and we seamlessly integrate this throughout our service model. Our tax optimization strategies range from making strategic portfolio-level investment decisions to advanced items such as business exits, trust and wealth transfer planning, jurisdiction choice and more. Our aim with comprehensive planning is to minimize tax burden both now and in the future to ensure you retain a greater portion of your wealth through tax saving strategies.

Advanced Tax Optimization for Startup Founders, Entrepreneurs, and Their Families

Our services include advanced tax optimization for startup founders, entrepreneurs, and their families. We possess a deep understanding of the unique issues and challenges you face.

Our expertise enables us to identify and implement valuable tax optimization strategies at different stages of your life. As your opportunity set evolves we’ll help you to retain more of your wealth.

Tax Strategy Process

Pro Forma Tax Analysis and Strategy Modeling

Our team conducts a thorough analysis of your tax situation. We incorporate previous years’ returns, your balance sheet, your financial plan, and expected future changes in your financial situation.

This process allows us to identify opportunities where implementing advanced tax strategies can minimize taxes both now and in the future. This model is updated whenever we have new information and is also used to determine the tax impact of certain decisions.

Examples

- Optimal timing for a large capital gain realization

- 1031 exchange

- Exit Planning

- Impact of future tax law changes

- QSBS planning

- Charitable Planning

- Multi-year Roth conversion strategy

Proactively Looking for Opportunities

We continuously seek ways to reduce your tax liability. We do our best to anticipate changes in tax legislation, your financial circumstances, or your available opportunity set.

Coupled with yearly recurring tax reduction strategies, these efforts can yield substantial savings over time. By anticipating possible changes in your life, we proactively refine your tax strategy.

Examples

- Opportunity Zones

- Estate and gift tax exemption sunsets

- State tax laws

- Charitable remainder trusts

- QSBS planning

Coordination Between Your Financial Plan and Investment Strategy

Coordinating your tax strategy with your financial plan and investment strategy is critical to minimize taxes you owe. This ensures that tax strategy doesn’t occur in isolation but is integrated with all aspects of your financial life.

By considering your goals and how your investments will affect your tax situation today and in the future, we can be proactive. This involves selecting the right types of vehicles or trusts for your investments and timing the recognition of income and gains. It also requires strategically planning for charitable giving, trusts, and estate planning.

Examples

- Tax-efficient investing and after-tax portfolio optimization

- Tax-loss harvesting

- Option exercise strategies

- Jurisdiction considerations

- Wealth transfer planning

- Asset location

- Depreciable assets

Tax Planning Meetings

Here, we review, evaluate, and adjust your tax strategy based on changes in your financial situation or new opportunities. We examine and stress-test aspects such as estate tax liabilities and explore tax reduction strategies and ways to reduce them.

We also forecast an estimate of your expected tax bill for the upcoming year. Together, we will review our analysis and assess the effectiveness of previously implemented tax saving strategies to ensure they meet expectations.

This iterative approach enables us to be agile and responsive. It enables us to ensure that your tax planning strategy aligns with your financial objectives and your expectations.

Examples

- Review your pro forma tax reports with summary data

- Interactively demonstrate your current tax situation

- Examine the tax impact of making specific decisions

- Forecast how things may look in future years.

Collaborating With Your Accountants and Attorneys

We collaborate with your accountant and attorneys to ensure that your financial plan and tax strategy are executed flawlessly and to explore ideas.

We work in tandem with your accountants and attorneys to serve as a quarterback to provide a comprehensive and unified approach when it comes to your tax minimization strategies.

Examples

- Tax law changes

- Strategy development and execution

- Quarterly tax estimates

Frequently Asked Questions

Having a tax strategy is crucial for anyone with substantial wealth, as taxes are typically one of the largest expenses. A proactive and comprehensive tax plan can help minimize tax burden both now and in the future.

Ultimately, it ensures that you retain a greater portion of your wealth. Without a tax strategy you miss out on opportunities to reduce your taxes or unintentionally incur additional taxes.

We optimize and implement tax minimization strategies by conducting a thorough analysis of your tax situation. We’ll proactively seek opportunities to reduce your tax liability by coordinating between your financial plan, investment strategy and your current and future opportunity set.

We’ll also regularly review and adjust our strategies while collaborating with your accountants and attorneys. This comprehensive approach allows us to identify and implement the most effective tax optimization strategies for you. Additionally, we stay updated on changes in the law.

Understanding capital gain tax on business sales is crucial for any entrepreneur. The amount of tax you will pay when selling your company depends on various factors. They might include

- The type of entity your company operates as

- The structure and terms of the sale

- The jurisdiction you live in

- How long you have owned your equity

- Any applicable deductions or exemptions

Our team conducts a thorough analysis to estimate your expected tax liability and plans custom tax reduction strategies on your behalf. It is crucial to have a proactive tax strategy in place as it relates to selling your company and to implement exit planning in advance.

Moving states before selling your business can have significant tax implications. Certain states have lower, or no state income taxes, and moving to these states can potentially reduce your tax liability. However, it is essential to consider factors of moving that impact quality of life such as uprooting your family and business operations.

Also, some states have strict residency requirements for tax purposes. It’s therefore crucial to consult with our team and your accountants before making any decisions. We can help you evaluate potential tax savings and determine if it is a wise move for your financial situation.

In addition, we can also explore other strategies involving trust planning to minimize tax burden in states with higher income taxes. Overall, it is essential to carefully weigh the potential benefits and costs before making a decision.