For high-net-worth individuals aiming to minimize tax and maximize assets transferred to beneficiaries, one strategy they can consider is the use of a Grantor Retained Annuity Trust (GRAT). This article will explore what a GRAT is, how it functions, its tax benefits, and the potential risks involved.

Additionally, we will explore Grantor Retained Annuity Trust strategies designed for founders and entrepreneurs holding private stock shares.

Why Would I Consider a GRAT for Wealth Transfer?

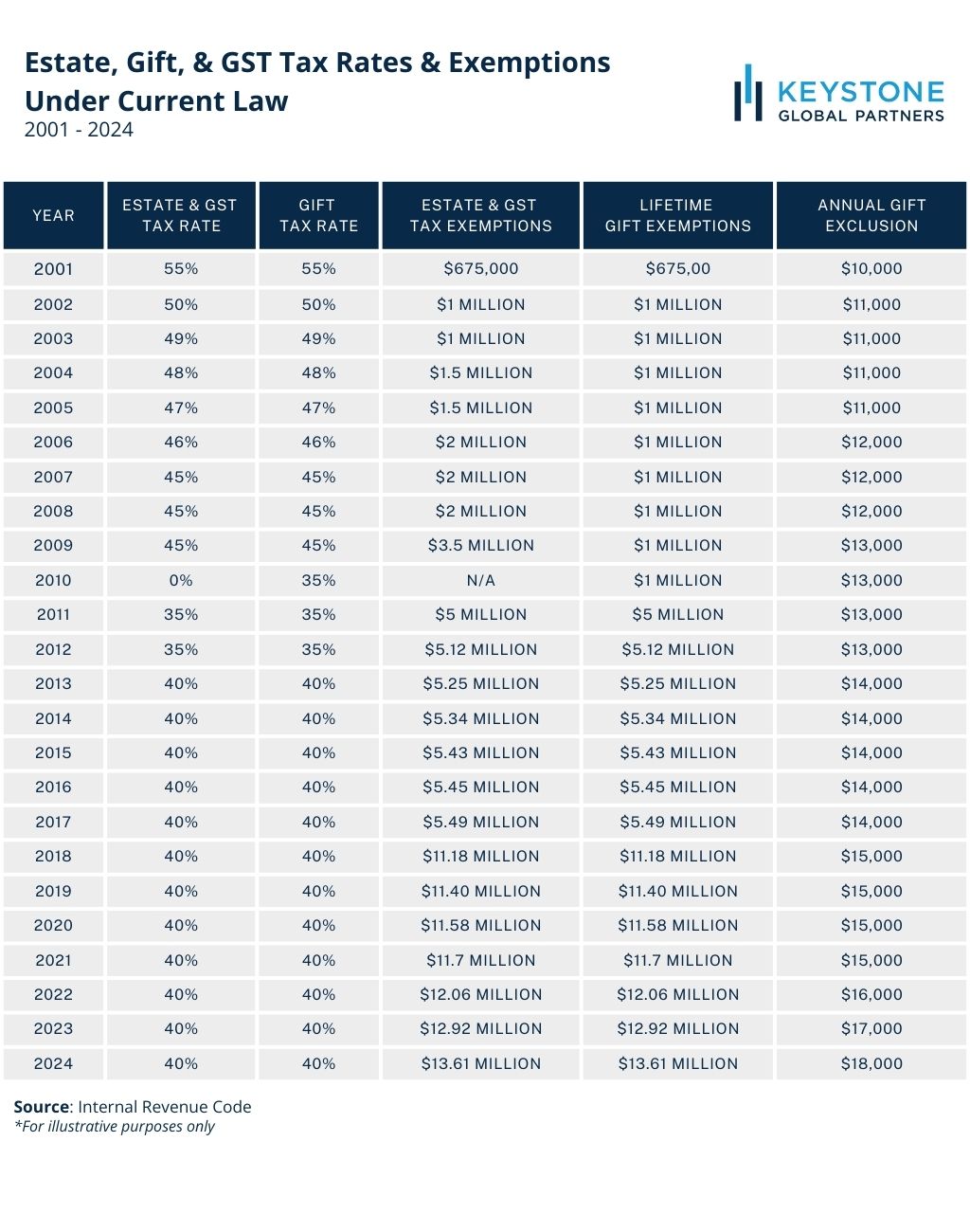

During your lifetime, you can only gift a limited amount of assets, and this limit is set to decrease by 2026. For 2024, the lifetime gift tax exemption stands at $13.61 million (or $27.22 million for married couples). This allows you to gift that amount without incurring federal gift taxes.

However, this exemption is projected to drop to approximately $7 million by 2026. Consequently, any gifts exceeding this lifetime limit, or an estate when you pass away that is over this limit, will incur a 40% tax rate.

To navigate this, wealthy individuals and families often utilize Grantor Retained Annuity Trusts (GRATs) to transfer wealth and minimize tax liabilities. A GRAT enables you to pass on the growth of assets to beneficiaries with minimal tax impact.

Ultimately, a Grantor Retained Annuity Trust lowers the estate’s taxable value and helps it avoid a potential 40% estate tax. This approach can significantly enhance estate planning strategies.

What is a Grantor Retained Annuity Trust (GRAT)?

A GRAT is a type of irrevocable trust designed to transfer assets to heirs while minimizing gift and estate taxes. The grantor places assets into the trust and receives an annuity payment for a specified term.

After the term concludes, any remaining assets in the trust pass to its beneficiaries. They can also transfer to a trust potentially free of estate and gift taxes.

How Does a GRAT Work?

The Grantor Retained Annuity Trust primarily operates by “freezing” the value of assets at the time of its creation. The grantor receives annual annuity payments based on the IRS Section 7520 rate, which is known as the hurdle rate. This rate is determined by the IRS and fluctuates monthly based on economic factors.

Determining Assets and Length of the GRAT Term

When choosing assets, high-growth assets such as stocks, shares in a private company, or family business interests expected to appreciate significantly are an ideal choice. During the term of the Granted Retained Annuity Trust, the grantor receives annuity payments calculated based on the initial asset value and the hurdle rate.

Any assets remaining in the trust at the end of the term are transferred to the beneficiaries or a trust tax-free. This is provided that the assets have appreciated beyond the hurdle rate.

Benefits of Using a GRAT

Tax Efficiency

A Grantor Retained Annuity Trust allows significant wealth transfer to heirs with minimal use of lifetime gift and estate tax exemptions. If the trust assets appreciate beyond the hurdle rate, the excess value passes to beneficiaries free of additional taxes.

Flexibility

GRATs provide flexibility in asset management. For example, if the initial assets underperform, they can be replaced with those that have greater potential.

This feature of Grantor Retained Annuity Trusts enables grantors to optimize for performance throughout the duration of the GRAT. Conversely, if the assets appreciate too quickly, they can be exchanged for cash or other assets projected to grow at a slower pace.

Income Stream

The annuity payments from the Grantor Retained Annuity Trust provide a steady income stream for the grantor. This can be particularly beneficial for those who still need access to liquid assets.

For those who are not as concerned with income, or who intend to use private company shares, annual payments from a Grantor Retained Annuity Trust (GRAT) can be back-end loaded. What results is smaller payments at the beginning and larger payments at the end of the GRAT term. This structure allows assets to remain in the GRAT and appreciate for a longer period.

Risks of Using a GRAT

Though it has benefits, a Grantor Retained Annuity Trust also has its own set of risks. Here a 3 to keep in mind:

Mortality Risk

If the grantor does not survive the GRAT term, the trust assets are included in the estate. This potentially negates the tax benefits.

Asset Underperformance

If the assets do not outperform the hurdle rate, the Grantor Retained Annuity Trust merely returns the assets to the grantor without significant tax benefits. At the same time, no additional adverse tax consequences arise.

Regulatory Changes

Potential changes in estate tax laws could affect the effectiveness of GRATs. It’s crucial to stay informed and consult with legal and financial advisors to navigate these complexities.

Strategies to Customize a GRAT Based on Your Own Situation

Implementing specific strategies can optimize the effectiveness of a GRAT. Here 3 in particular that come to mind:

Zeroed-Out GRAT

In a zeroed-out GRAT, the present value of the annuity payments equals the total value of the assets contributed. This approach ensures that any leftover assets at the end of the term are transferred tax-free, as the IRS considers the value of the remainder to be zero.

This is particularly helpful for those who have already utilized their lifetime gift tax exemption, and only want to transfer the upside of an asset.

Back-Loading Payments

Instead of equal annuity payments, consider structuring the Grantor Retained Annuity Trust to increase payments over time. This strategy keeps more assets in the GRAT longer, which maximizes potential appreciation. It’s a particularly efficient strategy when using private company shares.

Rolling GRATs

Establish a series of short-term GRATs. Rolling GRATs, as they’re often called, allow for greater flexibility and risk management. The annuity payments from the previous Grantor Retained Annuity Trust fund each new GRAT.

GRAT Strategy for Founders and Business Owners

Founders and business owners can strategically leverage a Grantor Retained Annuity Trust (GRAT) to transfer private company shares to heirs or a trust. By moving assets into a GRAT, founders receive annuity payments calculated based on the IRS 7520 rate.

When the assets within the trust grow at a rate exceeding the IRS 7520 rate, the excess growth remains in the trust and can be transferred to heirs free from gift and estate taxes. This remainder interest can be significant, particularly for private stock, which is expected to increase substantially in value. It is especially beneficial when planning ahead of a funding round.

A notable advantage of a GRAT is its design as a grantor trust. This means it allows grantors to cover the taxes generated by the trust if there is tax. The tax payment option associated with a GRAT can significantly enhance the value of assets transferred to heirs.

However, remember that for a GRAT to be effective, the grantor must outlive its term. If the grantor passes away before the term concludes, the assets could revert to being included in the founder’s estate, and potentially nullify intended tax benefits.

Additionally, for those whose private company shares qualify for QSBS, the remainder at the end of the GRAT could qualify for its own QSBS exclusion. This is one way of implementing QSBS stacking and can be particularly beneficial for those who have already done some trust planning. It’s also valuable for those who’ve exhausted their lifetime gift tax exemption, but would like to create additional taxpayers for QSBS purposes and multiply the QSBS tax benefits.

GRAT Example

Imagine a founder named Robert. He has $60 million in private shares and decides to earmark $30 million to utilize a Grantor Retained Annuity Trust before his company raises Series B funding.

Robert sets up a three-year zeroed GRAT and transfers $30 million in private company shares into it. Each year of the GRAT, Robert will receive the equivalent of $10 million, plus interest at the IRS 7520 rate, back in shares.

Now, let’s fast forward to the end of the three years. Because the stock value more than doubled after his company’s Series B, the GRAT remainder interest was nearly worth the initial $30 million that Robert had funded.

This remainder interest was able to transfer to Robert’s heir’s gift and estate tax-free. Talk about a win-win!

Final Thoughts on Grantor Retained Annuity Trusts

A Grantor Retained Annuity Trust (GRAT) is a powerful wealth transfer planning tool that enables high-net-worth individuals to transfer assets while minimizing tax liabilities. The flexible structure of a GRAT, combined with its potential for significant appreciation, makes it an appealing strategy, especially for business owners and founders with private shares.

Although there are inherent risks, such as mortality and regulatory changes, the benefits — such as tax efficiency and income generation — often outweigh these concerns when implemented carefully. Ultimately, proactive planning and collaboration with financial and legal advisors are crucial to maximizing the advantages of a GRAT and ensuring it aligns with broader estate planning objectives.

FAQs

What are the downsides of a GRAT?

The primary downside of a GRAT is that if the grantor does not survive the term, the assets transferred into the trust will be included in their estate and potentially subject to estate tax. Additionally, if the assets do not appreciate at a rate higher than the IRS 7520 rate, there may be limited tax benefits from using a GRAT.

What is a Grantor Retained Annuity Trust and how does it work?

A Grantor Retained Annuity Trust (GRAT) is an estate planning tool that allows high-net-worth individuals to transfer assets to heirs or a trust while minimizing tax liabilities. The grantor sets up the trust and receives annual payments based on the IRS 7520 rate for a fixed term, typically 2-10 years. Any growth in the assets above this rate passes to the beneficiaries free of gift and estate taxes.

What are some strategies for maximizing GRAT effectiveness?

Three common strategies for optimizing a GRAT include zeroed-out GRATs, back-loading annuity payments, and creating rolling GRATs. Additionally, founders and business owners can use a GRAT and QSBS and create additional taxpayers and multiply the QSBS benefits.

Who pays the tax on a Grantor Retained Annuity Trust?

The grantor is responsible for paying any taxes incurred by the trust since it is considered a grantor trust. This tax payment option can benefit founders and business owners as it essentially allows them to cover the taxes generated by the trust and increases the value of assets transferred to heirs. However, if there is no taxable event within the trust during its term, private shares for example, there may not be any taxes to pay.