Imagine maximizing your profits from your startup’s exit through a few strategic tax break strategies and the Qualified Small Business (QSBS) rules. For founders holding substantial positions of QSBS, this dream could become a tangible reality. By harnessing the often overlooked but powerful tax benefits of QSBS and QSBS Stacking, you may be able to enhance your post-exit take-home.

Quick recap, Qualified Small Business Stock refers to a tax provision under Internal Revenue Code Section 1202 which provides founders and entrepreneurs with substantial tax advantages, potentially allowing for the exclusion of up to $10 million, or 10x basis, whichever is greater, from taxes. Wondering if you qualify? You can read our article on whether you’re eligible for Qualified Small Business Stock (QSBS), here covering founder stock, the Section 1202 Exclusion, and how to qualify.

In this guide, we will delve deeper and discuss the tax benefits of QSBS stacking, an advanced strategy for multiplying the QSBS exemption, and we’ll examine a variety of strategies specifically designed for QSBS stacking. In this article, we will interchangeably use the terms QSBS exclusion and QSBS exemption. Many refer to the QSBS exclusion as the QSBS exemption, even though QSBS exclusion is the accurate term.

Timing

Understanding timing in the context of when to engage in this type of advanced planning is crucial for any startup founder with an exit on the horizon. Ideally, the optimal window is when an exit seems not only possible but probable, and certainly well in advance of when a formal offer or LOI has been accepted.

Delaying your planning until you have a deal could lead to an unintended, hefty tax liability through the assignment of income. The Internal Revenue Code states that if all contingencies have been addressed and cleared before the closing date, the transaction’s effective date is usually the signing date, not the closing date. Therefore, being proactive and not waiting until the last minute is crucial.

QSBS Stacking Strategies

1. Outright Gifting of QSBS

Founders looking to maximize their QSBS exemption might consider gifting their Qualified Small Business Stock (QSBS) outright to non-spousal family members, such as children, parents, or other qualifying individuals as one QSBS stacking approach. This method of donative transfer allows the recipient to retain the original QSBS holding period of the founder but obtain their own $10 million exclusion. For instance, if you have $20 million of QSBS and gift $10 million to your brother, you have created an additional $10 million of exclusion, totaling $20 million exempt from federal taxation.

However, what outright gifts gain in simplicity, they lack in other important areas, such as control, protection against creditors, and efficient utilization of your gift tax exemption. These items are why I typically do not recommend this QSBS stacking approach.

2. Irrevocable Non-Grantor Trust(s)

Company founders may explore a more advanced QSBS stacking approach: gifting QSBS to irrevocable non-grantor trust(s). This enables the trust(s) to meet the criteria for its own $10 million QSBS tax exemption. As the trust grantor, the founder chooses beneficiaries, such as children or future children, for example. When implementing this strategy, it’s crucial to note that if multiple trusts appear too alike, they might be viewed as a single entity for tax purposes. Simply put, if you intend to create several trusts, they should not be carbon copies of one other.

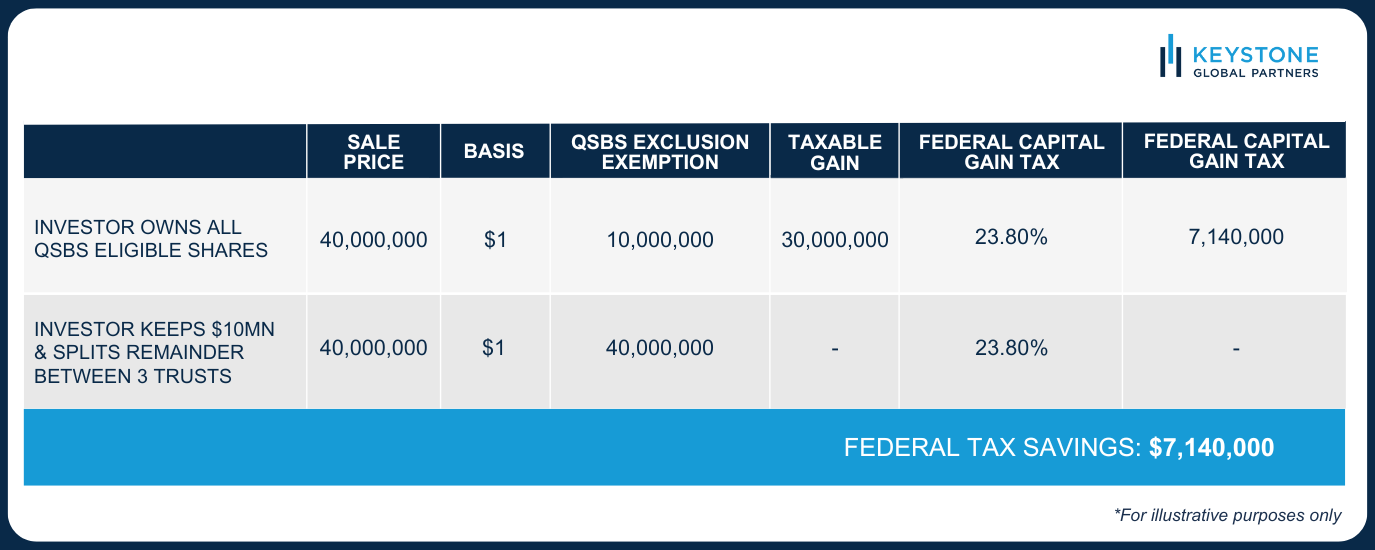

Consider a situation in which a founder has three children. The founder establishes a QSBS Non-grantor trust for each child and transfers $10 million of QSBS to each trust. By doing this, the founder successfully utilized QSBS to exempt $40 million from federal tax: $10 million for himself through his own exclusion and $30 million for the trusts.

Refer to the example provided below:

In addition to the federal tax benefits, it is important to also consider the potential state tax advantages. By establishing the trust in a tax-friendly state like Nevada or Delaware, there is a possibility of minimizing state taxes post-exit. It is also worth noting that while some jurisdictions, such as New York, conform to the federal tax treatment of QSBS, states like California do not.

When it comes to gifting QSBS shares to a trust, there’s an important factor to consider: it will utilize a portion of your $13.61 million ($27.22 million for a married couple) lifetime gift tax exemption. Strategically, it’s advisable to make this move well in advance of an exit when asset valuations tend to be lower instead of waiting until the exit is imminent. By taking this approach, you can maximize the efficiency and utilization of your lifetime gift tax exemption.

3. GRAT Structure: Gift of the Remainder Interest

A Grantor Retained Annuity Trust (GRAT) provides founders with a tax-efficient approach to transfer assets to beneficiaries, effectively reducing gift and estate tax obligations. By placing assets into a GRAT, the founder is entitled to a series of annuity payouts determined by the IRS Section 7520 interest rate. If the assets grow at a faster rate than the interest rate, any excess amount will be retained in the trust. After the trust’s term expires, this excess can be transferred to the beneficiaries tax-free. This interest could qualify for Qualified Small Business Stock (QSBS) status if transferred to another person (excluding the grantor) or to a non-grantor trust.

This method of QSBS stacking is particularly attractive for founders who have maxed out their lifetime gift tax exemptions. However, the founder must outlive the trust’s term. Otherwise, the benefits are lost, and the assets return to the founder’s estate. If you’re considering this approach, it’s important to weigh the benefits with the limitations.

4. Using a CRUT (Charitable Remainder Unitrust)

Another strategy for leveraging the QSBS exemption and QSBS stacking involves a Charitable Remainder Unitrust. By transferring shares into a Charitable Remainder Unitrust, also known as a CRUT, the CRUT can potentially secure its own $10 million QSBS exemption. This also provides the founder with a small deduction for their charitable contribution.

The founder then receives annual “unitrust” distributions from the CRUT, calculated by applying a fixed percentage to the value of the CRUT’s assets. Specific guidelines and the trust’s timeline determine this percentage, which typically ranges from 5% to 50%. The shorter the duration, the higher the annual distributions until the assets are returned to the founder, with the exception of a small portion that goes to the founder’s charity of choice.

The tax-exempt status associated with a CRUT allows a founder to avoid immediate taxation when their shares are sold through via an exit. While the founder will eventually face taxes on disbursements from the trust, these payments are typically subject to a tiered tax structure that prioritizes the distribution of the most heavily taxed segments first. However, if the CRUT meets the criteria for the Qualified Small Business Stock (QSBS) exclusion, a staggering $10 million in gains from the exit could potentially be excluded from taxation when distributed back to the founder. This could be another strategy for leveraging the QSBS tax exemption and effectively implementing QSBS stacking.

Conclusion

Founders with Qualified Small Business Stock (QSBS) have a variety of strategic choices to consider. By exploring strategies such as QSBS stacking, the tax code, and adhering to the QSBS rules, founders can optimize their after-tax results. QSBS stacking is just one of multiple sophisticated planning strategies to help reduce capital gains tax, lower future estate tax, and enhance asset protection. Implementing strategic QSBS solutions can further refine these approaches, maximizing benefits and aligning them with personal financial goals. Explore our guide for more insights on advanced tax-saving strategies tailored for company founders.

As always, approaching such tax strategies requires careful financial planning and collaboration with tax advisors, legal experts, and wealth management experts to ensure alignment with individual circumstances and objectives. to ensure alignment with individual circumstances and objectives.

Read more about this subject in our published article written by our cofounder, Peyton Carr, on Forbes.com.

FAQ

How does QSBS stacking work?

QSBS stacking is a strategy involving the Qualified Small Business Exemption under Section 1202 of the Internal Revenue Code, whereby a shareholder can exclude capital gains on the greater of $10 million, or 10x basis. The stacking strategy aims to expand the cumulative $10 million limit for Qualified Small Business Stock (QSBS) by creating additional $10 million (or 10x basis) exclusions. This strategy involves transferring Qualified Small Business Stock (QSBS) eligible shares to separate taxpayers or qualifying trusts, granting each recipient a new separate and additional $10 million exemption.

What disqualifies QSBS?

Several factors can disqualify QSBS, or a stock from being considered Qualified Small Business Stock (QSBS) under Section 1202 of the Internal Revenue Code. Firstly, the stock must be issued by a domestic C corporation. Also, at the time of issuance, the company’s gross assets must not exceed $50 million. The company must use at least 80% of its assets in active qualified trade or businesses in specific sectors. The taxpayer that owns the QSBS must hold it for at least five years and have acquired it directly from the company. Lastly, certain types of redemptions where the company buys back shares from a shareholder or related person can disqualify QSBS. Learn more about QSBS eligibility here.

Are QSBS Stacking and Packing the same?

No, QSBS stacking is designed to increase and multiply the $10 million QSBS exemption by generating additional taxpayers. QSBS Packing, on the other hand, is a tax strategy aimed at boosting your QSBS exemption above $10 million by increasing the basis of your QSBS stock.

Disclaimer

The information and opinions provided in this material are for general informational purposes only and should not be considered as tax, financial, investment, or legal advice. The information is not intended to replace professional advice from qualified professionals in your jurisdiction.

Tax laws and regulations are complex and subject to change, and their application can vary widely based on the specific facts and circumstances involved. Any tax information or advice in this article is not intended to be, and should not be, used as a substitute for specific tax advice from a qualified tax professional.

Investment advice in this article is based on the general principles of finance and investing and may not be suitable for all individuals or circumstances. Investments can go up or down in value, and there is always the potential of losing money when you invest. Before making any investment decisions, you should consult with a qualified financial professional who is familiar with your individual financial situation, objectives, and risk tolerance.