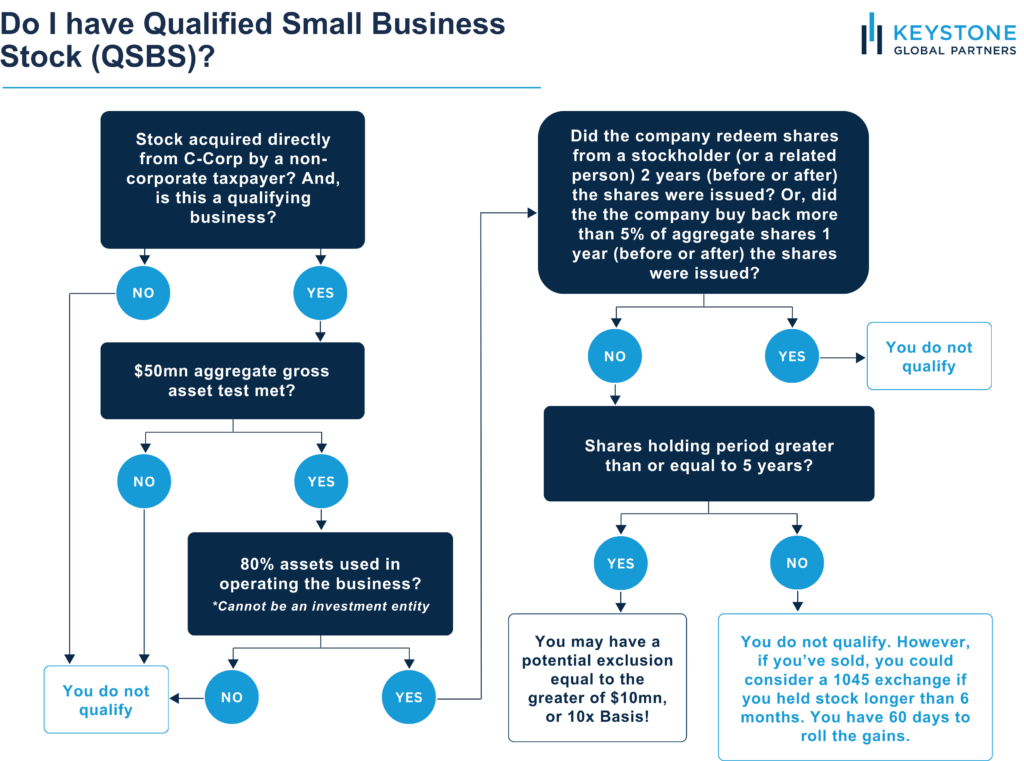

To access the exceptional tax advantages offered through QSBS, both companies issuing stock and individual shareholders must navigate a set of specific conditions. The QSBS rules are precise and failing to satisfy even a single condition could eliminate your potential tax benefits.

Here’s a streamlined breakdown of qualification factors to assess your eligibility. For Stock acquired after July 4th, 2025, you can read about the new QSBS rules here.

What are the Requirements for QSBS Redemption?

Before investors can claim benefits, companies must satisfy these QSBS criteria:

Corporate Structure QSBS Requirements

- C Corporation Status: In terms of QSBS rules, only active C Corps qualify. Investments must flow directly into a C Corporation to receive QSBS designation. Converting from an S Corporation will not be eligible, so maintaining consistent C Corporation status from issuance through sale is critical.

- U.S. Based Operation: The business must operate domestically. International corporations cannot qualify. Be aware that QSBS eligibility requirements vary by state. Currently, California, Mississippi, Alabama, Pennsylvania, and New Jersey disallow the exclusion entirely, while Hawaii and Massachusetts permit only partial benefits.

Financial Threshold Considerations

- $50 Million Asset Limitation: The “Gross Asset Test” mandates that total business assets remain under $50 million both before and after QSBS issuance. For assets contributed to the corporation, the tax basis will be based on the fair market value of those contributed assets right after the contribution. Once assets exceed the $50 million threshold, future QSBS issuance does not apply, though previously issued qualifying shares retain their status if all other conditions continue to be met.

Business Activity Standards

- Operational Focus: “Active Business” At least 80% of corporate assets must actively support the qualified trade or business operations. The entity cannot function primarily as an investment vehicle. As far as QSBS requirements go, this ensures that qualifying businesses are genuinely operational enterprises rather than passive investment structures seeking preferential tax treatment.

Industry Restrictions

- Business Type Limitations: “Qualified Trade or Business” Several sectors are explicitly excluded, including financial services, professional practices, resource extraction, hospitality, agriculture, and businesses whose value derives primarily from one or more employees. This restriction aims to direct investment toward innovation-focused enterprises. For comprehensive details on QSBS eligible businesses, consult official IRS resources.

Investor-Side QSBS Rules

Even with a qualifying business, shareholders must meet additional conditions to secure QSBS tax benefits:

Stock Acquisition Parameters

- Primary Market Purchase: Shares must be acquired directly from the issuing company. Secondary market acquisitions do not qualify, as the policy intends to encourage direct capital investment into qualifying businesses.

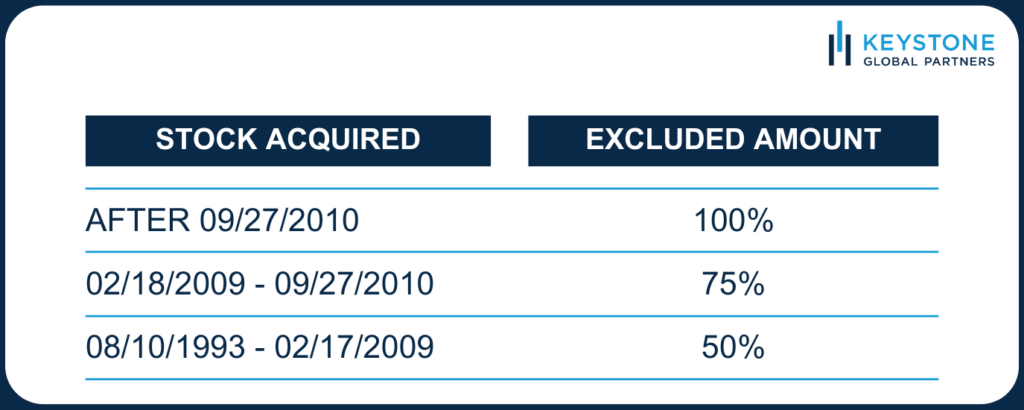

- Timing Considerations: For maximum benefit (100% gain exclusion), the acquisition must occur after September 27, 2010, with a subsequent five-year holding period. Acquisitions between February 18, 2009, and September 27, 2010, qualify for 75% exclusion, while pre-February 18, 2009, acquisitions receive 50% exclusion (all requiring five-year holds). These graduated benefits reflect policy changes over time.

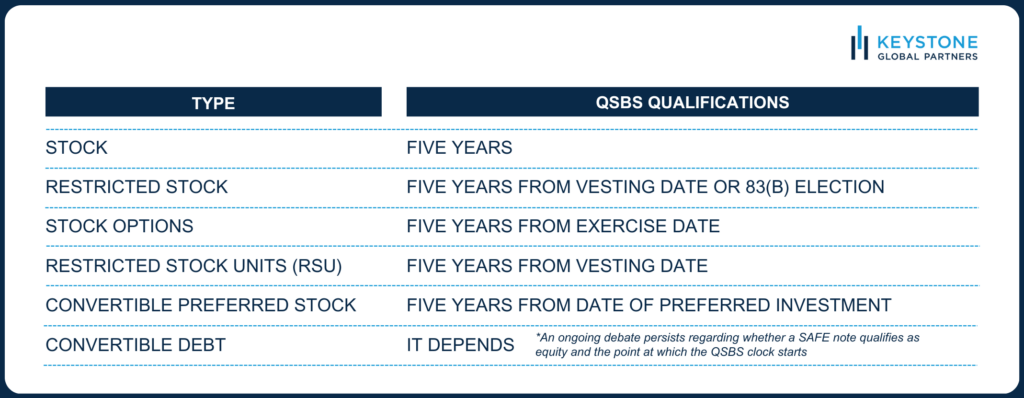

- Duration Requirement: The QSBS rules explicitly mandate a five-year minimum holding period, beginning only upon share acquisition. Many investors miscalculate this timeline and it invalidates their claims. Among QSBS requirements, this encourages long-term investment rather than speculative trading activity.

Early Exit Provisions

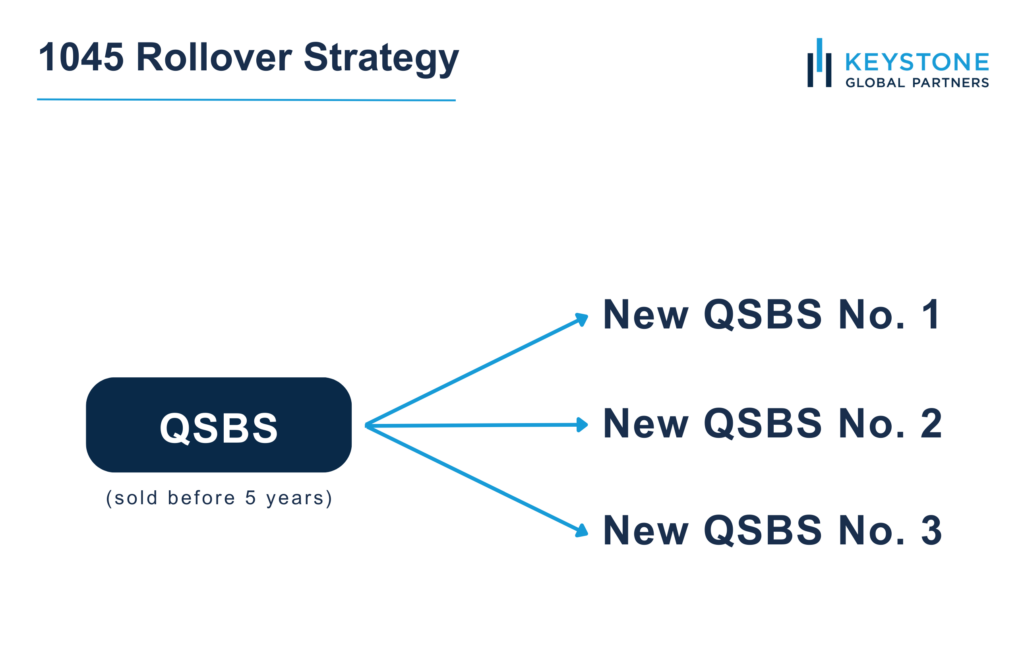

Internal Revenue Code Section 1045 offers flexibility for premature sales. It allows QSBS holders to transfer gains to alternative issuers when:

- Original shares were held beyond six months.

- Rollover / reinvestment occurs within a 60-day window.

This provision among QSBS requirements recognizes that business circumstances sometimes necessitate selling before the ideal holding period concludes, while still encouraging continued investment in qualifying enterprises.

Practical Verification Approach

When evaluating potential qualification, investors should systematically assess each criterion rather than making assumptions. Small technical details often determine eligibility, and retrospective qualification is impossible if conditions weren’t properly established at issuance.

Closing Thoughts

The QSBS exclusion represents a potent yet frequently overlooked tax planning opportunity within Section 1202. Implemented correctly, it eliminates federal income tax liability while providing exemption from alternative minimum tax and the 3.8% investment income tax. Our detailed QSBS guide explores these advantages in greater depth.

Despite this overview, following QSBS rules involves nuanced complexities. We strongly advocate proactive planning and consultation with specialized tax and legal professionals to fully leverage these provisions for your unique circumstances. Early planning maximizes potential benefits and prevents disqualification through technical oversights that cannot be remedied retrospectively.