Entrepreneurs, founders, and tech executives in the know understand the potential to avoid taxes on gains from selling Qualified Small Business Stock in their companies, provided they meet the criteria. For founders looking to capitalize on this opportunity, thoughtful attention must be given to the establishment, management, and exit strategy of their companies.

The Qualified Small Business Stock (QSBS) exclusion offers significant tax benefits for individuals starting or investing in eligible small businesses. It allows the potential exclusion of up to $10 million, or 10x basis, whichever is greater, from taxation. For example, investing $2 million in Qualified Small Business Stock in 2012 and selling it five years later for $20 million could result in no federal capital gains tax on the profit.

What is Qualified Small Business Stock (QSBS), and why is it important?

Tax savings can wield a significant impact, standing out as a top priority in our dealings with founder and entrepreneur clients. Notably, when delving into the realm of Qualified Small Business Stock, a noteworthy portion of individuals typically fall into distinct categories:

- Understand a few basics about Qualified Small Business Stock.

- They may possess it yet lack the understanding of how to multiply or stack Qualified Small Business Stock, or how to protect it.

- Lack of awareness of Qualified Small Business Stock altogether.

Entrepreneurs scaling their businesses often juggle various priorities and have a lot on their minds. As such, personal finance and tax savings strategies commonly fall to the bottom of the list. But why pay long-term capital gains taxes when you might qualify to pay zero percent in federal capital gains taxes when you have an exit? That’s right – If your company is a venture-backed tech startup, there’s a good chance you could be eligible for QSBS qualification.

Federal Qualified Small Business Stock vs. State Qualified Small Business Stock

This guide focuses primarily on QSBS at the federal tax level, but it’s crucial to understand that different states adhere to QSBS in different ways. For example, while some states, like New York, conform to the federal treatment of the Section 1202 code, others, like California and Pennsylvania, don’t allow the exclusion.

So, if you reside in New York, satisfy all the QSBS Rules, sell your startup, and pocket $10 million, you won’t owe any federal or state taxes. In the same example, if you live in California, you would pay the state tax. However, there are some California QSBS strategies that can be used to optimize. To make it even more confusing, states like Massachusetts and Hawaii have their unique adjustments to the exclusion.

Below is a list of states/jurisdictions that currently do NOT conform to the federal treatment, meaning you still pay the state tax even if you meet the Qualified Small Business Stock rules and qualify:

- Alabama

- California

- Mississippi

- New Jersey

- Pennsylvania

- Puerto Rico

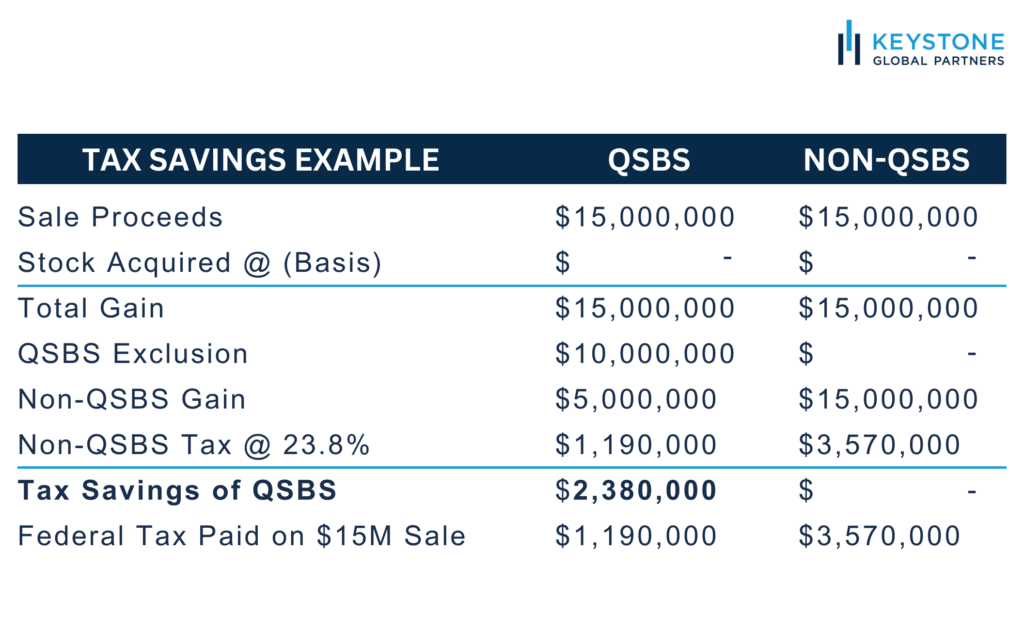

Qualified Small Business Stock Example

In a scenario where a founder’s company is being acquired, strategic financial planning is key as it relates to startup equity tax implications. By obtaining Qualified Small Business Stock status for her shares and calculating her tax rate with her legal and financial team, she showed foresight. Her shares, meeting Section 1202 QSBS requirements, were acquired in 2012 at a low cost but grew to $15 million at the acquisition. The first $10 million of her gain was federally tax-exempt thanks to QSBS, resulting in substantial savings.

Most VC-backed C Corp founders have the potential to qualify for QSBS, as illustrated in the example below.

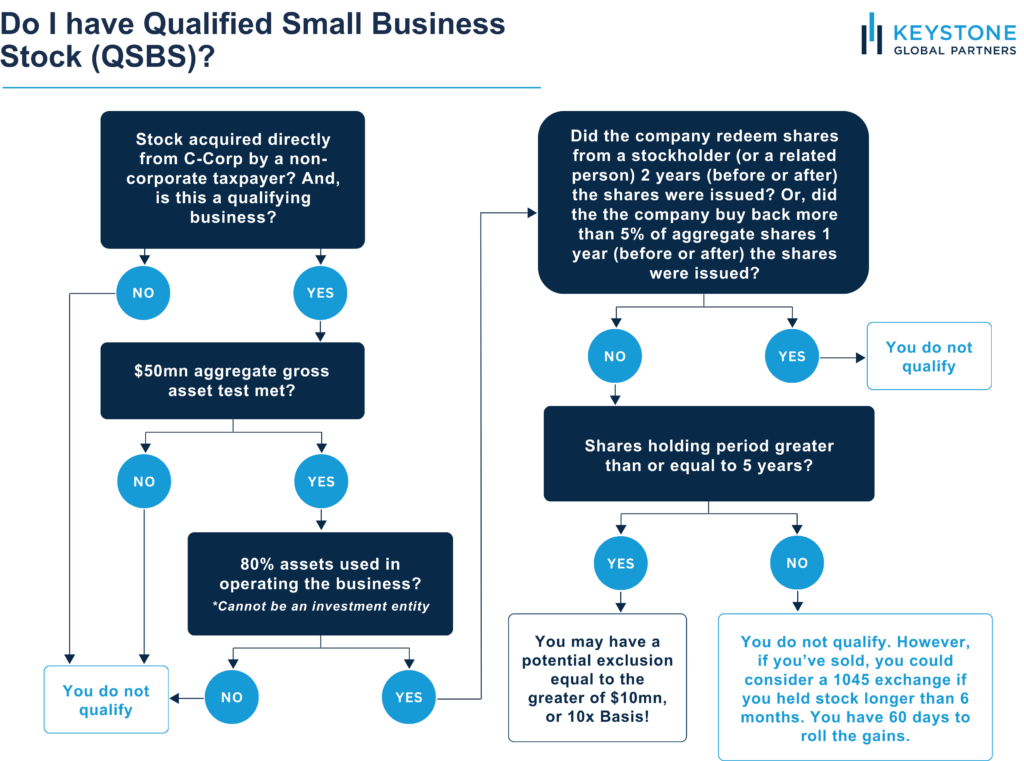

Clients often inquire about their eligibility for a QSBS exclusion, asking: “How do I determine if I meet the criteria?” It is crucial to satisfy the following requirements:

- The company is a domestic C Corporation.

- Stock is acquired directly from the company.

- Stock has been held for over 5 years to qualify for the exclusion.

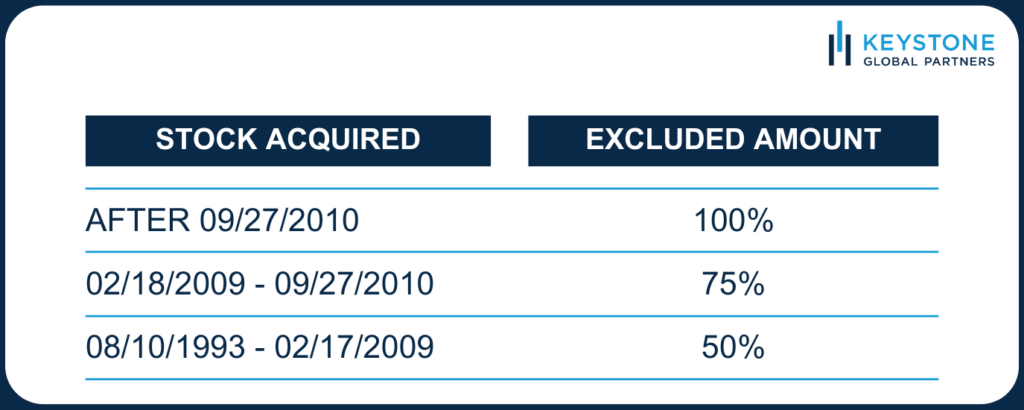

- Stock was issued after August 10, 1993, and preferably, after September 27, 2010, for a full 100% exclusion.

- The company’s aggregate gross assets must not exceed $50 million before and immediately after the stock is issued

- The company is an active business, with at least 80% of its assets actively utilized in a qualified trade or business.

- The business cannot be an investment entity. The business must not fall under excluded categories such as, but not limited to finance, professional services, mining/natural resources, hotel/restaurants, farming, or any business where the reputation of the business is dependent on the skills of one or more employees.

Consult this flowchart to determine your eligibility:

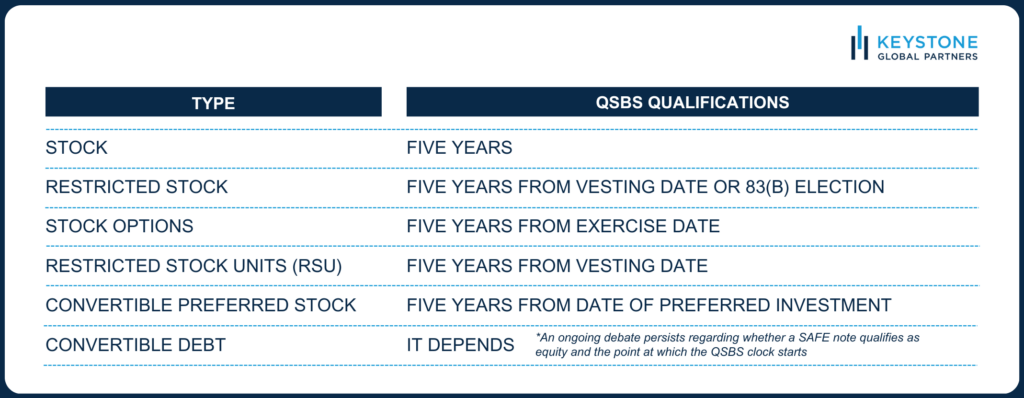

When does the QSBS holding period start?

To be eligible for the qualified small business stock exclusion, a key condition is maintaining ownership of your stock for at least 5 years. It is important to note that the countdown starts upon acquiring shares. We have come across instances where people believed they met these conditions, only to discover that was not the case and vice versa.

There are also scenarios where there are differences in options on whether one may qualify. Explore some illustrative cases below:

Consider a hypothetical but common scenario in which an investor makes an early-stage investment in a company that later becomes a big win, turning their investment into a major success.

However, this investment was made using a SAFE, a common strategy for early-stage companies. Upon the conversion of the SAFE, the company’s total assets surpassed the $50 million gross asset test threshold. This is where things can get complex because there is a divergence of opinions regarding whether a SAFE should be classified as equity and when the clock for QSBS starts ticking. Some argue that all SAFEs should be considered equity, while others disagree.

Actionable tip: When utilizing a SAFE, it’s crucial to understand the technicalities and seek proper advice and legal counsel.

The Section 1045 Rollover: What if I sell my QSBS before five years, or it is acquired?

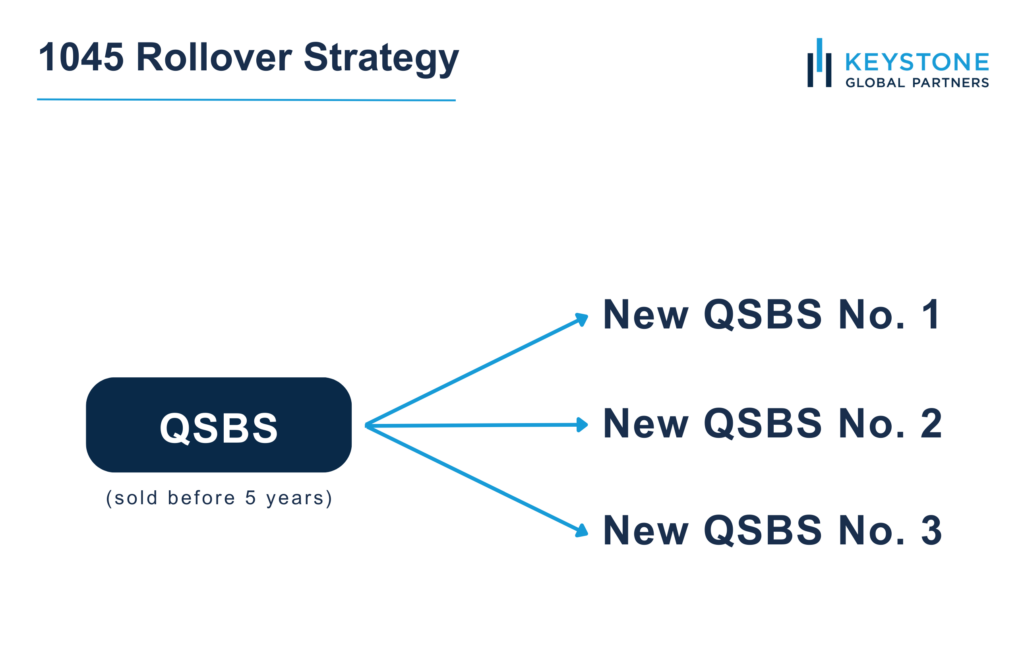

You may be able to leverage Section 1045 of the Internal Revenue Code. For a detailed exploration, check out our comprehensive post on the Section 1045 Rollover. This provision enables QSBS holders to transfer gains obtained from the sale of eligible QSBS into QSBS from other issuer(s). When navigating this scenario, it’s crucial to keep track of two critical timeframes:

- To qualify for QSBS treatment, the original shares must be owned for over six months when sold.

- The rollover should take place within a 60-day timeframe.

Actionable tip: It’s worth mentioning that a 1045 election must be submitted by the tax return deadline for the tax year associated with the 1045 rollover.

Remember that while 1045 rollovers are allowed in these cases, it’s important not to rush into an investment decision just to meet the 60-day rollover deadline. Often, things don’t fall into place perfectly here since there must be a good investment to make. In other words, don’t let the tax tail wag the investment dog!

If a favorable opportunity arises and the stars align, capitalize on it tax-efficiently through a 1045 rollover. It’s not limited to just one QSBS company as the replacement QSBS. Meeting the requirements for a Section 1045 rollover could enable you to potentially reinvest gains from selling your QSBS into three (or more for example) new QSBS-eligible companies, qualifying for QSBS treatment from all three companies in the future. A definite win-win scenario!

Stacking Qualified Small Business Stock

Stacking QSBS is a strategic approach we commonly use with our founder clients to leverage multiple QSBS exclusions to boost the total exclusion amount. This tactic proves beneficial for founders and entrepreneurs anticipating exits over ten million dollars, aiming to raise the ten million dollar exemption to $20 million, $30 million, or beyond.

Typically, this process involves gifting shares into specific types of trusts. The benefits, including immediate and long-term advantages, extend to wealth transfer and state tax benefits incorporated within this planning strategy.

Real-life QSBS situations you may encounter

A larger non-QSBS company acquires your QSBS stock or company

If your QSBS stock is acquired in a stock deal by a company with non-QSBS stock, your received stock retains QSBS benefits only up to the exchange value. For instance, if post-acquisition, you hold shares worth $10 each in the acquiring company and meet the five-year holding requirement, you can only exclude gains up to the acquisition date value of $10 per share. If you hold the shares and they increase to $20 per share and then you sell, you still only get to claim $10 per share for QSBS purposes. The additional gain would be considered as regular capital gains.

If you invest in private equity and/or venture capital

Investors in private equity or venture may leverage qualified small business stock. Often, these investments are channeled through LLCs taxed as partnerships. If the LLC, taxed as a partnership, is the initial purchaser of qualified small business stock, the eligible gains could potentially be passed on to the investors once the 5-year holding requirement is met. Venture capital firms face added complexities at the general partner level, necessitating consultation with legal and tax advisors for guidance. Record-keeping can be intricate, but as a general practice, we suggest requesting QSBS representation from the company.

Advanced Tax Strategies Using Qualified Small Business Stock

Timing: when to start exit planning

The best timing is when an exit is foreseeable, but definitely before a formal offer is finalized. Delaying, like waiting until you have a signed offer to sell your company, could lead to tax obligations through income assignment.

1. Gifting QSBS Outright

Entrepreneurs and company founders may contemplate gifting QSBS to family members or eligible individuals for potential exclusions. However, this direct approach might have limitations in areas such as creditor protection, control, and effective gift tax exemption utilization.

2. Non-Grantor Trust(s)

One advanced QSBS trust strategy involves gifting QSBS to irrevocable non-grantor trusts, allowing each trust to potentially qualify for its own $10 million exclusion. This is called QSBS Stacking. However, caution is needed to avoid IRS rules that consider multiple trusts as a single entity if these trusts look too much alike. By gifting QSBS to individual trusts for each child, a founder may qualify for additional QSBS exclusion for each trust.

3. GRAT Strategy – Gift of Remainder Interest

A Grantor Retained Annuity Trust (GRAT) is a tax-efficient method for founders to transfer assets to beneficiaries, minimizing estate and gift tax obligations. The founder places assets in the trust, receives annuity payments based on IRS interest rates, and excess growth can be transferred gift and estate tax-free to beneficiaries after the trust’s term. This amount that transfers tax-free to the beneficiaries could qualify for its own QSBS exclusion.

4. Charitable Remainder Unitrust (CRUT)

One advanced tax strategy involves funding a Charitable Remainder Unitrust (CRUT). The founder gets a small charitable deduction and then receives annual distributions based on a fixed percentage, ranging from 5% to 50% over the CRUT’s term. The CRUT has tax benefits and potentially gets its own QSBS exclusion.

How Not to Disqualify QSBS

You might be wondering: with so many requirements, how can I be sure to avoid any costly mistakes and follow the QSBS rules? Various factors can lead to blowing your shot at QSBS qualification. Here are some of the more common ones to be mindful of:

1: S Corporation

Investments in a C Corporation are the sole qualifiers for QSBS eligibility. Transitioning from an S Corporation to a C Corporation post-establishment may jeopardize QSBS eligibility. A possible remedy could be setting up a new C Corporation. Seeking appropriate tax and legal counsel is vital in this scenario.

2: Active business requirement

The “active business requirement” mandates that 80% of the company’s assets must be actively utilized in business operations. Typically, most early-stage C Corporation startups meet this criterion unless they fall under excluded categories like service-oriented businesses, hotels, finance, insurance, banking, leasing, farming, mining, or oil and gas industries etc.

3: Company redemptions

Founders often overlook a critical aspect of QSBS – the company’s stock redemptions. This has been observed by my team multiple times.

When it comes to redemptions, there are two types that can significantly impact your QSBS:

- Significant Redemptions – If the company makes a significant redemption exceeding 5% of the company’s stock within one year of the stock issuance, whether before or after (two-year bracket.) There are a few exceptions to this rule.

- Related Person Redemptions – Stock redemptions by the company from recipients or related persons within two years (before or after) stock issuance (four-year bracket). There are a few exceptions to this rule.

4: Avoid gifting QSBS stock to charity

For those who are charitably inclined, donating long-term appreciated stock with a low basis to charity can be beneficial. That said, it’s preferable to gift long-term appreciated stock that is not QSBS and has a low basis. Gifting QSBS stock is not tax efficient. There are some scenarios where it could make sense, such as gifting a 50% or 75% QSBS exclusion percentage, particularly if the holding period is under five years or if you have already utilized your $10 million exclusion and don’t plan to fund any trusts for QSBS stacking purposes. It’s advisable to seek guidance from a professional when considering these strategies.

5: Avoid contributing QSBS to a Family Limited Partnership (FLP)

Many entrepreneurs and families choose to utilize Family Limited Partnerships (FLPs) for wealth transfer and to manage the family’s investment endeavors better. Although gifting QSBS can bring substantial advantages, it’s crucial to understand that directly gifting QSBS to a partnership can nullify the stock’s QSBS status and should be avoided. Nevertheless, it is permissible to invest in QSBS stock directly from the Family Limited Partnership and retain the QSBS status.

6: Team with Qualified Small Business Stock expertise

Having the right team in place to support you is crucial. Yet, it falls on you to understand and document the necessary requirements. I always advise my clients to inform me before making any financial decisions regarding their company or QSBS stock. This way, we can ensure there are no negative impacts. Sometimes, it’s a simple yes or no; other times, a more in-depth analysis involving further guidance.

My team and I discovered an opportunity to secure a significant tax refund for a client. This individual had his company acquired by a public company years ago. As part of the acquisition, he received stock which he later sold. The entire stock holding period lasted 5 years, covering both the initial and public stock holding periods. Despite being informed, his accountant overlooked this opportunity. This situation highlights how easily such matters can be missed by those unfamiliar with them. We identified and promptly requested the accountant to amend the return, rectifying the oversight.

7: Record keeping

Safeguard yourself by meticulously documenting all details. Given the numerous requirements, maintaining thorough records is of paramount importance. We strongly advise documenting the QSBS status promptly and consistently, especially after each financing round. If needed, seek assistance from your company to ensure proper documentation or get a QSBS representation letter.

Remember, it is crucial to document:

- Purchase date

- Consideration paid

- Company QSBS attestation letter

- Representation that your company is below $50 million in aggregate gross assets

- Certification that your company has at least 80% of its assets actively utilized in business operations, with the intention of continuing this practice

Closing remarks

Numerous online resources can guide you through the complexities of Qualified Small Business Stock (QSBS). However, beyond sifting through the federal income tax code line by line, the optimal approach is to initiate a conversation with a professional. This task isn’t suited for a DIY approach, and valuable guidance is truly priceless. Remember – Qualified Small Business Stock might appear burdensome, but it’s a powerful tax benefit. If you meet the requirements, it has the potential to significantly alter your life.

Read more about this subject on our published article written by our co-founder, Peyton Carr, on TechCrunch.com.

FAQ

Do I pay tax on founders’ shares?

Assuming that the founders’ shares qualify as qualified small business stock that was issued by your company after 9/27/2010, if you meet the five-year holding requirement, and have a personal exit of $10 million or less, you could pay no federal capital gains tax. This is because the first $10 million of gain, or ten times the basis (whichever is greater), is excluded. Whether you pay state tax depends on the state you live in; for instance, residents of CA will pay state tax, while those in New York will not. For individuals with a personal exit exceeding $10 million, there are QSBS stacking strategies available that I cover in the article above to extend this $10 million exclusion.

How does the 1202 exclusion work?

Section 1202 exclusion permits the exclusion of up to 100% of capital gains from eligible, qualified small business stock. One requirement is holding the stock for a minimum of five years to qualify for the gain exclusion. This tax incentive aims to encourage investment in small businesses, which is very common in venture-backed companies.

Disclaimer

The information and opinions provided in this material are for general informational purposes only and should not be considered as tax, financial, investment, or legal advice. The information is not intended to replace professional advice from qualified professionals in your jurisdiction.

Tax laws and regulations are complex and subject to change, and their application can vary widely based on the specific facts and circumstances involved. Any tax information or advice in this article is not intended to be, and should not be, used as a substitute for specific tax advice from a qualified tax professional.

Investment advice in this article is based on the general principles of finance and investing and may not be suitable for all individuals or circumstances. Investments can go up or down in value, and there is always the potential of losing money when you invest. Before making any investment decisions, you should consult with a qualified financial professional who is familiar with your individual financial situation, objectives, and risk tolerance.