This article was originally published on November 8, 2021 on TechCrunch.com. Written by Peyton Carr.

With a 1045 Exchange / Rollover, Founders Can Optimize QSBS Before 5 Years

The tax code is structured with numerous provisions designed to incentivize investments in the technology startup ecosystem and small business sector. A notably effective provision is Qualified Small Business Stock (QSBS), also known as Section 1202 stock. Following the QSBS rules offers the potential to defer capital gains and potentially eliminate capital gains tax completely, provided specific criteria are fulfilled.

You can learn more about those requirements and QSBS rules here, but in summary, must be a domestic C corporation, the business must meet the $50 million gross-asset test, the business must be actively engaged in a qualified trade or business, not be an excluded business, and the taxpayer’s stock holding period must meet five years.

However, not everyone can time when to sell their company. Many acquisitions occur before the five-year mark, leaving numerous founders and angel investors shy of qualifying for substantial capital gain savings. This is where the Section 1045 Exchange / 1045 Rollover becomes particularly relevant.

What is a Section 1045 Rollover?

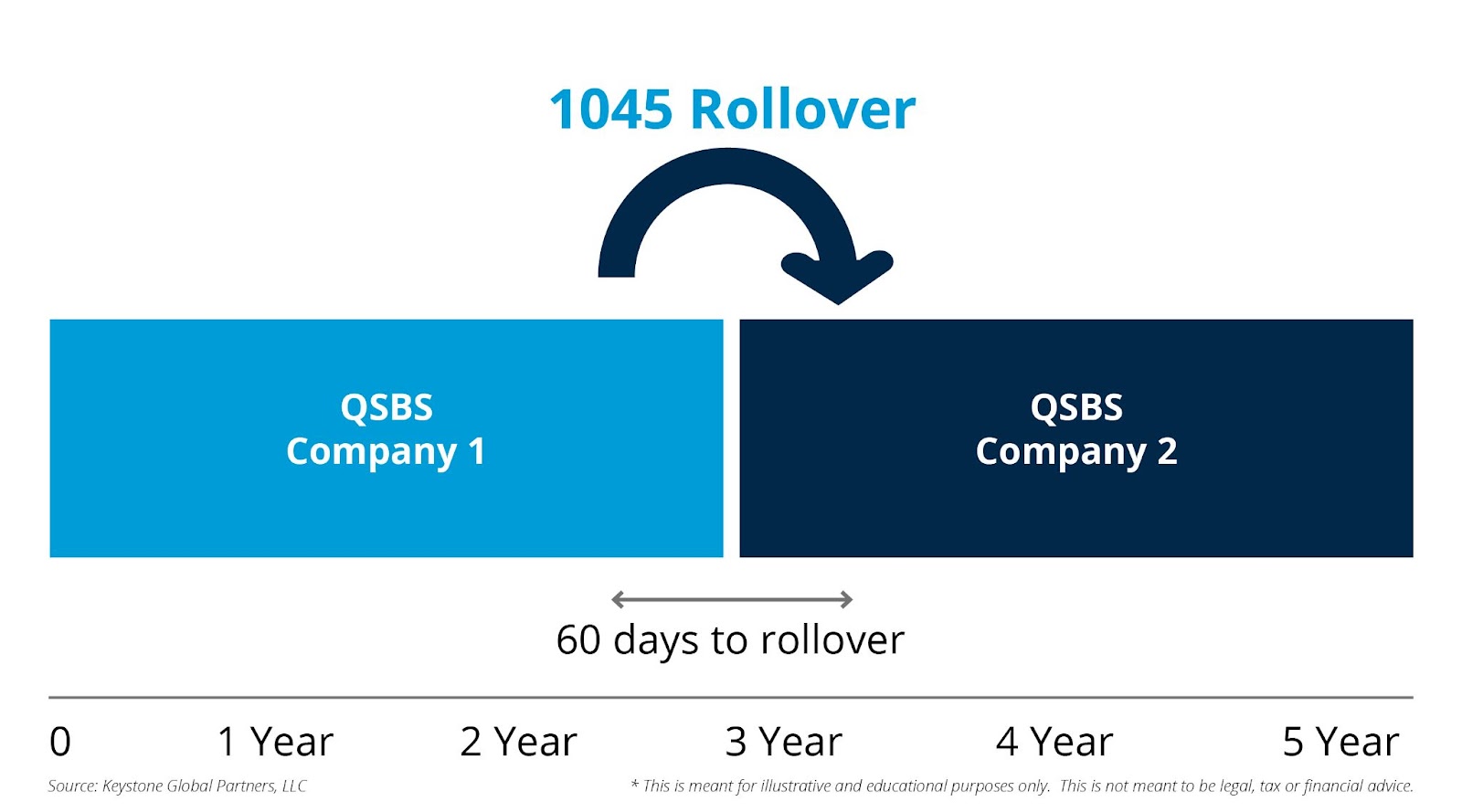

A Section 1045 Exchange / Rollover allows a founder or taxpayer whose company/ QSBS has been sold prior to the five-year holding period to defer the capital gain by using the sale proceeds to purchase replacement QSB stock. It also acts on a standalone basis, deferring gain on the initial sale of the original qualified small business stock.

A Section 1045 rollover enables founders and entrepreneurs to access multiple tax benefits and opportunities that might otherwise be overlooked by those taxpayers.

Extended Tax Deferral

With a Section 1045 rollover, the taxpayer can achieve a gain deferral on the sale of the original Section 1202 QSBS. Under the right circumstances, tax can be deferred until the replacement QSBS is sold.

If the combined holding period is five years and other requirements (discussed below) are met then no federal capital gains are due. But if the requirements are not met, then taxes will be due on the sale of the replacement QSBS.

Shortened Holding Period

Generally, the taxpayer’s holding period for all taxable exchanges commences on the day following the exchange. However, the taxpayer’s holding period for the replacement QSBS includes the holding period of the original QSBS, allowing for the clock to continue ticking. This means a Section 1045 rollover, in turn, shortens the next QSBS holding period requirement.

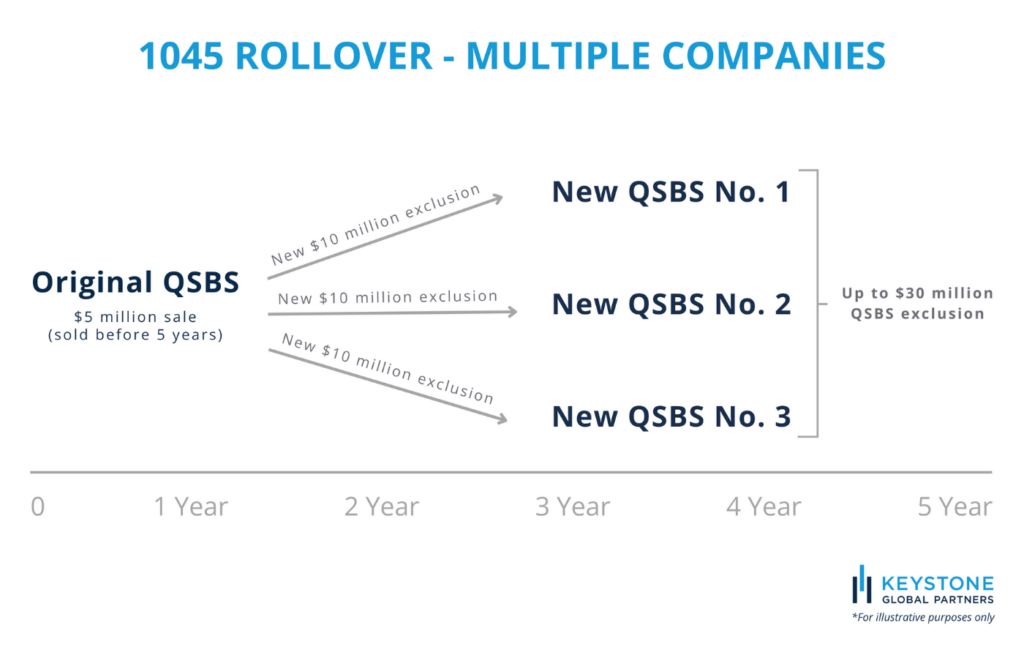

QSBS Stacking

Stockholders have the opportunity to multiply—or “stack”—the benefit of a section 1045 rollover by spreading the section 1202 QSBS exclusion to more than one new investment. This is accomplished by rolling the sale proceeds from one QSBS into multiple replacement QSBS companies, gaining the benefit each time. In the example above, the investor sells the original QSBS before five years and purchases replacement QSBS.

Specifically, Section 1045 allows for a $10 million QSBS exclusion per company. By rolling proceeds from the sale of qsbs into more than one company, the seller qualifies for the $10mn QSBS exclusion multiple times over, stacking the benefit in their favor. More on other types of QSBS stacking here.

Section 1045 Rollover Requirements

For a qualified rollover of the QSBS gain on the sale into a replacement QSBS under Section 1045, certain requirements need to be satisfied. Fundamentally, the original company must qualify for QSBS, and the new company must meet the requirements of QSBS both at the time of rollover and after the rollover is complete. In addition to that, you’ll need to pay close attention to timelines and other key qualifying measures.

Section 1045 Rollover Timeline

When it comes to meeting the Section 1045 rollover requirements, timing is key.

It’s important to note that the Section 1045 Rollover election is made on the tax return for the tax year in which the initial qualified business stock is sold—not when it’s rolled over into a new investment—even if the process extends into the following year. But you can’t delay for long. You only have 60 days from the date of sale of the original QSBS to roll the gain into a new QSBS investment.

Further, not only must the original qualified small business stock be owned for more than six months prior to the sale, but the replacement QSBS purchased must also meet requirements for at least six months to qualify for the deferral on the original QSBS sale. To avoid missteps, you’ll need to pay attention to the calendar.

The 100 Percent Rule

In order to defer 100 percent of the tax, you must roll 100 percent of the QSBS proceeds into the new QSBS. Just rolling the gain isn’t an option.

So if you want to realize the gain exclusion, you have to be willing to go all-in with the new investment. If you roll less than 100 percent of the proceeds, you only defer a pro-rata portion of the gain.

Section 1045 rollover requirements might seem restrictive. But by diving deeper, you’ll see that what could’ve been a heavy tax burden now opens you up to a whole new world of potential opportunities.

Section 1045 Rollover QSBS Strategies for Startup Founders

Now that you know more about Section 1045 rollover, you might be wondering if this is something that would be beneficial for you to leverage. It depends on your circumstances, big-picture financial plan, timing considerations, and your willingness to implement advanced tax and business investment strategies.

Below we highlight the most relevant Section 1045 rollover strategies for founders, entrepreneurs, tech executives, and angel investors.

Invest in Replacement QSBS Startups

As someone involved in your own startup, the natural next step could be to invest in other eligible QSBS startups. After all, you’re already familiar with the scene, current trends, and have your finger on the pulse of where technology is headed. You’re clearly positioned to use the valuable insights you’ve gained to your advantage.

So if you have a desire to invest in QSBS startups, you’ll need to know how to proceed.

At the most basic level, you’re simply rolling your QSBS proceeds into buying eligible stock in one or multiple QSBS startup companies.

For example, let’s say you’ve been running your startup for three years, it’s eligible for QSBS, the stock has taken off, and your company is being acquired. Congratulations! The original QSBS was $5 million, but you’ve made significant gains that could be swallowed by a huge tax bill. So you decide to do a 1045 exchange and reinvest into multiple new QSBS-eligible startups. By stacking the benefit— with $10 million in exclusions for each qualifed small business —you’ll see tax savings on your proceeds for a total exclusion of $30 million.

Tip: If you already have QSBS-eligible investments lined up, this could be a good strategy. But don’t rush to invest just to meet the 1045 rollover requirements. We always tell our clients not to let the tax tail wag the investment dog.

Acquire One or More Qualified Small Business (QSBS) Companies

If your internal startup or the one you invested in early is being acquired, you’ve proven yourself and are likely feeling confident. Maybe you don’t just want to invest in a new venture but you’d like to acquire a controlling stake in a company or multiple companies yourself.

If you are going to use your 1045 rollover to acquire one or more QSBS companies, you’ll need to implement the strategy within 60 days. However, the strategy does allow more time to actually find and make your acquisition. Here’s how.

A newly formed C-corp must be created, and you would need to roll the proceeds of the original QSBS into the new company. This newly formed C-corp can then acquire a new QSBS eligible company.

Keep in mind that in order for QSBS to apply—however long it takes this newly formed “acquisition” C-corp to find a target—the total holding period of the actively engaged new company must be at least 80 percent of the holding time period, including the search timeframe.

For example, let’s say it takes eight months to acquire a company. To meet the 80 percent requirement, the holding period of the actively running QSBS company must be 32 months.

Tip: It’s possible to leverage multiple C-corp entities for diversification and stack the QSBS to claim multiple $10 million exclusions or 10 times basis exclusions, as mentioned above.

Start a New QSBS Company

You don’t have to take your proceeds and invest them into someone else’s big idea. With your experience and track record, maybe it’s time to make a move on your next big idea. For founders looking to jump right into another venture soon after an exit, this self-funding, serial entrepreneur strategy could be the ticket.

Keep in mind, you’ll need to tack on the holding period, get a new $10 million exemption, and defer the gain. And remember the 100 percent rule: If you only roll part of your sale proceeds, you only get to defer a pro-rata portion of the tax. Are you ready to go all-in?

To implement this strategy, you’ll need to form a new C-corp to start a new QSBS company and roll your sale proceeds into the company.

Tip: This strategy can also serve as a layer of protection for you. If the business fails, you have the option to wind down the company and possibly qualify for QSBS to exclude the original gain for any funds returned.

Conclusion

It may come as a surprise that the tax code is written in your favor, but the idea is to encourage business growth, innovation, and entrepreneurship. You’re playing a vital role in the economy. So if you’re worried about taxes eating up the proceeds of your buyout and hard-earned gains, think again. You have a variety of options to stay in the game, fund your fellow founders, or step back and use the insights you’ve acquired to put your money to work for you.

Before implementing any of these strategies, be sure to work closely with counsel to review all of your financials and ensure you are protecting your interests.

The information and opinions provided in this material are for general informational purposes only and should not be considered as tax, financial, investment, or legal advice. The information is not intended to replace professional advice from qualified professionals in your jurisdiction.

Tax laws and regulations are complex and subject to change, and their application can vary widely based on the specific facts and circumstances involved. Any tax information or advice in this article is not intended to be, and should not be, used as a substitute for specific tax advice from qualified tax advisors or attorneys.

Investment advice in this article is based on the general principles of finance and investing and may not be suitable for all individuals or circumstances. Investments can go up or down in value, and there is always the potential of losing money when you invest. Before making any investment decisions, you should consult with a qualified financial professional who is familiar with your individual financial situation, objectives, and risk tolerance.