When a founder has an exit, valuation seems to get a lot of attention. However, too much focus on valuation can sometimes lead to a neglect of personal financial planning and tax considerations. Personal tax planning can significantly influence a founder’s net earnings just as much as changes in exit valuations can. Focusing on personal tax planning now can help you minimize capital gains tax leading to a substantial impact on future outcomes.

Following an exit, some founders may owe 0% in taxes, while others could end up parting with over 50% of their sale proceeds. It’s intriguing that one party might walk away with double the net profit compared to other founders selling at the same price, solely due to circumstances and strategic tax planning. How is this possible? The amount of taxes owed will vary based on factors such as the type of equity owned, how long it’s been held, the shareholder’s location, potential future tax rate adjustments, and leveraging tax-saving opportunities.

If you’re already considering tax planning, chances are you’re likely ahead of the curve. However, anticipating how much you might owe or take home isn’t as straightforward. In this guide, I’ll provide a brief overview of how founders can think about taxes and a way to approximate what you might owe upon having an exit. I’ll also touch upon how to minimize capital gains tax through advanced tax planning, state taxes, and speak to some future tax risks.

Taxation of Shareholders

Imagine you’re a founder with ownership stakes in a venture-backed C-Corp. Several factors will influence whether you will be taxed at short-term capital gains (ordinary income tax rates) versus long-term capital gains, or Qualified Small Business Stock (QSBS) rates. It’s important to understand these distinctions and identify opportunities for optimization.

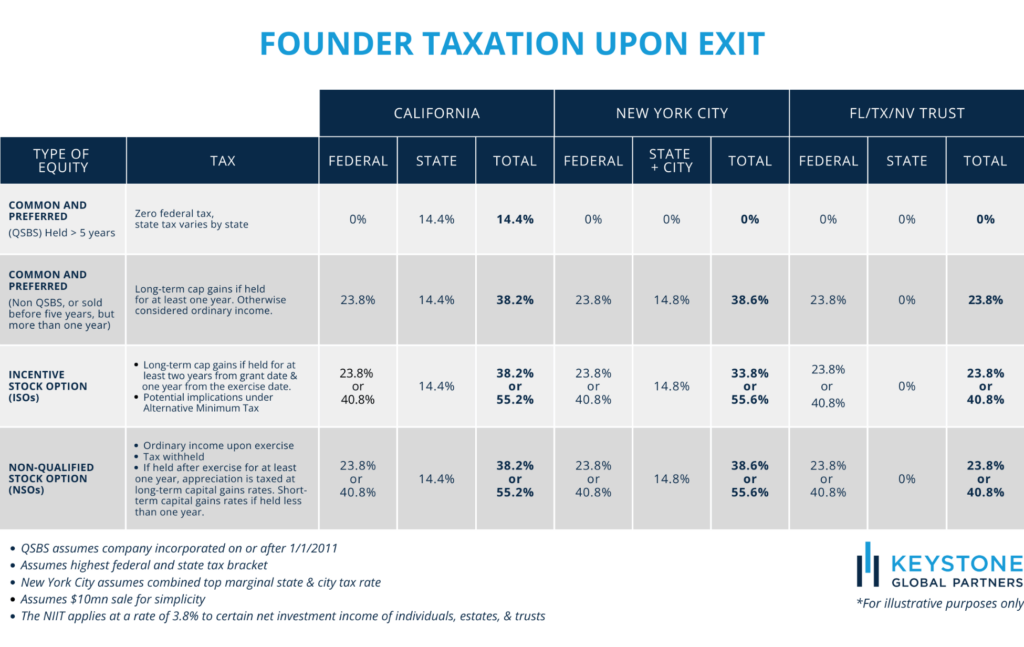

Below is a chart summarizing various types of taxation and their respective applicability. This is further broken down to illustrate the “all in” federal, state, and city taxation combined, where applicable.

As you reference the chart above, you will notice some of the more common factors influencing a founder’s tax liability post-exit, such as QSBS, trust creation, state residency, shareholding duration, and the choice to exercise options.

Charitable planning is not included above but can yield excellent tax outcomes for those with significant exits. Generally, when an exit includes an IPO or public stock, the founder has the option to contribute a portion of the stock to a foundation or donor-advised fund. This allows them to claim a fair market value deduction for the stock without realizing a capital gain.

Qualified Small Business Stock

One of the key strategies to minimize capital gains tax is Qualified Small Business Stock, or QSBS. Meeting QSBS eligibility criteria and fulfilling the holding period requirements when you sell in the future can put you in an advantageous position. QSBS stands out as a significant tax-saving tool in many transactions.

Currently, a taxpayer has the option to exclude up to $10 million or 10 times the basis amount, whichever is higher. Depending on the circumstances, startup founders can leverage other tax-saving opportunities to exclude more than $10 million through a strategy called QSBS stacking.

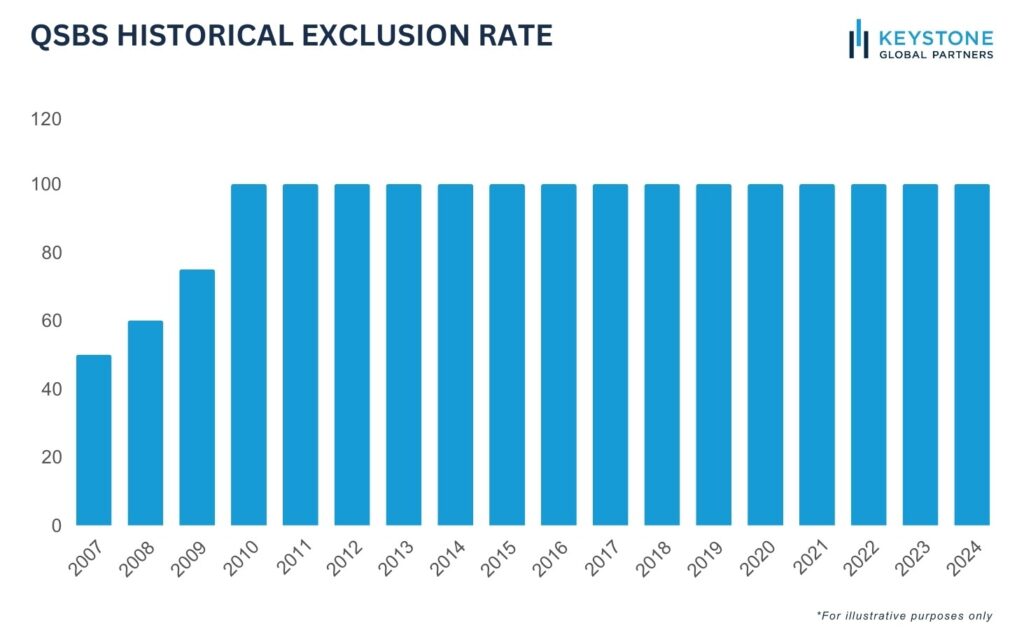

That said, there’s a chance that the QSBS exclusion could be adjusted at some point in the future, and founders should be familiar with the history of QSBS. The 100% exclusion rate for QSBS has been in effect only since late 2010, which has worked out very well for many founders who’ve had some of the more recent exits. However, some legislators in that past had considered cutting the exclusion by half. The first iteration of the Build Back Better Bill proposed a decrease from 100% to 50%. Although the bill was unsuccessful, there is always a chance something could change in the future.

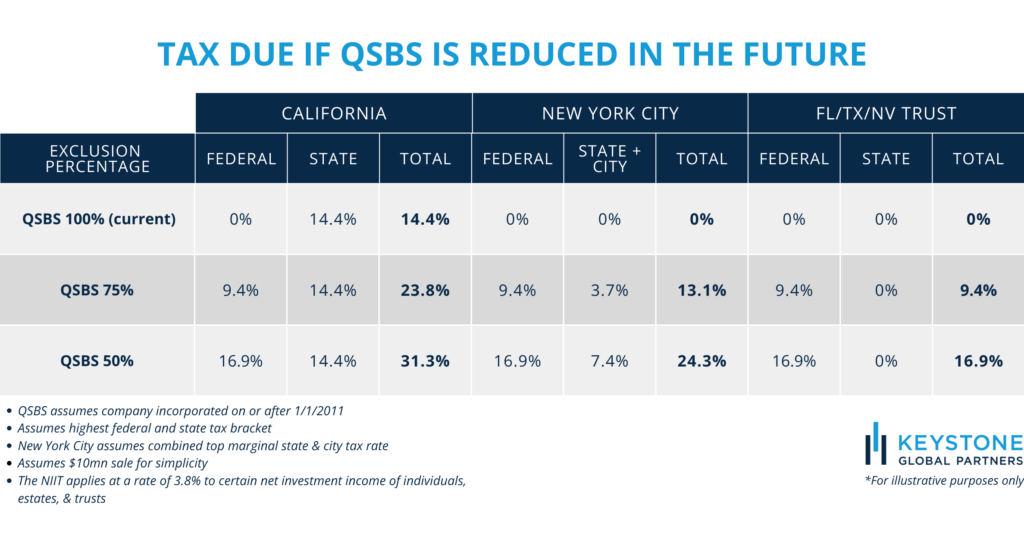

So, what implications would reducing the QSBS exclusion to 75% or 50% hold for you in the future? To understand the potential impact on a founder post-exit, refer to the graphic below, which shows projections of the total tax due (federal + state + city) based on the state of residence following an exit event.

Strategies to Maximize QSBS Benefits

The data in the table highlights that California founders, in particular, would stand to face the most significantly pronounced outcomes. In addition to this, California recently raised its top marginal income tax rate from 13.3% to 14.4%, effective as of 2024. California-based founders and key shareholders statewide should understandably be aware of this.

Some common questions we encounter when speaking with founder clients are as follows

- How can I minimize capital gains tax before my transaction?

- How does the tax vary between waiting the full five years to claim QSBS compared to selling now?

- Is it advisable to relocate to a different state prior to my transaction?

- Should I establish a trust prior to my transaction?

The answer to the questions above really depends. When exploring strategies to minimize capital gains tax and leverage Qualified Small Business Stock (QSBS) benefits, one must consider numerous factors carefully. You can utilize the charts provided in this article to explore different hypothetical scenarios resembling your circumstances. However, it’s important to note that there isn’t a one-size-fits-all approach.

For instance, founders located in different regions, such as New York City, Texas, or Florida, who delay their sale to meet the Qualified Small Business Stock (QSBS) eligibility and holding period requirements, may encounter significantly different tax obligations. Assuming a full QSBS exclusion, a founder in NYC who waits could effectively face 0% in capital gains tax. Conversely, without waiting, the New York City founder would pay 38.6%, while a founder from Texas or Florida would only pay 23.8%. Hence, postponing the sale could be beneficial, assuming all other factors remain constant.

On the other end of the spectrum, there are instances where a founder might not experience a significant impact. For example, if the QSBS tax benefit is reduced by half from a 100% exclusion to a 50% exclusion, a California founder who waits five-years instead of an immediate sale would pay 31.3% instead of 38.2%. This slight decrease might not justify delaying the sale for years, as the tax benefit may not significantly affect the transaction’s timing.

Relocating to another state for tax reasons before you sell your company is worth considering. If the same California founder in the same scenario (QSBS at 50%) were to permanently move to Florida and sell following the five-year mark, they would only pay 16.9%. With that being said, we believe that relocating solely for tax reasons may not be the most qualitative decision. However, if there was already a plan in motion to relocate to a tax-friendly state such as Texas or Florida, expediting the timeline for the move could be advantageous.

For founders who choose not to relocate to a tax-friendly state, there are alternative options available. Trust creation may be a viable choice in certain situations; however, this requires thorough consideration and careful planning beforehand. I cover some of those QSBS trust strategy considerations here; however, depending on where the QSBS exclusion is in the future, they may ultimately yield a different set of answers over time. Understanding these evolving nuances are important when planning your QSBS strategy.

Summary

As a founder, it’s crucial to strategize for your personal tax situation to minimize capital gains tax and maximize your profits when selling your company. The framework outlined in this article is designed to enhance your knowledge and approach to tax planning, outline hypothetical scenarios for current and future considerations, and facilitate more insightful discussions with your tax advisor or CPA around leveraging tax-saving opportunities.

Read more about this subject on our published article written by our co-founder, Peyton Carr, on Techcrunch.com.

FAQs

How can you minimize the effect of capital gains tax?

Numerous strategies can be implemented to minimize the effect of capital gains taxes. In this article, we focus mostly on Qualified Small Business Stock (QSBS) as a way to minimize capital gains tax, highlighting key areas such as meeting the requirements for QSBS, considering the state you reside in, your holding period, and any strategies you have implemented to optimize QSBS benefits, such as QSBS stacking.

What is 1202 capital gains?

Section 1202 of the IRS code, also known as Qualified Small Business Stock, allows shareholders to exclude capital gains from the sale or exchange of qualified small business stock from federal taxes. Additionally, to qualify for this exclusion, one of the rules requires that the stock be held for a minimum of five years. To that end, if someone refers to a 1202 capital gain, that would be the gain on section 1202 QSBS stock that may be excluded from federal (and some states) tax if it qualifies.

What is the Section 1202 QSBS tax exemption?

Section 1202, commonly referred to as the Qualified Small Business Tax Exclusion, is a provision within the Internal Revenue Code designed to incentivize investment in small businesses by exempting federal taxes on capital gains from the sale or exchange of specific small business stocks. The terms “Section 1202 QBSS Tax Exemption” and “Section 1202 QSBS Tax Exclusions” are used interchangeably, both referring to the same advantageous tax provision.

What disqualifies QSBS?

Several criteria can disqualify Qualified Small Business Stock (QSBS) under Section 1202 of the Internal Revenue Code. For instance, the business must be structured as a C corporation. Additionally, at the time of stock issuance, the company’s gross assets must not exceed $50 million, and 80% of its assets must be actively employed in the operational activities of the business, specifically within designated sectors. The stock must be retained for a minimum of five years and must have been acquired directly from the company. Furthermore, certain types of stock redemptions may disqualify the QSBS.