Securing the considerable tax relief offered by QSBS necessitates that the company issuing the stocks and the shareholder both satisfy a list of prerequisites. These regulations have precise stipulations, and not conforming to even a single requirement could lead to a loss of tax benefits. Below is a concise summary of the qualifying criteria that will help determine your eligibility for QSBS.

Qualified Small Business (QSBS) Requirements

In order for an company to be classified as a qualified small business according to Internal Revenue Service (IRS) regulations, it must satisfy the following requirements:

Business Type

C Corporation: The company must be an active C Corp. Only investments made into a C Corporation will be eligible for Qualified Small Business Stock (QSBS) designation. If you initially establish your company as an S Corporation and later convert it to a C Corporation, you will lose eligibility for QSBS status. Therefore, it is crucial to maintain the corporation’s C Corporation status consistently, starting from the date of issuance until the date of sale.

Domestic Entity: The company must be based in the United States. Foreign corporations are not eligible for consideration. However, it is important to note that the QSBS exclusion is not universally applicable across all states. For instance, as of April 2023, it is disallowed in California, Mississippi, Alabama, Pennsylvania, and New Jersey. In Hawaii and Massachusetts, partial exclusions are the only options available.

Gross Asset Test

Aggregate Gross Assets: To qualify for QSBS, businesses must meet the “Gross Asset Test” or “Size Test.” This test requires that the total value of the business’s assets remains below $50 million before and after the issuance of QSBS. If assets were contributed to the corporation, the tax basis will be based on the fair market value of those contributed assets right after the contribution. If the gross assets have ever exceeded $50 million, the business will no longer be eligible to issue QSBS in the future. However, QSBS that was issued before surpassing the threshold will still be eligible, as long as all other eligibility criteria are met.

Operating Criteria

Active Business: To qualify as an active business, it is required that at least 80% of the corporation’s assets are actively utilized in the operation of the qualified trade or business. It is important to note that the business should not be considered an investment entity.

Eligible Industry

Qualified Trade or Business: The business must not fall under excluded types such as, but not limited to: finance, professional services, mining/natural resources, hotel/restaurants, farming, or any business where the reputation of the business is dependent on the skills of one or more employees. For more details about QSBS eligible businesses or trades, please visit IRS.gov.

Qualified Small Business Stock (QSBS) Shareholder Requirements

To be eligible for QSBS tax benefits, shareholders must also meet certain requirements, regardless of whether the small business qualifies. These requirements apply to investors and include the following:

Stock Criteria

Original Issue: Stock must be acquired directly from the company.

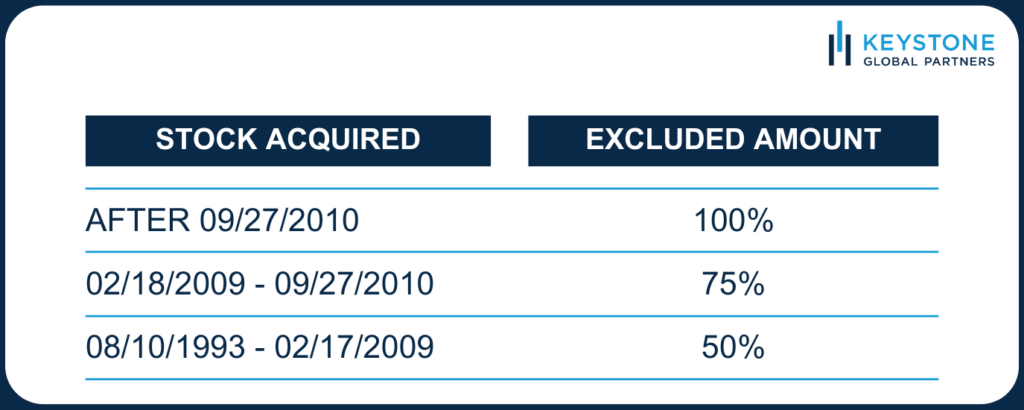

Date of QSBS Issue: In order to be eligible for a 100% gain exclusion, stocks must have been acquired post-Sept. 27, 2010, in addition to satisfying the five year holding period criteria. For stocks acquired from February 18, 2009 through to September 27, 2010, and held for over five years, the maximum capital gains tax exclusion is 75%. For stocks acquired before Feb. 18, 2009, and held for over five years, the maximum capital gains tax exclusion is 50%.

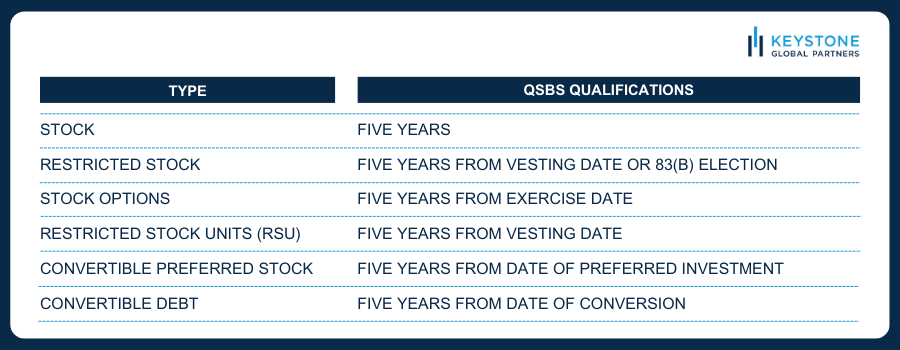

Holding Period: To qualify for the QSBS exclusion, one crucial requirement is holding your stock for a minimum of 5 years. It’s important to note that the clock starts ticking only after you acquire the shares. We’ve encountered situations where individuals believed they fulfilled these conditions, only to discover that wasn’t the case. Explore a few illustrative examples here:

Eligibility for QSBS if stock is sold or acquired before 5 years

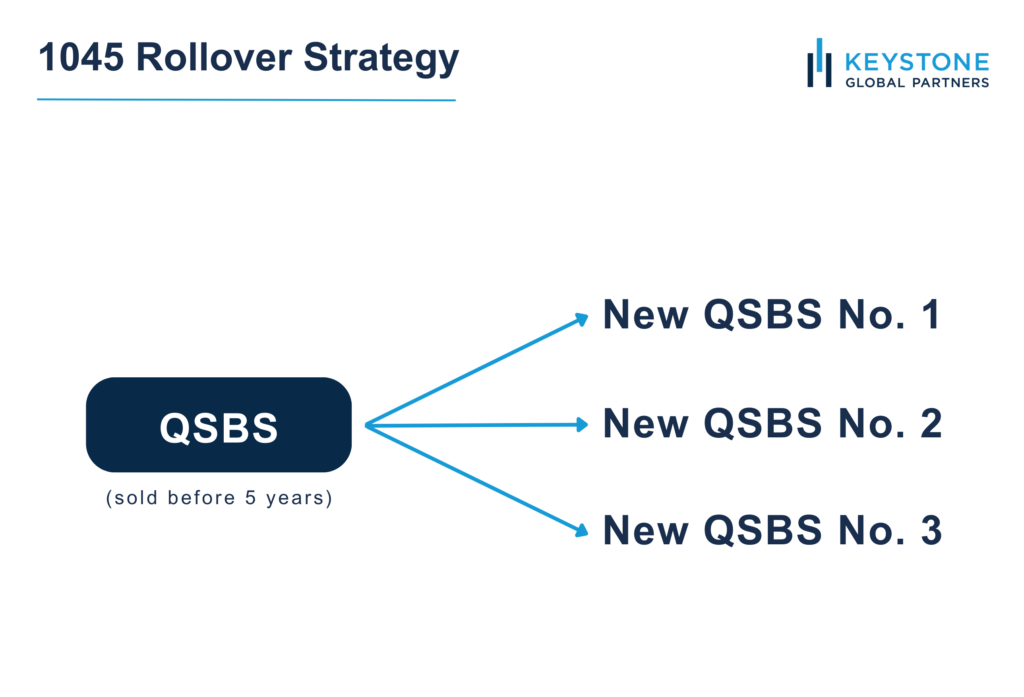

Section 1045 of the Internal Revenue Code can provide you with leverage. If you want to learn more about the Section 1045 Rollover, or Section 1045 Exchange, check out our comprehensive article here. This provision allows holders of Qualified Small Business Stock (QSBS) to roll over gains from selling qualifying QSBS into QSBS of a different issuer(s). There are two important timelines to consider in this scenario:

- The original QSBS must be held for more than six months at the time of disposition.

- The rollover must take place within 60 days.

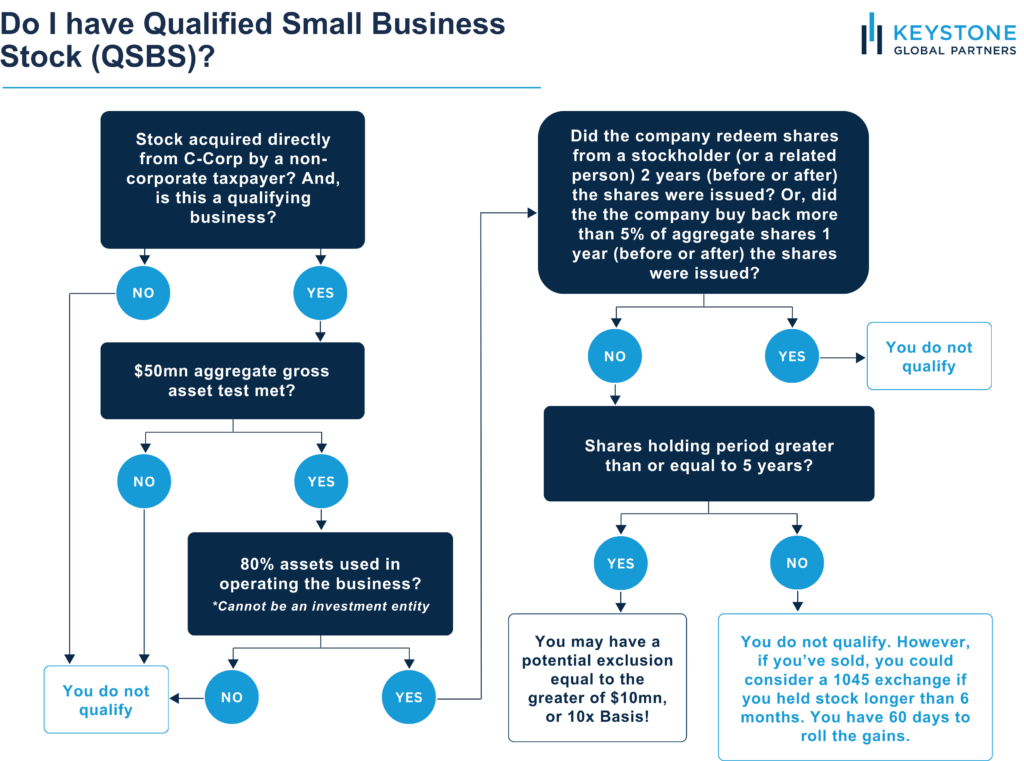

QSBS eligibility can be verified by referring to the given flowchart:

Conclusion

The QSBS exclusion is a highly valuable but often overlooked provision in the Section 1202 tax code. When implemented correctly, it can result in substantial tax savings for federal income tax purposes and be free from income tax, alternative minimum tax, and the 3.8% net investment income tax. To fully capitalize on this benefit, it is crucial to grasp the eligibility criteria and employ the right strategies. Understanding these aspects will enable you to maximize the advantages offered by the exclusion.

Although this guide offers a wealth of information, it’s important to acknowledge that QSBS eligibility can be intricate for both companies and shareholders. We highly recommend engaging in careful planning well in advance, and seeking independent tax and legal advice to gain a comprehensive understanding of how the QSBS exclusion may apply to your specific circumstances. For a more detailed exploration of Qualified Small Business Stock (QSBS) and how it can potentially save you millions in federal tax, we recommend reading our in-depth QSBS Guide.

Disclaimer

The information and opinions provided in this material are for general informational purposes only and should not be considered as tax, financial, investment, or legal advice. The information is not intended to replace professional advice from qualified professionals in your jurisdiction.

Tax laws and regulations are complex and subject to change, and their application can vary widely based on the specific facts and circumstances involved. Any tax information or advice in this article is not intended to be, and should not be, used as a substitute for specific tax advice from a qualified tax professional.

Investment advice in this article is based on the general principles of finance and investing and may not be suitable for all individuals or circumstances. Investments can go up or down in value, and there is always the potential of losing money when you invest. Before making any investment decisions, you should consult with a qualified financial professional who is familiar with your individual financial situation, objectives, and risk tolerance.