QSBS Strategy for Founders and Entrepreneurs

Tax Benefits of QSBS

Qualified Small Business Stock (QSBS) offers substantial tax break for founders and entrepreneurs to exit a company while reducing their tax burden. In many cases, they can pay 0% in capital gains tax. Despite its advantages, numerous opportunities go unnoticed. Strategic exit planning plays a crucial role, and understanding the intricacies of QSBS is essential for optimizing your post-tax financial outcomes.

Our Approach

We help you understand all Qualified Small Business strategies and opportunities tailored to your unique circumstances during our comprehensive pre-sale preparation. Key considerations include

- Client/family objectives and priorities

- Company lifecycle and exit anticipations

- Your personal budget balance sheet

- Tax code and regulations (federal and state)

- Company valuations

- Company growth projections

- Wealth transfer and gifting: Desires and constraints

Find Out How Best to Optimize

Navigating the complex realm of Qualified Small Business Stock (QSBS) and strategic exit planning demands expert tax advice for QSBS, comprehension of the Internal Revenue Code, and astute strategic planning.

Our expert team specializes in developing tailored QSBS strategies that align with your unique financial situation and objectives. Feel free to reach out to us to schedule a call and explore how we collaborate with our network of founder and entrepreneur clients on QSBS.

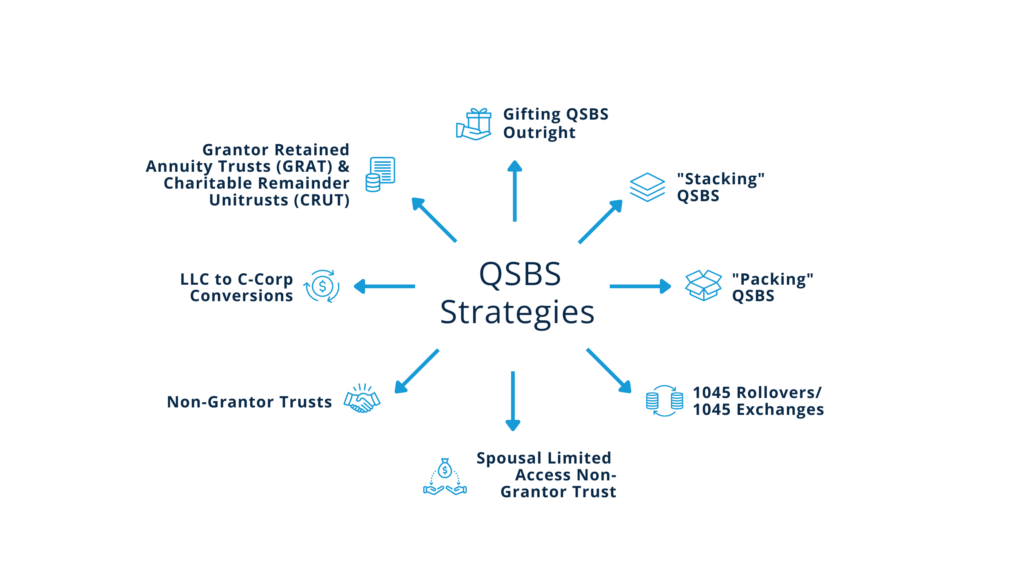

Examples of QSBS strategies we use

- Gifting QSBS Outright

- “Stacking” QSBS

- “Packing” QSBS

- 1045 Rollovers / 1045 Exchanges

- Non-Grantor Trusts

- SLANTS (Spousal Limited Access Non-Grantor Trust)

- LLC to C-Corp Conversions

- Grantor Retained Annuity Trusts (GRAT) and Charitable Remainder Unitrusts (CRUT)

- Option Exercise

Timing these strategies effectively and appropriately is crucial—especially when utilizing the lifetime gift tax exemption.

QSBS Eligibility and QSBS Rules

Understanding the QSBS eligibility and QSBS rules is fundamental to leveraging its benefits effectively. QSBS eligibility is bound by specific conditions set forth by Section 1202 of the Internal Revenue Code “tax code.” Key eligibility factors include

- Entity Type: The stock must be issued by a domestic C corporation whose gross assets, according to the “gross asset test,” do not exceed $50 million (for QSBS acquired before July 4th, 2025) both before and immediately after the stock issuance. The gross asset test was increased to $75 million for any QSBS that was acquired after July 4th, 2025, as part of the One Big Beautiful Bill Act (OBBBA). For property contributed to the corporation, the tax basis would be based on the fair market value of those contributed assets right after the contribution.

- Holding Period: The stock must be held for at least five years if QSBS was acquired before July 4th, 2025. For QSBS acquired after OBBBA’s enactment (July 4th, 2025), Section 1202 now provides a tiered capital gain exclusion based on a three, four, or five-year holding period, depending on how long the stock is held. Consider alternative strategies if the stock is sold early, such as a Section 1045 Rollover, which requires a minimum holding period of six months.

- Activity of the Business: The C corporation must engage in qualifying trades or businesses, and 80% of the company’s assets must be actively used in the qualified trade or business. Excluded activities include certain service businesses like health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, financial services, brokerage services, hotels, restaurants, farming, and any business where the principal asset is the reputation or skill of one or more of its employees.

- Ownership of Stock: The QSBS must have been acquired directly from the C Corporation in exchange for money, property (not including stock), or as compensation for services to the corporation.

- Redemptions: Certain types of redemptions can eliminate QSBS eligibility and QSBS tax treatment.

- Company growth projections

- QSBS Issuance Dates:

– After 8/10/93 and before – 2/18/09 qualify for a 50% gain exclusion, and have a 7% Alternative Minimum Tax AMT add-back

– After 2/17/09 and before – 9/28/10 are eligible for a 75% gain exclusion, and have a 7% AMT add-back

– After 9/27/10 and before 7/4/2025, qualify for a complete 100% gain exclusion without having an AMT add-back

- After 07/04/2025 there is a tiered gain exclusion rate based on whether the stock is held three, four, or five years

- 3 years of holding → 50% of the gain is excluded (14% effective federal tax rate)

- 4 years of holding → 75% of the gain is excluded (7% effective federal tax rate)

- 5 years or more → 100% of the gain is excluded, as before (0% effective federal tax rate)

QSBS Stacking

When you go through this process you ultimately gift shares into specific types of trusts. You get immediate and long-term benefits, plus there are advantages for wealth transfer and state taxes all wrapped up in this planning strategy.

Section 1045 Rollover

Specifically, this tax provision lets you, if you’ve held QSBS for more than six months but less than your target holding period (three, four, or five years), reinvest your proceeds into new QSBS within 60 days of the sale. This allows you to defer capital gains until the newly purchased QSBS is sold.

This strategy can be especially helpful if you’re working to meet your holding period requirements.

QSBS Packing

You can exclude either up to $10 million/$15 million (based on when you acquired your QSBS), or a 10x basis, whichever is greater.

Navigating the complexities of QSBS can significantly impact your financial outcome when selling your startup. Founders can maximize their net after-tax take home by understanding and utilizing strategies like QSBS Packing and others.

What Can Cause a QSBS Disqualification?

- Certain Share Repurchases

- Not qualifying Businesses or activities

- Investing company assets into certain non-cash instruments

- Exceeding the $50 or $75 million gross asset threshold

Timing these strategies effectively and appropriately is crucial, especially when utilizing the lifetime gift tax exemption.

What States Qualify for Qualified Small Business Stock

Firstly, you must be a U.S. taxpayer to qualify for QSBS for federal income tax purposes. As it relates to the state level, many states conform to the federal tax treatment, and some do not.

Residents of the following states or territories are NOT eligible for QSBS tax treatment at the state level.

- Alabama

- California

- Mississippi

- New Jersey (On Jan 1, 2026, New Jersey WILL be eligible)

- Pennsylvania

- Puerto Rico

States such as Hawaii and Massachusetts only partially adhere to federal guidelines, leading to variations based on a range of factors.

Client Success Story

Transforming Financial Outcomes Through Strategic QSBS Planning

Let’s dive into an example that vividly shows the impact of QSBS planning through Jordan’s story (name and details changed for privacy). This case serves as a hypothetical scenario. He is the founder and CEO of a fintech company and has utilized advanced QSBS Stacking successfully across various stages and at different valuations of his company’s lifecycle. By strategically gifting a portion of his QSBS over the course of a few years, at different times, and into different trusts, he not only shared the wealth generated by his life’s work with his family and future descendants but also reduced his taxable estate, generating three new QSBS exemptions totaling $30 million.

About six months before his company’s exit, and since the shares in an early trust had significantly increased to over $20 million now, he strategically decided to decant the trust into two new ones, securing an additional QSBS exemption. As a result, Jordan now has four trusts.

After his company’s successful exit, Jordan was able to exclude $10 million in capital gains personally, and $10 million each from four trusts, totaling $50 million exempt from federal taxation. This amounted to approximately $11.9 million in tax savings.

Jordan’s opportunity set and our strategic guidance harmonized to create a scenario where financial success was not just realized but optimized, showcasing the profound impact of interactive, timely, and well-thought-out QSBS planning. Below is a timeline showing Jordan’s QSBS Stacking Example and the value realized.