As an entrepreneur, you launched your business to generate value. Not only for your customers but also for yourself. Amid your busy schedule, if personal wealth is a priority, the net worth you’re building deserves your attention. In this article, I will discuss a variety of advanced tax strategies that we use with our founder clients who are high-net-worth individuals seeking to optimize their tax situation.

Various advanced tax strategies can be used to reduce capital gains tax, minimize future estate tax, and increase asset protection from creditors and lawsuits. Capital gains tax can diminish your gains by up to 38%, while estate taxes may consume up to 50%+ on the assets you intend to pass on to your heirs. Thoughtful and proactive planning can significantly reduce your risks and potentially save you millions.

Savvy founders and early employees should carefully assess their equity ownership, even in the initial phases of their company’s development. Different strategies should be employed at different times and for specific purposes. Here are some important factors to consider when deciding what, if any, advanced tax planning strategies you might consider:

- The stage of your company’s life cycle – whether it’s early, mid, or late.

- The value of your shares – What are they currently worth, what do you foresee their future worth to be, and when?

- Your personal circumstances and goals – What are your current needs, and what will you require in the future?

Consider additional factors such as Qualified Small Business Stock (QSBS), gift and estate taxes, state and local income taxes, liquidity, and asset protection. Furthermore, think about whether you and your family will maintain control and management of the assets over time.

The following are some advanced tax planning strategies to implement at different stages of your company life cycle to reduce tax and optimize wealth for you and your family. If you’re interested in additional topics on speaking with your children about money, you can find them here.

Irrevocable Non-Grantor Trust

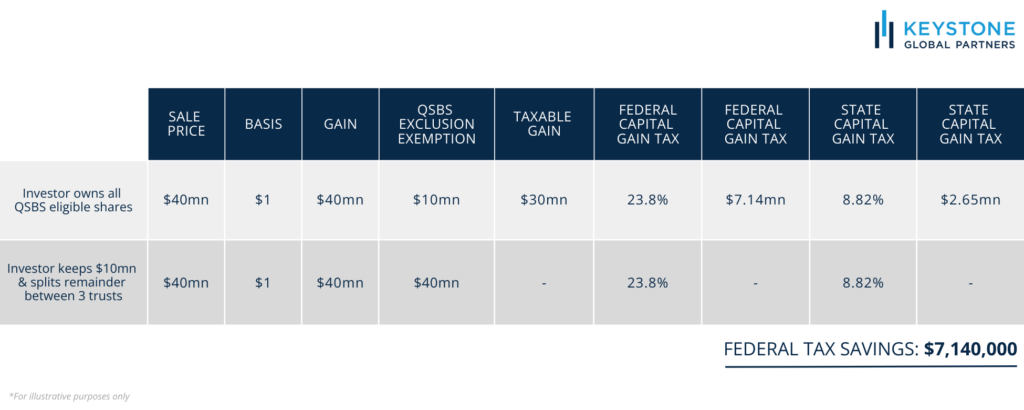

QSBS allows you to exclude tax on $10 million of capital gains (tax of up to 38%) during an exit or sale. This benefit is available to all individuals and certain trusts, offering a substantial opportunity to significantly increase the QSBS tax exclusion beyond $10 million.

The founder may gift QSBS-eligible stock to an irrevocable non-grantor trust, such as one established for a child or descendent(s) benefit, allowing the trust to qualify for its own $10 million exclusion.

In this scenario, the founder holding the shares acts as the grantor. Such trusts are generally established for children or future offspring. It’s crucial to understand that for the shares to retain their QSBS eligibility, the founder/grantor must gift the shares. Selling the shares into the trust would strip them of their QSBS status.

Beyond federal tax savings, founders can also benefit from reduced state taxes. Proper trust structuring can avoid state taxes altogether. However, even if a trust is subject to state tax, most states, New York included, conform to the federal tax treatment of the QSBS rules. California, on the other hand, does not.

For example, as a resident of New York State, you can also avoid the 8.82% state tax, resulting in an additional $2.6 million in savings, as shown in the example above. Consequently, the total tax savings could amount to nearly $10 million, which is substantial in the context of a $40 million gain.

Each individual is subject to a lifetime gift tax exemption. Any gifts exceeding this threshold can incur a gift tax of up to 40%, which must be paid. This creates a tradeoff: you can gift shares early, while the company’s valuation is low, using less of your gift tax exemption. Alternatively, you can wait and gift them later, potentially using more of your lifetime exemption.

The decision to delay stems from the fact that setting up these trusts requires significant time, effort, and financial investment. Ideally, you want to maximize the advantages of your lifetime gift exemption while ensuring the cost of establishing the trust delivers a meaningful benefit. However, not every company achieves a successful exit, so it’s often wise to wait until there is reasonable confidence that the expected benefits will materialize.

Parent-Seeded Trust

A parent-seeded trust offers founders a strategic way to prepare for future generations while minimizing estate and high state taxes in places like California or New York. This trust is established by the founder’s parents, with the founder as the beneficiary, allowing the founder to sell shares to the trust. This approach bypasses the need for any lifetime gift exemption and avoids gift taxes, although it does forfeit the ability to claim QSBS. The advantage is that all future appreciation of the asset is removed from the founder’s and parent’s estates, thereby avoiding potential future estate taxes.

The trust can be established in a tax favorable jurisdiction, effectively eliminating state-level taxes from the founder’s home state. This strategy can result in significant state and local tax savings. The trustee, chosen by the founder, has the discretion to make distributions to the founder, who may also serve as a beneficiary if desired.

Moreover, this trust can benefit multiple generations. The trustee has the discretion to make distributions, allowing assets to transfer seamlessly from one generation to the next without incurring estate tax liabilities.

Grantor Retained Annuity Trust (GRAT)

This approach allows the founder to reduce estate tax exposure by moving wealth out of their estate without tapping into any lifetime gift exemption or incurring gift tax. It is especially beneficial for those who have exhausted their lifetime gift tax exemptions. This is a powerful tax optimization strategy for managing substantial “unicorn” position sizes to minimize future gift or estate tax obligations.

For a GRAT, the founder (grantor) transfers assets into the GRAT and receives a series of annuity payments in return. These payments are calculated using the IRS 7520 rate. When assets placed into a trust appreciate at a rate exceeding the IRS 7520 rate, any excess remaining in the GRAT after all annuity payments are made to the founder (grantor) becomes a remainder amount. This remainder is excluded from the founder’s estate and can either transfer to beneficiaries or stay in the trust, free from estate taxes.

As time progresses, the remaining amount can multiply significantly from the initial contribution. If you hold company stock that you anticipate will increase in value, transferring those shares into a GRAT can be highly advantageous. By allowing the share value increase to happen within the trust, you can transfer the gains to your beneficiaries without incurring gift and estate taxes, effectively removing them from your estate. Furthermore, since this trust is structured as a grantor trust, the founder can cover the taxes incurred by the trust, enhancing the effectiveness of the strategy.

It is important to note that for a GRAT strategy to be effective, the grantor must outlive the trust’s term. Should the grantor pass away before the term ends, the strategy collapses, and all or some of the assets remain in the grantor’s estate as though the strategy had never been implemented.

Intentionally Defective Grantor Trust (IDGT)

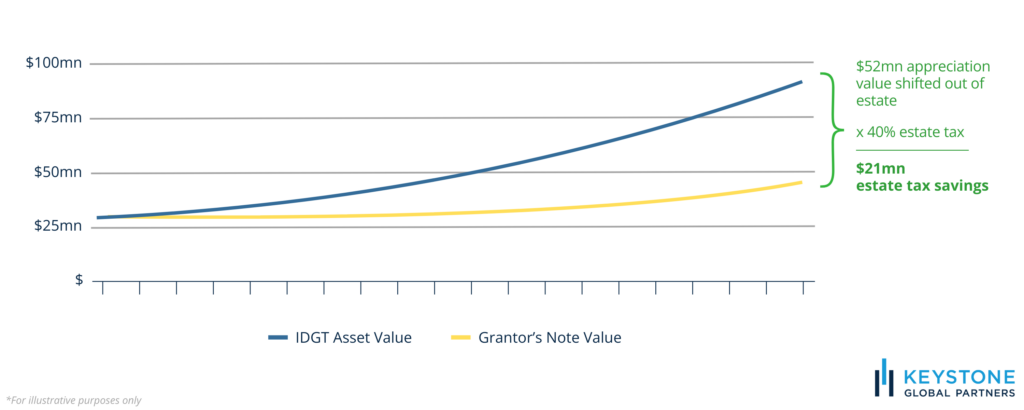

Like a GRAT, this approach allows founders to reduce estate tax exposure by transferring wealth outside their estate, but with distinct differences. With an IDGT, the grantor can “seed” the trust by gifting 10% of the asset’s value intended for transfer. This uses a portion of the lifetime gift exemption or incurring gift tax.

The remaining 90% of the value is sold to the trust in exchange for a promissory note. This transaction is not taxable for income tax or QSBS purposes. The key advantage is that, rather than receiving annuity payments that demand larger sums, the grantor transfers assets into the trust and receives an interest-only note in return. Consequently, the payments are significantly lower since they are interest-only instead of annuity-based.

Another notable distinction is that the IDGT strategy offers greater flexibility than the GRAT and allows for generation-skipping. If the goal is to avoid a generation-skipping transfer tax (GSTT), the IDGT offers advantages over the GRAT. With the IDGT, assets are assessed for GSTT purposes at the time of their contribution to the trust, before they have appreciated. In contrast, the GRAT evaluates assets at the end of its term, after they have potentially increased in value.

Conclusion

We tailor our strategies to each founder’s unique circumstances, utilizing a mix of approaches based on specific situations and goals. Each founder, along with their company’s life cycle, growth expectations, and personal circumstances, is unique.

These strategies are most effective when planned in advance. Delaying can reduce their benefits. When exploring advanced tax strategies to protect wealth and minimize taxes related to company stock, there is much to consider. This is just a summary. We recommend seeking expert advice and selecting wealth transfer and tax-saving strategies tailored to your unique circumstances and comfort with complexity.