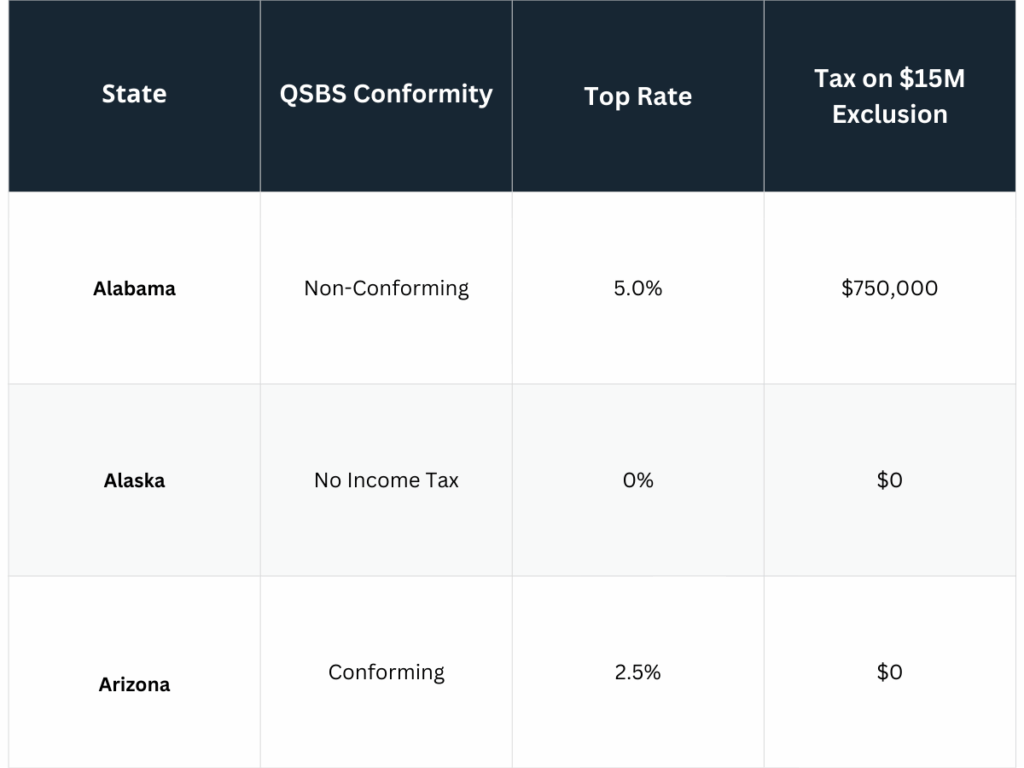

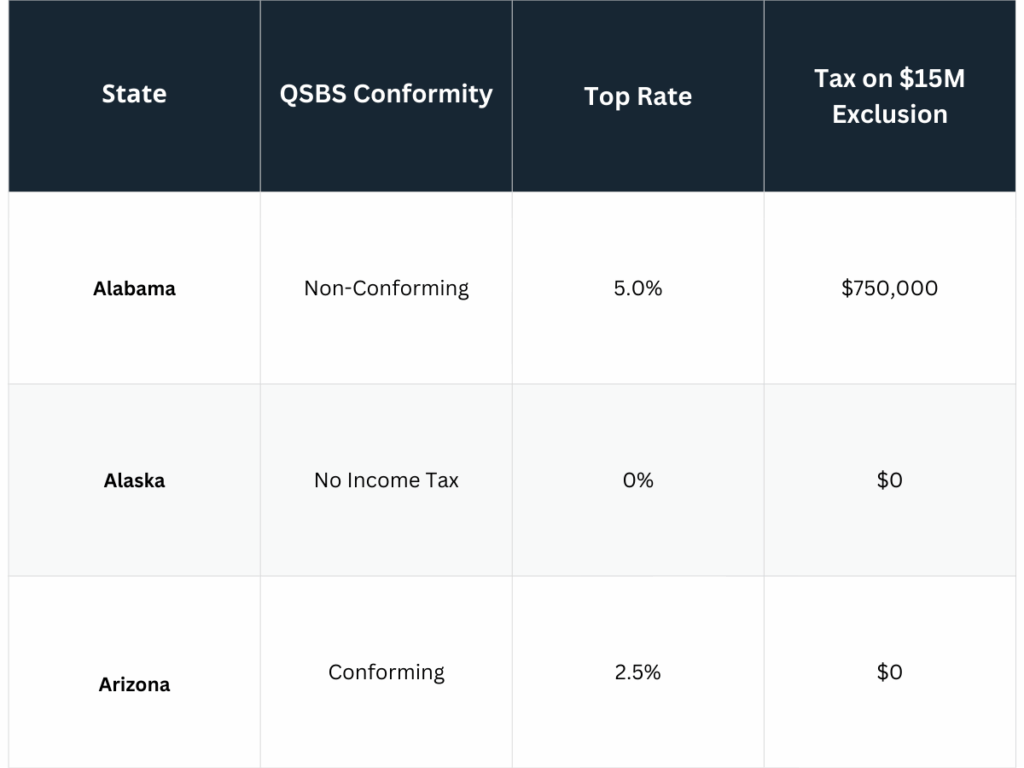

2026 QSBS by State: Eligibility Index

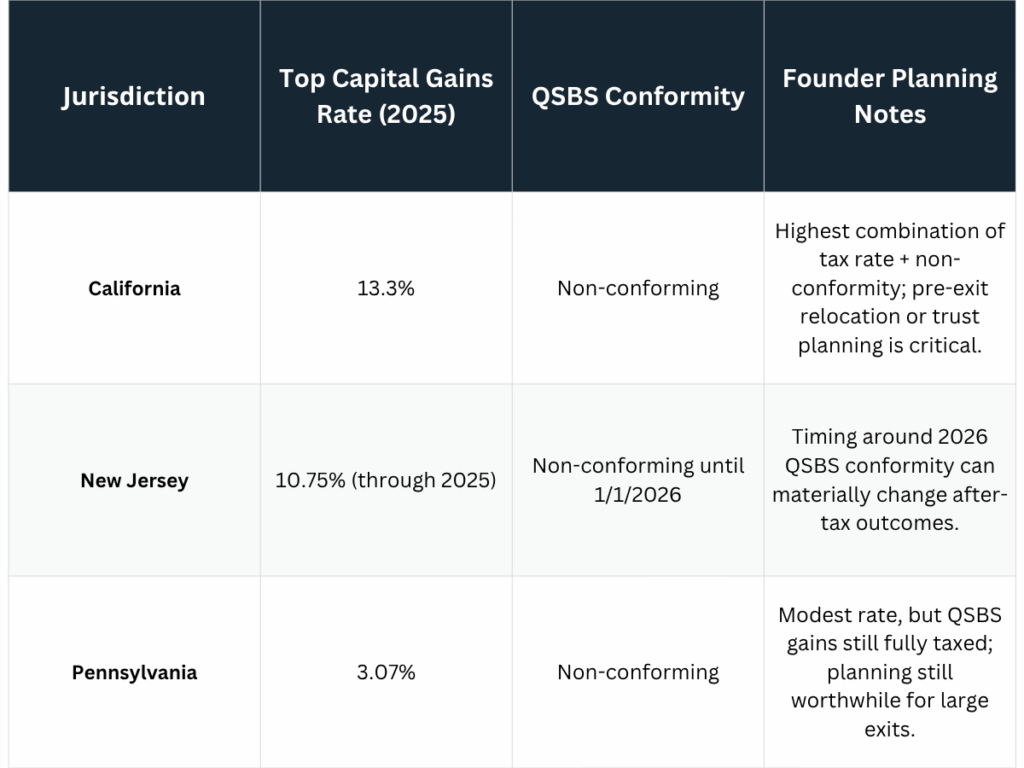

If you’re planning a $20+ million exit, your state of residency determines whether you keep your full federal QSBS tax savings or lose millions to state taxes. Section 1202 now

If you’re planning a $20+ million exit, your state of residency determines whether you keep your full federal QSBS tax savings or lose millions to state taxes. Section 1202 now

Our research team conducted a comprehensive analysis of Section 1202 QSBS exclusion data from 247 founder exits exceeding $20 million, combined with analysis of the new One Big Beautiful Bill

Last updated: October 2025 | Source: Tax Foundation 2025 State Tax Competitiveness Index Executive Summary For founders planning business exits in 2025, state capital gains tax policy represents one

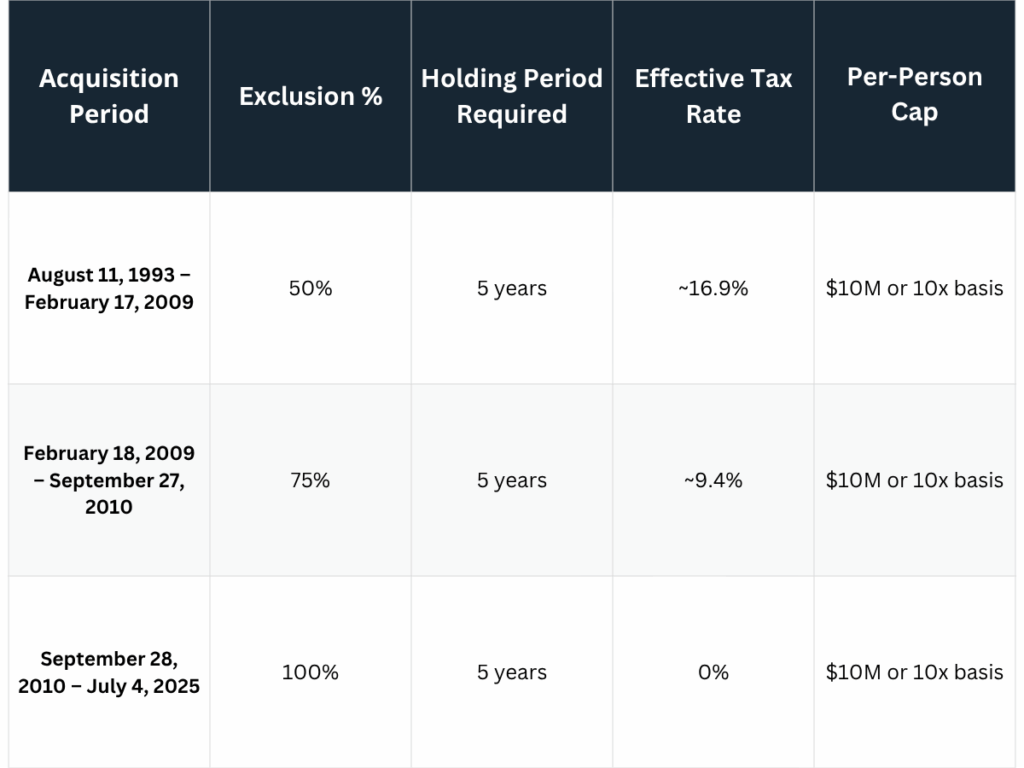

The Section 1202 tax exclusion for Qualified Small Business Stock (QSBS) has evolved dramatically from its original 1993 introduction to today’s One Big Beautiful Bill Act expansion. If you’re a

Imagine maximizing your profits from your startup’s exit through a few strategic tax break strategies and the Qualified Small Business (QSBS) rules. For founders holding substantial positions of QSBS, this

Keystone Global Partners Named Finalist in ThinkAdvisor 2025 Luminaries Awards for Thought Leadership & Education Keystone Global Partners, a fiduciary wealth management firm serving ultra-high-net-worth (UHNW) pre- and

Public Law 119-21, signed July 4, 2025. The One Big Beautiful Bill Act (OBBBA) rewrites key parts of the U.S. tax code, with outsized implications for ultra-high net worth founders,

Executive Summary This guide breaks down the One Big Beautiful Bill Act (OBBBA), signed in 2025, with key updates for UHNW families and founders: $15M estate exemption, enhanced QSBS, $40k

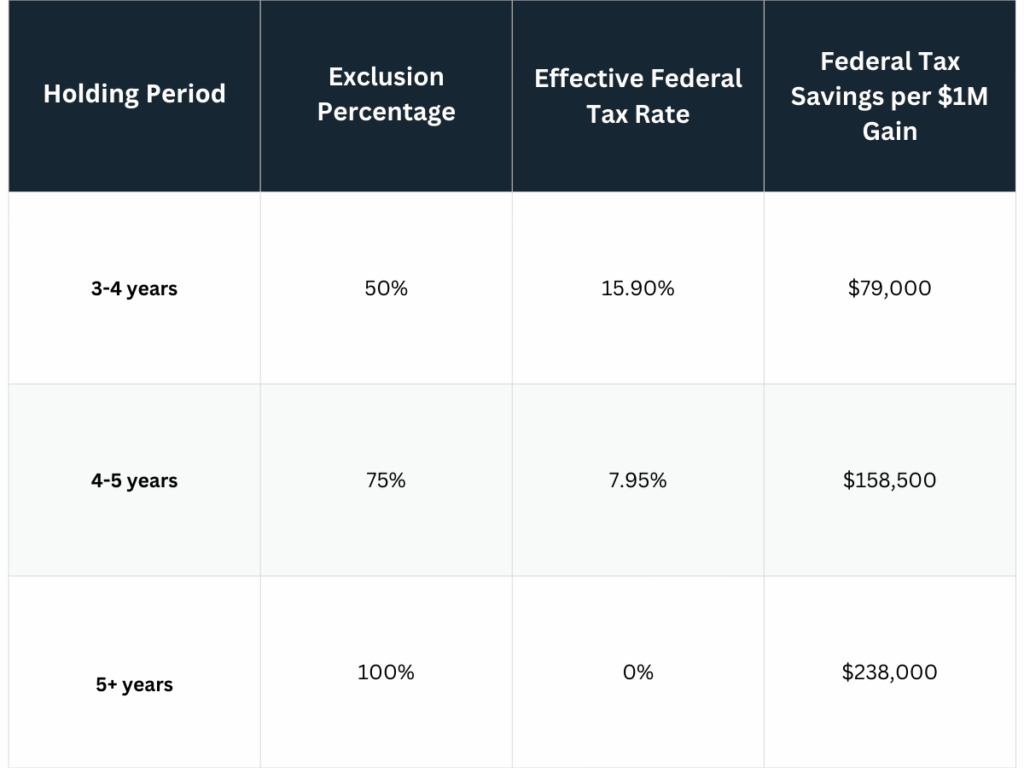

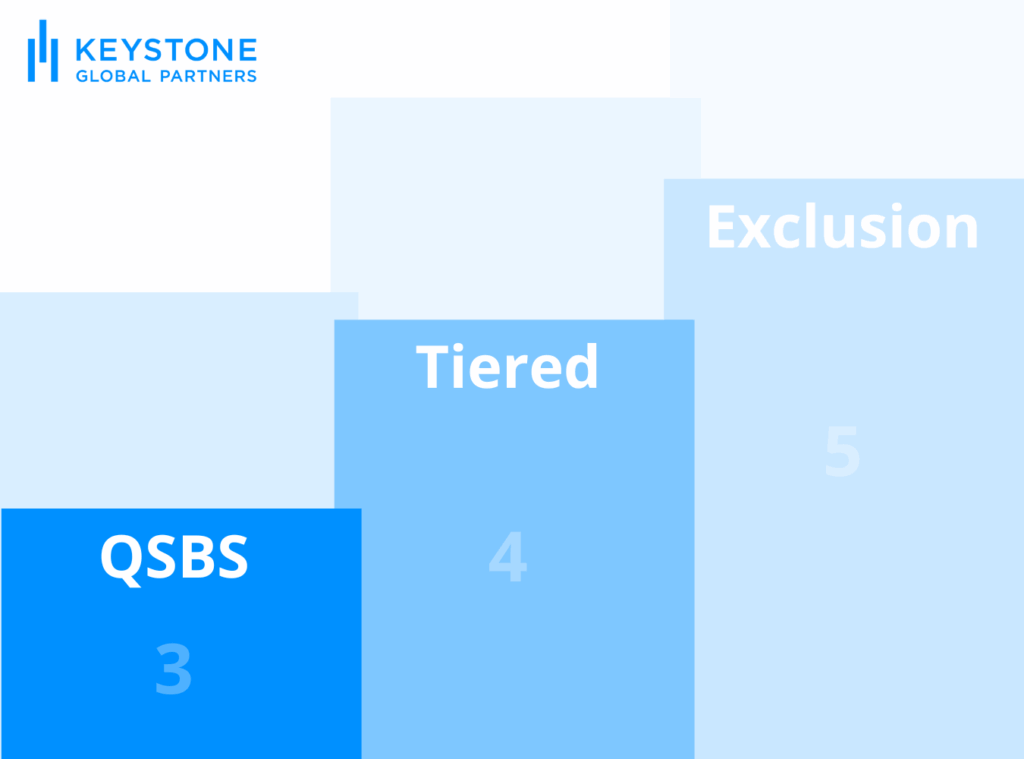

The landscape of QSBS has undergone a major shift with the introduction of the new QSBS tiered exclusion implemented through the One Big Beautiful Bill Act (OBBBA), signed into law

The passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025, has transformed startup equity compensation. Significant updates to QSBS stock now offer new rules for option

For company founders and shareholders with an exit on the horizon, this isn’t a myth. Learning how to minimize capital gains tax on a business sale can make a lot

This article was originally published on Forbes.com on December 4, 2019. Written by Peyton Carr. For founders and early employees of private companies seeking liquidity, a tender offer is an

2128 W 32nd Ave Suite 200 Denver, CO 80211

Los AngelesSign up to receive our quarterly newsletter filled with timely insights & information

© 2025 Keystone Global Partners | Disclosures | Form CRS | Investment Adviser Public Disclosure | Terms of Use

Keystone Global Partners LLC is an SEC Registered Investment Advisor