Investment Strategies

At Keystone, we design, manage, and maintain your investment strategies to align seamlessly with your goals, aspirations, and both short-term and long-term plans. As your trusted partner, we navigate the ever-changing markets, capitalize on opportunities, mitigate risks, and keep you focused on what truly matters.

Our Approach

We build high-quality, diversified investment strategies across public and private markets to achieve long-term compounded returns. By optimizing asset allocation across various asset classes such as stocks, bonds, private equity, venture capital, real estate, specialty assets, and more, we aim to deliver higher returns with lower risk.

We proactively seek unique opportunities in less efficient private markets (alternative investments) to ensure long-term, multi-asset diversification.

Optimizing Investment Strategies for our Client’s Portfolios

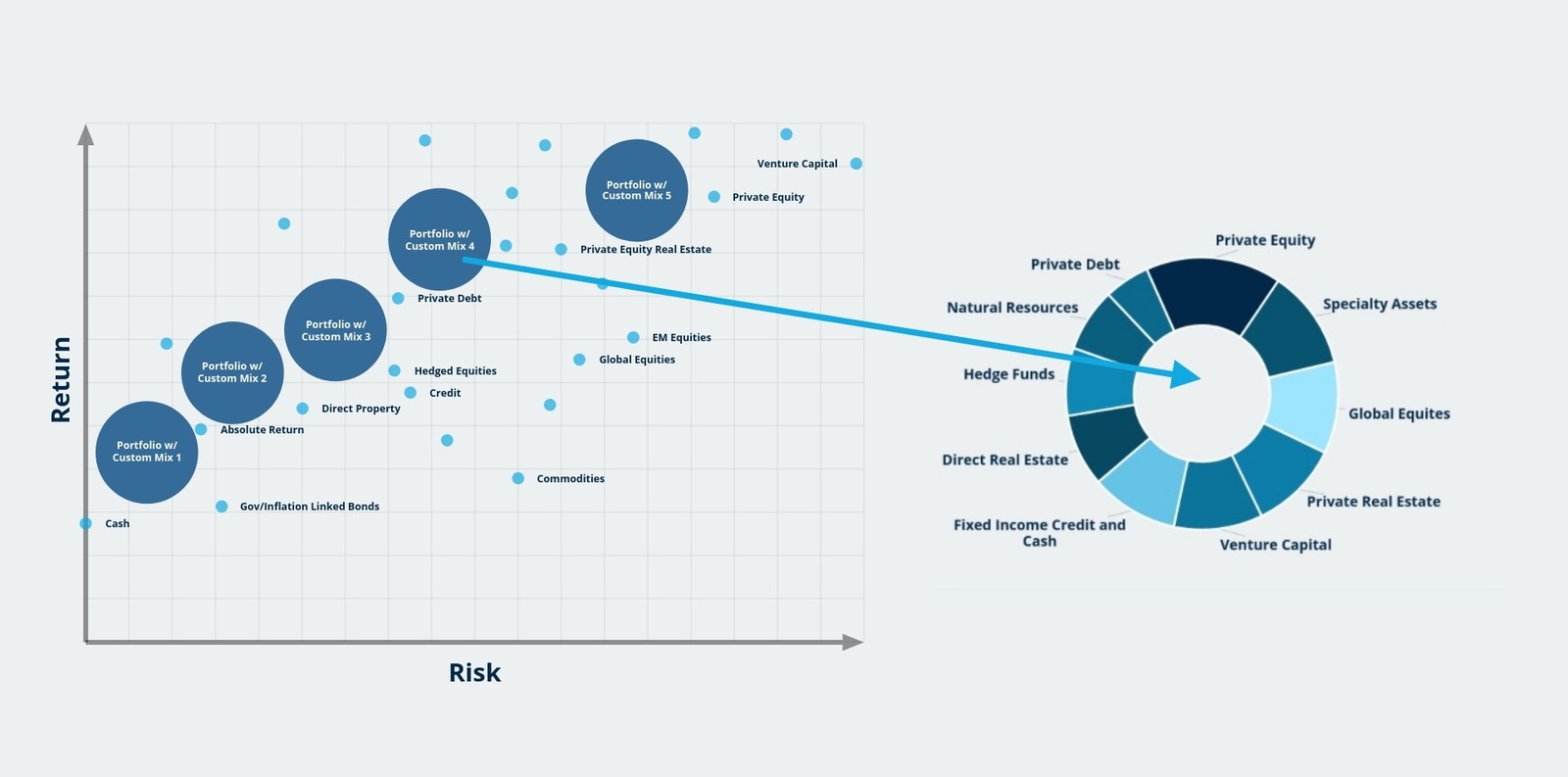

At different desired levels of risk and return targets, there are different mixes of assets and investment strategies.

Based on a client’s goals, liquidity needs, and financial plan coordination, further items play a role in determining the optimal mix of assets.

Net Worth Approach

We invest based on our clients’ entire portfolios and net worths, not just what we manage for them. This allows us to see the full picture and develop better investment strategies and make better decisions on their behalf.

Optimized Portfolios based on the desired level of risk, liquidity preferences, and alternatives mix

Private Markets Intelligence, Access, and Alternative Investment Program

Access to upper-quartile private equity, venture capital, direct investments, investment assets such as real estate, and other non-traditional private market investment strategies which are typically only available to a select few.

Our sourcing machine comprises multiple channels. This allows us to provide our clients with significant access while remaining disciplined in our approach, yet flexible in investor-level portfolio customization.

Portfolio Construction and Analytics

Years of experience, and advanced analytics that deliver actionable insights to power our investment management services decision-making. We seek to optimize our client portfolios, increase efficiency, reduce fees, understand exposures, identify risk factors, anticipate opportunities, and provide transparency.

Investment Pacing, Forecasting, and Cash Flow Management

We use cash flow optimization and steady capital deployment processes to optimize target allocations. We anticipate liquidity needs and plan for cash flows.

Opportunity Set and Diligence

Our team performs rigorous due diligence on every investment opportunity to ensure it meets our high standards. We conduct comprehensive analyses that allow us to identify top-tier investment opportunities that align with our client’s goals and risk profiles. This ensures that every addition to their portfolio has the potential for significant upside while mitigating potential downsides.

Tech-Enabled Client Experience

We provide a seamless portal through our partnership with Addepar, where all your financial data converges, including complex and unmanaged investments. Encrypted and accessible, this platform serves as your command center for your investment strategies. It enables you to make empowered decisions with all your financial information at your fingertips.

Our Core Investment Philosophy Concepts

We design investment strategies for you that draw upon our entire toolkit of investment management capabilities in both public and private markets and access opportunities from multiple channels. Our core Investment Philosophy concepts are as follows

- Diversification through multi-asset class (endowment/family office-like) portfolios

- Seek to generate alpha in the private markets (Alternative Investments)

- Optimize risk vs. return

- Focus on after-tax returns and tax-efficient investment strategies

- Reduce fees where applicable – most publicly traded active managers do not outperform

- Long-term investment approach: We prefer to focus on personal/entity level risk budget, not entry and exit points

- Extreme volatility can provide tactical entry points for rebalancing and taking advantage of opportunities/market dislocations

Ongoing Performance Monitoring and Reporting

To keep our clients informed and empowered, we provide robust performance monitoring and reporting of your investment strategies. We track the performance of each asset and the overall portfolio against our benchmarks and clients’ financial goals. Continuous monitoring, coupled with periodic reviews, ensures that portfolios remain aligned with our client’s changing needs and market conditions.

Detailed reports offer transparency by presenting performance metrics, risk assessments, and strategic recommendations. They ensure that you have the proper financial information at your fingertips when you need it.

Behavioral Finance Coaching

Behavioral finance reveals that investors often make irrational decisions, influenced by various biases. Investing can be emotional, so it’s crucial to maintain a long-term perspective.

We step in when natural investor behavior threatens to negatively impact portfolio returns. Additionally, we educate and set expectations through stress testing exercises and other educational methods to ensure informed decision-making.

Client-Centric Service and Support

At Keystone, our commitment to exceptional client service sets us apart. We prioritize understanding each client’s unique needs and take a personalized approach to portfolio management and customized investment strategies. Our dedicated team is always available to offer insights, answer questions, and make adjustments as needed.

We strive to build long-term relationships based on trust, integrity, and a shared commitment to achieving remarkable financial outcomes for our clients.

At Keystone Global Partners, we’re more than investment strategists. We’re also true partners dedicated to growing your financial success. Our role is to both manage and guide your wealth in the most optimized way for a prosperous future.

Join us in a smarter approach to investing. Let us show you what’s possible. Schedule a call with our team to learn more.

Not ready yet for portfolio management or investment strategies? Learn about our exit planning services.