Insights

Select a Category

Understanding Liquidity in Alternative Investments

Posted on May 14, 2024

QSBS Stock Strategy for Founders: QSBS Stacking

Posted on April 16, 2024

California QSBS Tax Guide

Posted on April 10, 2024

Business Exit Strategies Video: What to Expect After the Celebration

Posted on February 1, 2024

Exit Planning: Unpacking Post-Deal Experiences of Founders

Posted on January 31, 2024

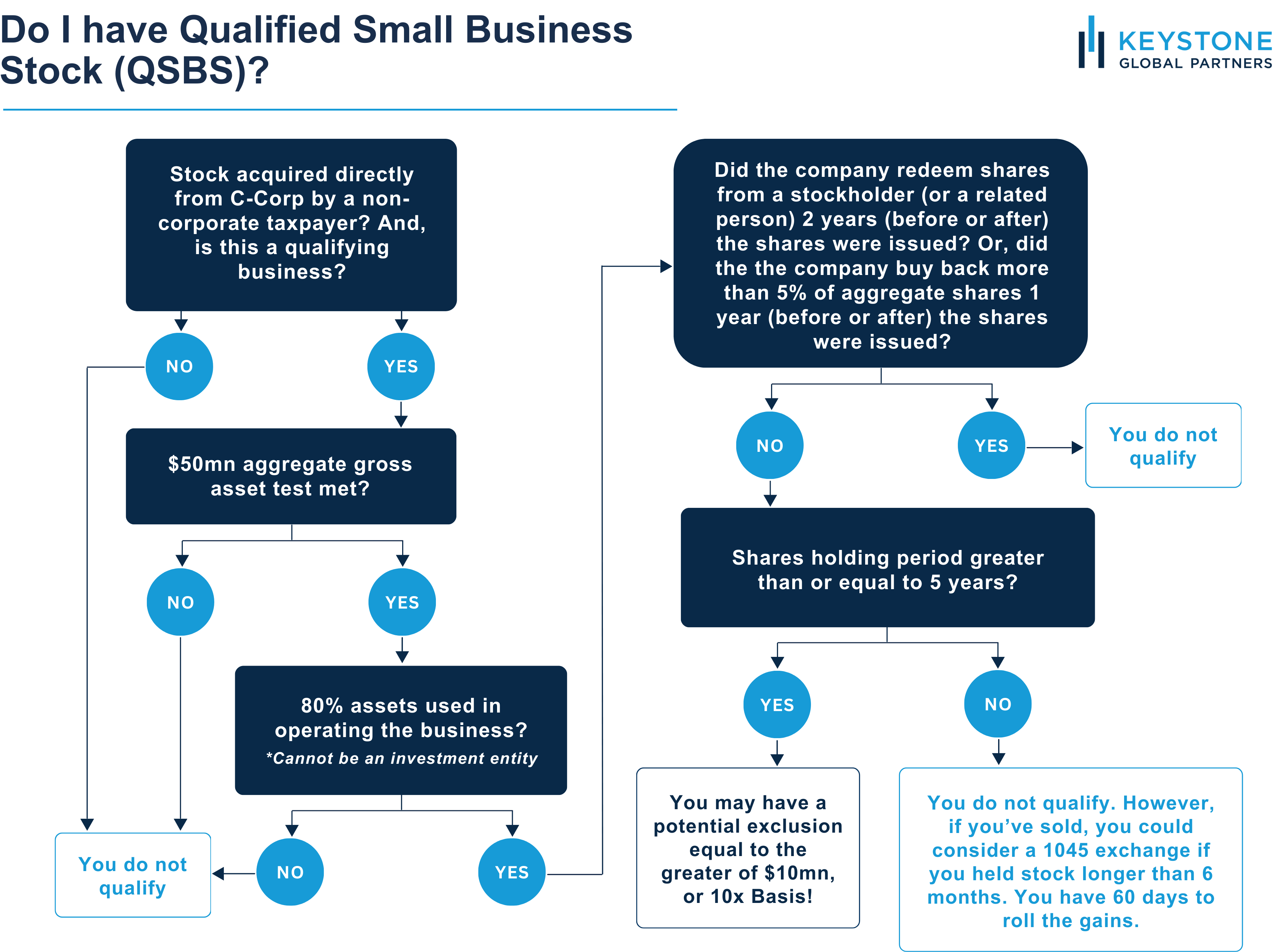

Am I Eligible for QSBS?

Posted on January 29, 2024

Nurturing Financial Literacy: How to Talk to Kids About Money

Posted on January 19, 2024

IRS Announces 2024 Federal Income Tax Brackets and Inflation Adjustments

Posted on November 11, 2023

Year-End Tax Planning Strategy for 2023

Posted on November 10, 2023

Protecting Your Assets: A Sophisticated Spear-Phishing Scheme We Encountered

Posted on October 4, 2023

Should You Move to a New State for Tax Savings Before Selling Your Startup?

Posted on July 13, 2023

Five Key Considerations When Building an Alternative Investment Program for a Client

Posted on January 20, 2023

California Quietly Increases Marginal Income-Tax Rate

Posted on November 1, 2022

With a 1045 Exchange / Rollover, Founders Can Optimize QSBS Before 5 Years

Posted on November 15, 2021

Advanced Tax Strategies for Company Founders

Posted on June 1, 2021

Real Estate as an Investment Asset

Posted on May 1, 2021

Buying Real Estate: A Personal Financial Venture for Founders

Posted on April 1, 2021

How Does a House or Condo Fit Into Your Financial Plan as a Founder?

Posted on March 1, 2021

Rent vs Buy Real Estate: How to Decide Which is Right for You

Posted on February 6, 2021

The Founder’s Guide to Managing Your IPO Stock

Posted on July 31, 2020

Is Your Net Worth Too Closely Tied to Your Company’s Success?

Posted on July 29, 2020

How to Approach Your IPO Stock

Posted on June 28, 2020

2020 Tax Code Changes: What You Need to Know

Posted on June 18, 2020

4 Areas of Your Estate Plan to Review in Light of COVID-19

Posted on May 19, 2020

Crisis Investing Mindset

Posted on March 20, 2020

Happily Ever After: Financial Planning for Newlyweds

Posted on February 24, 2020

Liquidity Options for Founders and Early Employees

Posted on January 6, 2020

6 Ways to Maximize Your Charitable Giving Strategy

Posted on December 1, 2019

Make a Personal Plan for your Exit or IPO

Posted on November 26, 2019

A Guide to Trusts for Estate Planning

Posted on October 31, 2019

Why Founders And Investors Shouldn’t Overlook The QSBS Tax Benefit

Posted on September 5, 2019