In the intricate dance of startup exit strategy, the spotlight often shines on Qualified Small Business Stock (QSBS) and the potent tax advantages under Section 1202. While much has been discussed regarding the breadth of these advantages, QSBS Packing is a particularly nuanced tax strategy that stands out for its ability to substantially boost your exclusion beyond $10 million per issuer.

How? By leveraging the often overlooked 10 times basis limitation.

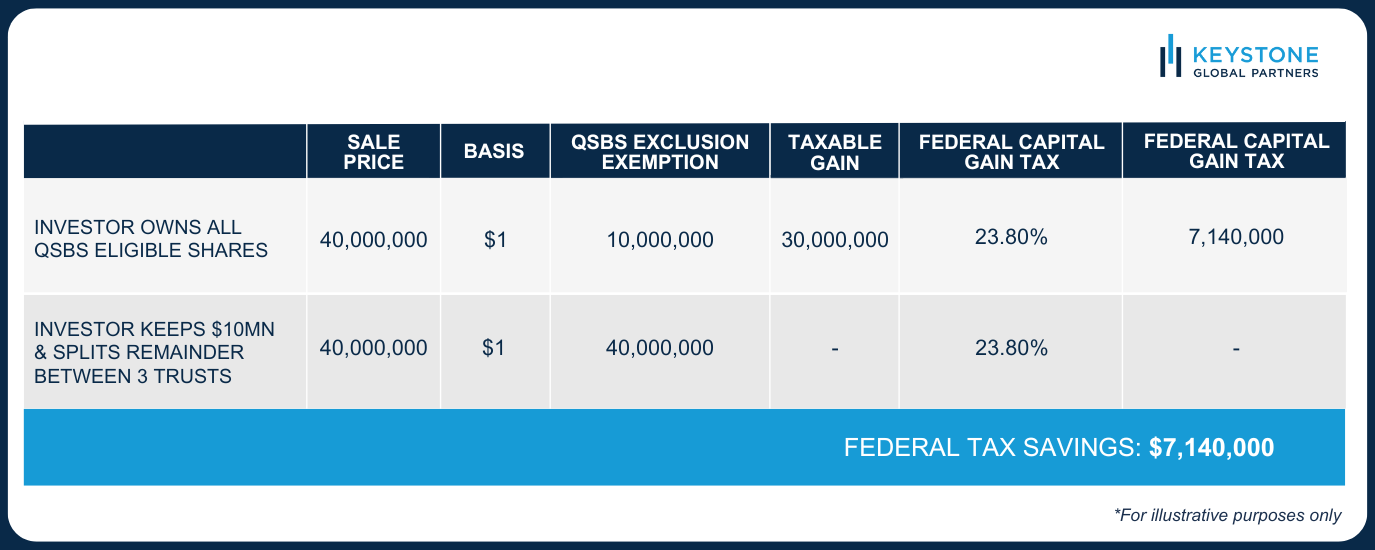

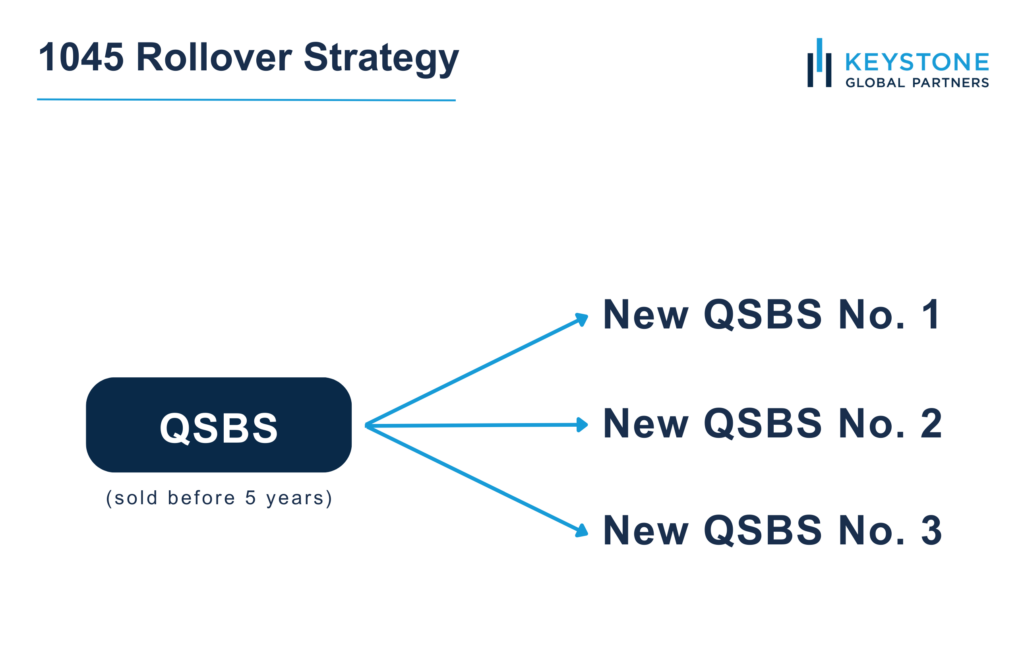

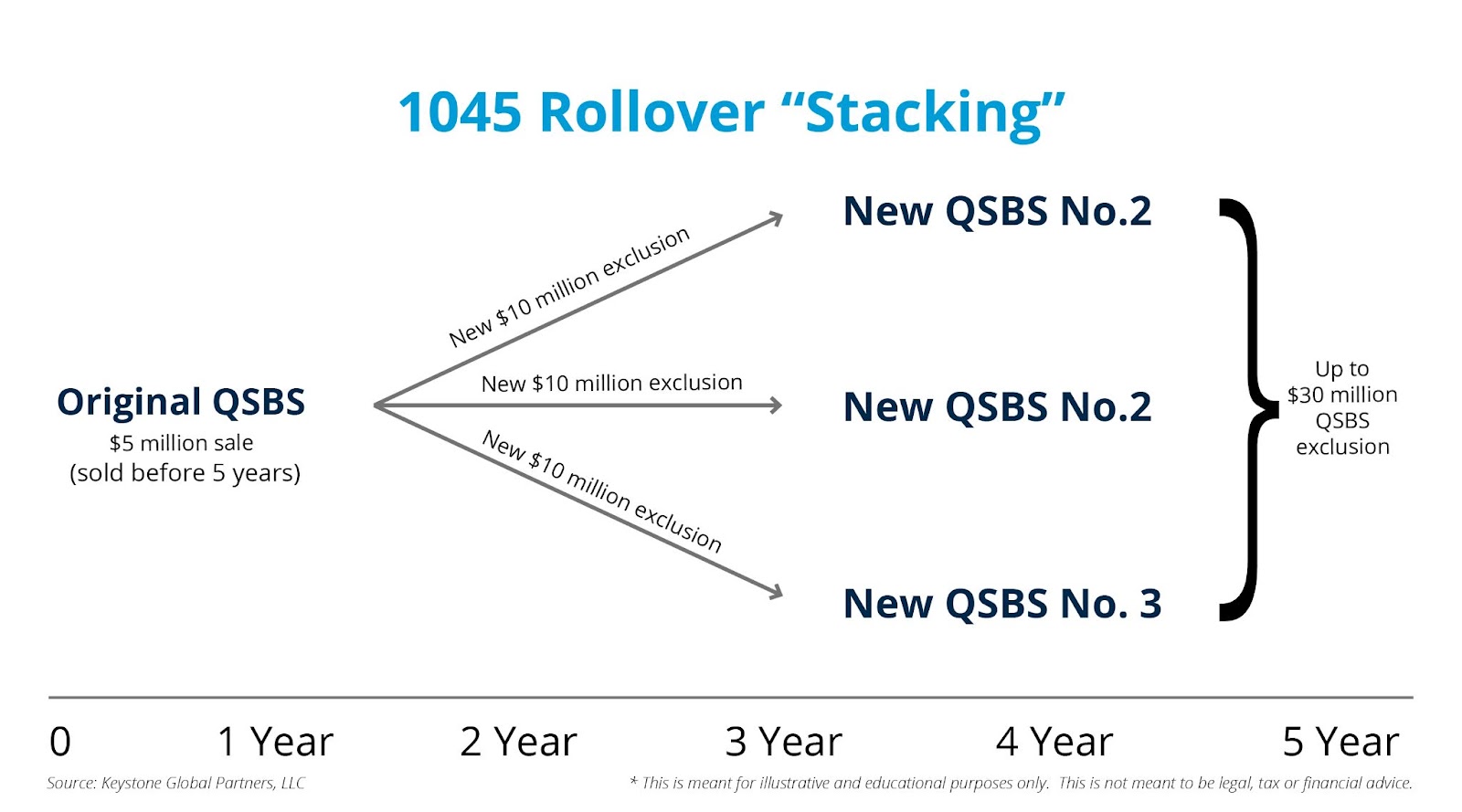

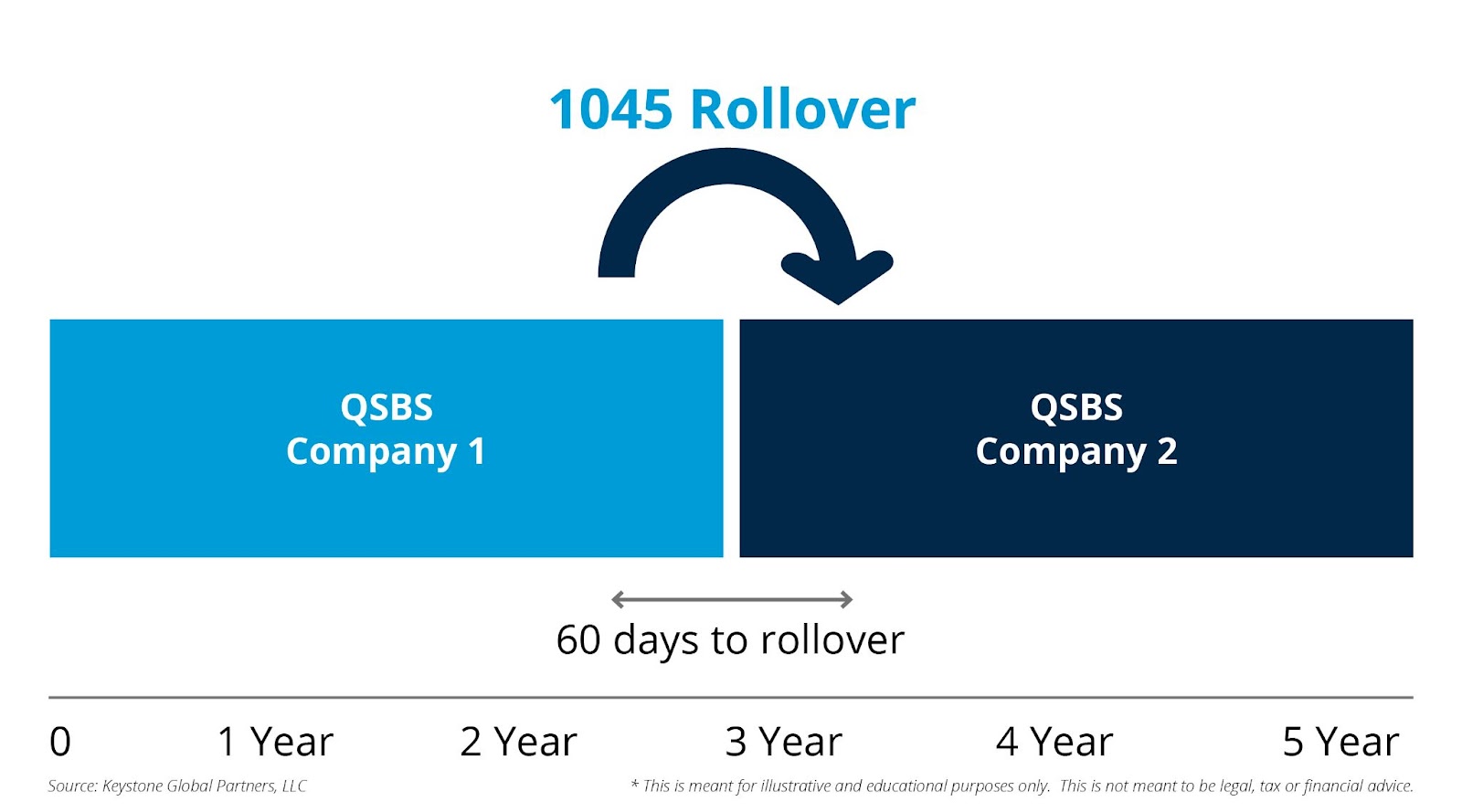

If you’re planning a larger exit strategy (which we all hope for, right?), you might quickly reach the $10 million per taxpayer limit. There are restrictions on how many additional taxpayers you can create through QSBS stacking or multiplying the QSBS Exemption.

However, unlike QSBS stacking, which aims to increase the cumulative QSBS exclusion above $10 million by adding more taxpayers, QSBS Packing is a tax strategy that seeks to boost your QSBS exemption beyond $10 million and up to $500 million. This is done by increasing the basis of your QSBS stock.

This can work very well when it comes to exit strategy and planning. Let’s dive deeper into this, shall we?

Quick QSBS and Section 1202 Overview

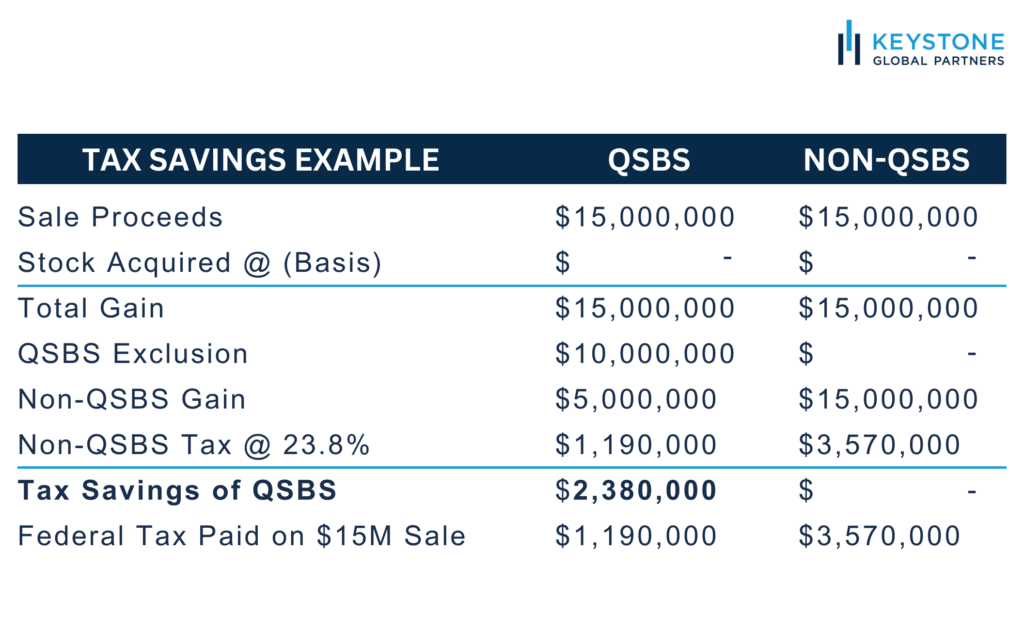

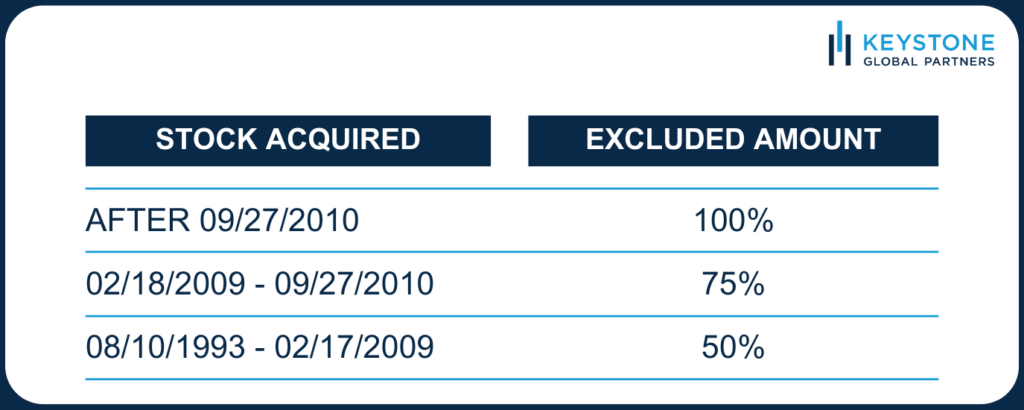

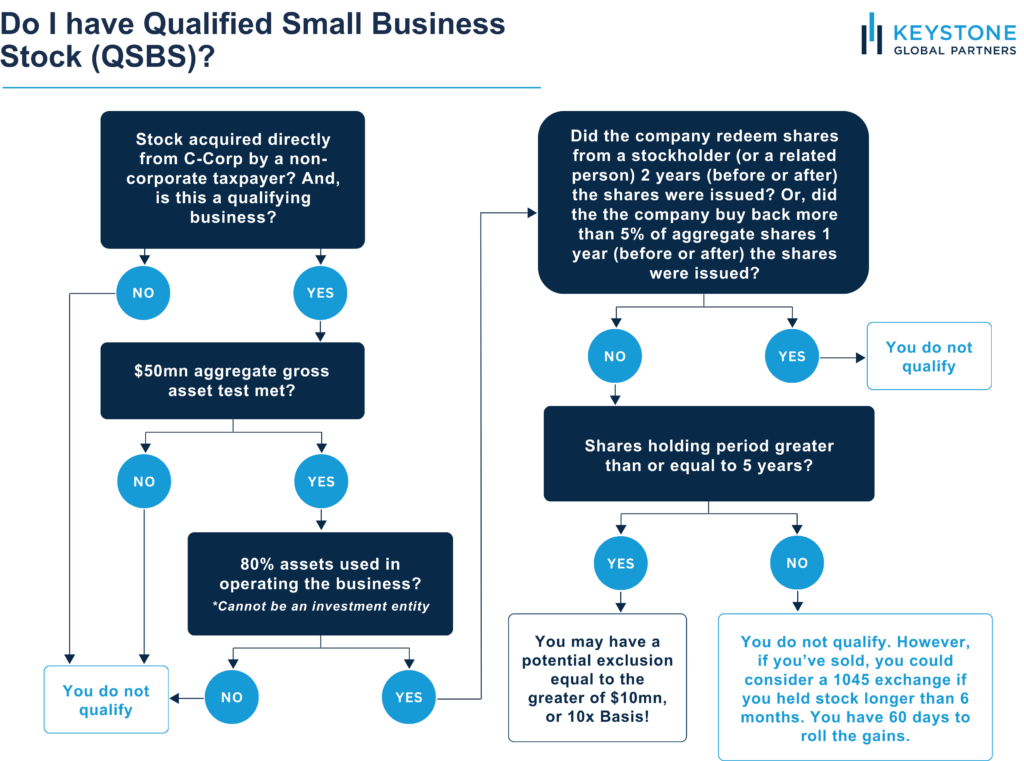

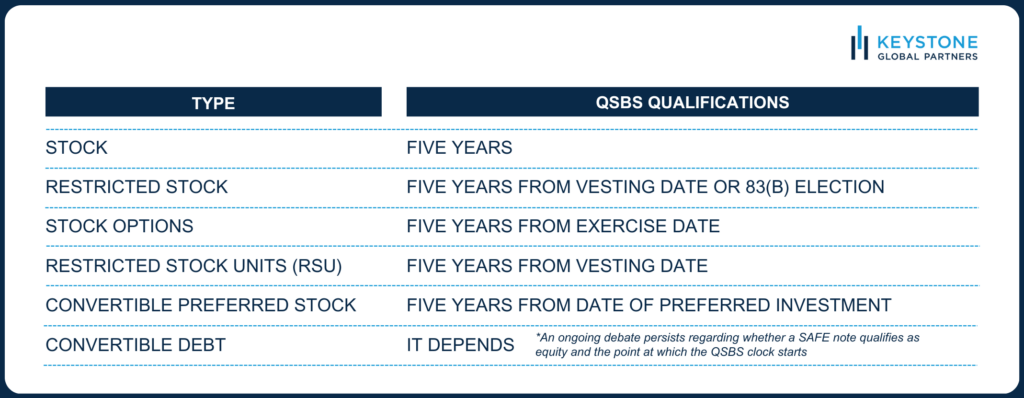

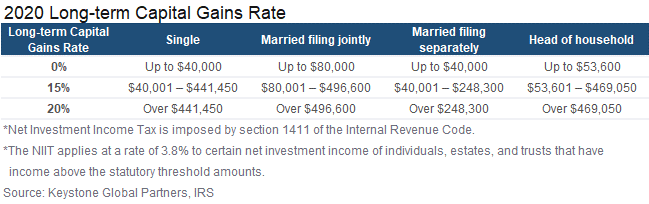

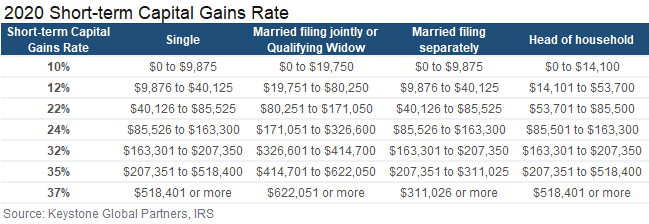

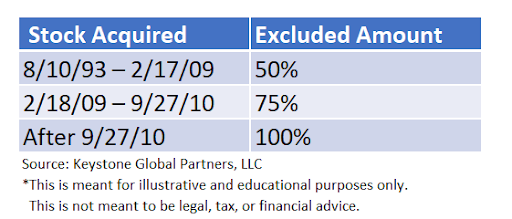

Before we get into QSBS Packing tax strategies, a foundational understanding of QSBS and its context is crucial. Under Section 1202, startup founders and their investors can exclude the greater of $10 million or 10 times their investment basis per shareholder provided they meet certain requirements.

A few of those requirements are as follows:

- 1202 stock is issued by a domestic C Corporation.

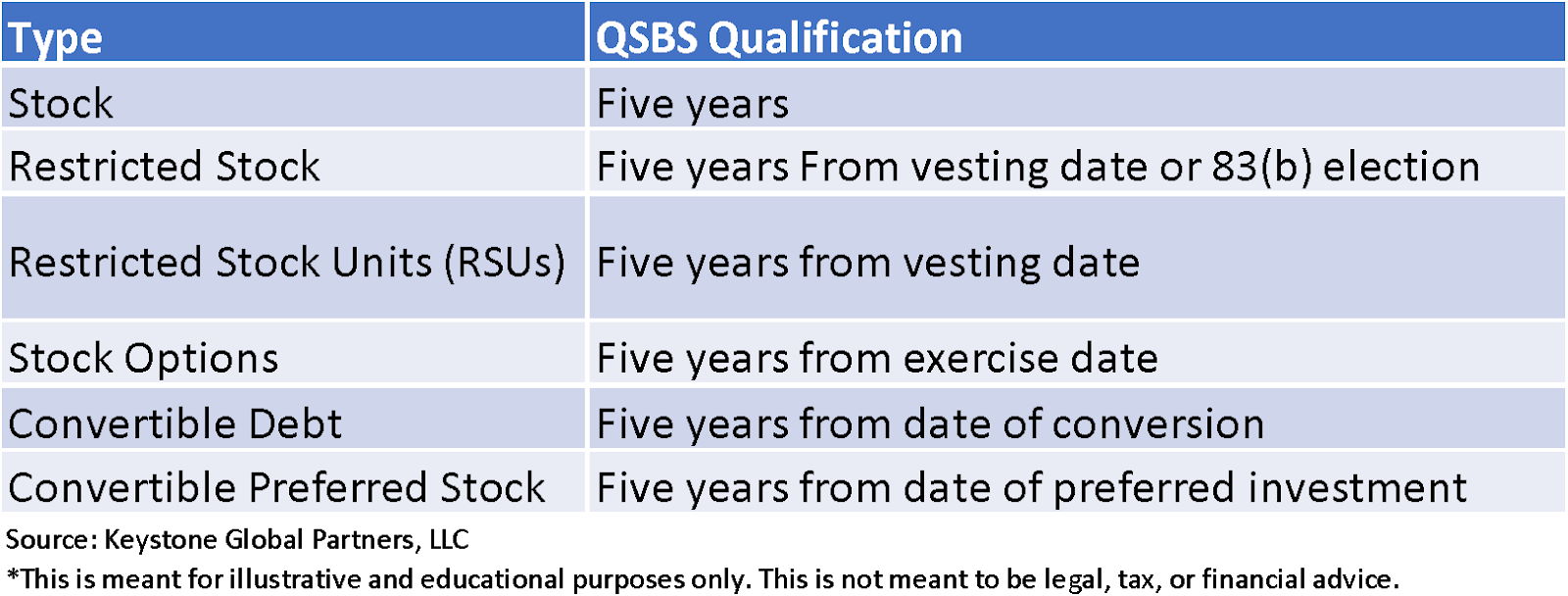

- The holding period is greater than or equal to five years.

- The investor must acquire the 1202 stock directly from the C Corporation.

- Gross assets must not exceed $50 million before or after the 1202 stock is issued.

- The company is an active business and not an excluded business type.

QSBS Packing Tax Strategy Overview

At its core, QSBS Packing and the tax strategy around it is the process of intentionally increasing the basis of your QSBS stock. This is done to obtain an exclusion equal to 10x basis, which exceeds the $10 million per taxpayer limitation.

Remember that you can exclude either up to $10 million or a 10x basis, whichever is greater. For example, let’s say you have $4 million of basis in your startup and you sell. You can then exclude up to $40 million of capital gains on your QSBS stock.

But what does this entail in practice? I’ll break down QSBS Packing and exit strategy by focusing on three powerful tactics.

It’s important to note that there are other QSBS Packing strategies beyond those discussed below. But the reality is that founders do not as regularly use them, so I’m leaving those out of this discussion.

1) Starting a business as an LLC, then later converting to a C corp

Typically, founders acquire shares in their companies at the beginning for a nominal amount. If a founder sells their company and the QSBS exemption qualifications are met, they get to exclude up to $10 million while any gain above $10 million will be taxable.

However, let’s imagine those same founders had started their company as an LLC. If they had waited until the LLC was valued at $30-million pre-money then converted it to a C corporation before raising a round, the founders would receive QSBS stock with a basis of $30 million.

Assuming the company experiences significant growth, is eventually sold, and the founders meet the qualifications, they could exclude up to $300 million via QSBS Packing. That’s $30-million fair market value of the LLC, contributed in exchange for 1202 stock and multiplied by 10 times the basis.

Sounds better than just $10 million, doesn’t it?

This QSBS Packing tax strategy works because of a rule in the tax code that permits the acquisition of QSBS for property other than cash or stock. That means if you convert an LLC into a C corporation, the basis of the new C corporation stock will be the fair market value of the property contributed. In the instance of our example, this means the original LLC’s fair market value, which amounts to $30 million.

It’s clear that this QSBS Packing tax strategy can yield some significant benefits. The higher the sale price, the more effective it becomes. However, depending on the situation, it’s crucial to understand that this QSBS Packing tax strategy can also have some drawbacks to be aware of.

Here’s what to watch out for:

Delays the five-year QSBS clock

Waiting too long to convert from an LLC to a C Corp can delay the start of your five-year QSBS clock.

Don’t exceed the $50-million gross asset test

The LLCs’ aggregate gross assets must be below $50 million at conversion to qualify for the QSBS Exemption. You’d want to have a valuation done to support that the conversion was done at a value of less than $50 million, and this would also need to be coordinated with future valuations and funding rounds.

Downside Scenario

In a scenario where growth does not meet expectations, this particular QSBS Packing tax strategy could actually end up being less beneficial. It can actually decrease the QSBS benefits when compared to starting as a C Corp from the outset.

This is because the appreciation up to the amount of LLC to C corp conversion will not be exempt from tax via QSBS. For example, in a scenario where the sale price is $40 million, capital gains would be paid on the first $30 million.

After that, each founder can only exclude $5 million individually. They would be left with quite a bit of unused 1202 stock QSBS exemption.

2) Contributing cash or intellectual property to increase your tax basis

Another QSBS Packing tax strategy to consider is contributing cash or intellectual property in exchange for QSBS equity. This can effectively increase the basis of your QSBS stock and allow you to exclude more from capital gains when you sell.

For example, let’s say you contribute $2 million in cash and receive $2 million of QSBS stock. Your new QSBS basis is $2 million. Assuming you meet the requirements, you can exclude ten times your stock basis which equals $20 million.

3) Selling high-basis QSBS stock and your low-basis QSBS during the same tax year

Another QSBS packing tax strategy to consider is selling both high-basis and low-basis QSBS stock during the same tax year. The goal is to increase the total aggregate basis of your QSBS stock since you can exclude 10 times the aggregate adjusted basis for the 1202 stock sold in that given year.

For example, let’s say you have two different share classes of QSBS stock:

- One with a basis effectively zero.

- Another with a basis of two million that has little or no gain and has only been held for a year.

In this particular scenario, if you sell both classes of stock in the same tax year, you can exclude $20 million from capital gains. That would be a 10x basis of those total shares sold. This is possible even though you’ve only held the zero basis stock for over five years.

Plan Your Exit Strategy With Tax Experts You Can Trust

Navigating the complexities of QSBS can significantly impact your financial outcome when selling your startup. Founders can maximize their net after-tax take home by understanding and utilizing strategies like QSBS Packing and others.

While complex, these strategies offer a pathway to legally minimize capital gains tax and maximize returns. However, the intricacies involved require early and thoughtful exit planning plus collaboration with trusted tax professionals. The potential for financial benefit is substantial, which makes it well worth the effort to explore these options thoroughly.

Please reach out to Keystone if you would like to discuss and develop an exit strategy for your startup today.

Disclaimer

The information and opinions provided in this material are for general informational purposes only and should not be considered as tax, financial, investment, or legal advice. The information is not intended to replace professional advice from qualified professionals in your jurisdiction.

Tax laws and regulations are complex and subject to change, and their application can vary widely based on the specific facts and circumstances involved. Any tax information or advice in this article is not intended to be, and should not be, used as a substitute for specific tax advice from a qualified tax professional.

Investment advice in this article is based on the general principles of finance and investing and may not be suitable for all individuals or circumstances. Investments can go up or down in value, and there is always the potential of losing money when you invest. Before making any investment decisions, you should consult with a qualified financial professional who is familiar with your individual financial situation, objectives, and risk tolerance.